U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage and Personal Item Size Limits (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

The Best Way to Renew a Passport in 2024

The proposed online passport renewal system is behind schedule.

The Best Carry-on Luggage of 2024

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

The Ultimate Guide to Travel Insurance: Everything You Need to Know

The Editors

We are the editors of SmarterTravel! Together we have appeared in countless travel publications including ABC News, Huffington Post, Travel + Leisure, USA Today, and more. We dedicate our days to creating and producing expert travel content, including packing tips, general travel advice, destination inspiration, and helpful videos. Follow us across social media on YouTube , Pinterest , Facebook , Instagram , and Twitter or drop us a line to say hi at [email protected]!

Travel Smarter! Sign up for our free newsletter.

Editor’s Note: For travel insurance information specific to the current COVID-19 epidemic, see our stories on Travel In the Time of COVID: What You Need to Know ; Travel Insurance Coverage: 18 Things Your Policy Won’t Cover ; and Cancel for Any Reason Travel Insurance, Explained .

Purchasing travel insurance is wise if you want to protect your trip against an array of unforeseen events such as natural disasters , missed flights , personal injury or sickness abroad , tour operators going bankrupt , or even acts of terrorism . But with so many types of travel insurance, lots of fine print, and complicated insider lingo to decipher, it can feel impossible to determine which kind of travel insurance is right for you.

With the right resources, however, it’s possible to pick a trip insurance policy you’ll be confident traveling with and paying for. This ultimate guide to travel insurance covers:

- Who needs travel insurance

- The basic types of travel insurance

- The most common policy needs to consider

- Little-known trip insurance technicalities you need to know in case they affect you

Click on any bold, linked text on this page to read more about the subject elsewhere on SmarterTravel.com.

Who Needs Travel Insurance?

There are several different types of travel insurance policies available, ranging from trip cancellation insurance to emergency medical evacuation, all of which vary widely in what their coverage includes and how much it costs. Make sure you know exactly what your policy will and will not cover before you purchase anything, and always buy your insurance from a reputable company (check out our list of travel insurance providers at the end of this article).

Is Travel Insurance a Waste of Money? For some people and certain trips, travel insurance is a virtual necessity; for others, it’s probably not worth the money. The question boils down to a matter of risk, and the best way to assess that risk is by answering four basic questions.

- Are you willing to risk the loss of deposits or prepayments if your trip is canceled for any reason?

- Are you willing to pay out of pocket if you need to return home early from your trip for any reason?

- Are you willing to foot the bill for any out-of-pocket medical expenses, ranging from basic emergency care to emergency medical evacuation home, if you encounter any sickness or injury on your trip?

- Do you have a credit card or general insurance that includes bundled travel insurance?

If you answered “no” to any of the first three as well as the final question, you would probably be wise to invest in a travel insurance policy that includes TCI (trip cancellation or interruption) and/or travel health insurance. Read more about weighing risk and the cost of travel insurance here.

If you need to buy trip insurance for an upcoming vacation, first look at the insurance policies you already have to see what they will cover. Some health insurance policies cover medical emergencies overseas, while others will not. Many credit cards and homeowner’s policies cover baggage loss. Also, many credit card companies (particularly gold cards) offer their members international medical assistance, and accidental death and dismemberment insurance if the user simply charges their airline tickets on their credit card. Read more about where you might already have access to travel insurance coverage here.

The Basic Types of Travel Insurance

Following is a brief description of the different types of travel insurance options available. Note that every policy is a little bit different, so be sure to read the fine print carefully before purchasing.

Trip Cancellation/Interruption Insurance

Trip cancellation/interruption insurance covers you if unforeseen events cause you to cancel or interrupt your trip. In general, this coverage is meant for illness, injury, or death suffered by the insured or a member of the insured’s immediate family. Some policies also cover cancellation in the event of illness, injury, or death to the insured’s travel companion. Most policies exclude trip cancellation in the event of war, civil disturbance, or a change in your own financial circumstances. (Lose your job before your trip? If you don’t have job loss protection—not offered by all companies—you could be out of luck.) Some policies also exclude travel to specific destinations that are prone to political unrest.

Many comprehensive travel insurance policies now include coverage if your tour operator defaults; however, it is important to understand exactly what is covered by your policy. If you buy a policy directly from a tour provider, usually it does not cover the default of that provider—so it’s generally a good idea to purchase your policy from an independent company. Some policies only cover tour operator default if the operator ceases operations entirely, which it may not do even if it files for bankruptcy.

When considering trip cancellation insurance, take time to think about how much money you’ll be putting down before your trip. Are you purchasing expensive airline tickets that can’t be refunded? Are you putting down a large nonrefundable deposit on a cruise or tour? If the answer is yes, or if you might cancel for any reason, then buying trip cancellation insurance is a prudent idea. Some travel insurers also offer comprehensive “ cancel for any reason ” policies. Read more about TCI/TII (Trip Cancellation Insurance) here.

Cancel for Any Reason Insurance, Explained

Medical/Medevac Insurance

Medical insurance encompasses several types of coverage. Emergency medical evacuation insurance covers the cost of transportation if a qualified physician determines that you must be evacuated for treatment to the nearest medical facility or to your home country (if it’s warranted), due to injury or sickness. This insurance is highly recommended for cruise passengers and travelers visiting remote areas or developing countries.

For example, if you fall and are injured while trekking in the Himalayas, you might need to be evacuated by private helicopter, then airplane—which can get quite expensive. Emergency medical evacuation back to the United States without insurance can easily cost $35,000 or more. Check to make sure you choose an insurance provider that does not exclude adventure travel from its coverage. If you’re an adventure traveler who has paid $3,000 up front for a white water rapids package deal in a remote area of South America and you won’t receive any refund if you cancel, then you might want to consider both trip cancellation and emergency medical evacuation insurance. Read more about buying medical and evacuation insurance here.

Other types of medical insurance coverage include:

- An app, or service you can call, that will direct you to English-speaking doctors while you are overseas. In some cases the policy will also provide a physician monitoring service, where a qualified physician from the U.S. will monitor the treatment you are receiving by a local physician via telephone.

- Cash payment to the insured or beneficiary in the event of accidental death, loss of sight, or loss of limb.

- Expenses for repatriation of the insured’s remains in the event of death.

Keep in mind that you may need to pay up front for your medical services, and then your insurance company will reimburse you later, once you’ve filed a claim. On the other hand, some services provide “proof of direct payment” to the healthcare provider, who may require one before treatment occurs. Talk to your insurance provider about the process upon purchasing the policy.

Before purchasing a travel insurance policy with medical coverage, be sure to check what your regular medical insurance does or doesn’t cover, particularly when traveling overseas. You should also consider the medical care offered at your destination. Many Western countries have excellent socialized medical care available, and you may not even be charged for the care you receive. On the other hand, if you are in a remote area of a developing country and need to be evacuated for adequate medical care, the expenses can mount quickly.

Read the fine print regarding coverage or lack thereof for pre-existing conditions. Generally any medical problem that arises within 60 days prior to purchasing the policy is not covered; however, there are some exceptions to this. (See below for more information on pre-existing medical conditions.)

Baggage Loss/Delay

Baggage loss and delay coverage protects you in the event that your luggage is lost, delayed, or stolen. This often includes a cash payment if your bags are delayed for more than 12 hours after you arrive at your destination.

Flight Delay/Cancellation

Flight delay or cancellation insurance (sometimes called “travel delay”) typically pays for accommodations, meals, and new travel arrangements once you’ve been delayed a certain amount of time (often six to 12 hours—read your policy carefully).

Travel Document Protection

Travel document protection can kicks in to help you replace a passport or other travel documents when they’re lost or stolen.

Annual Travel Insurance

If you travel many times a year (particularly internationally), it may be more economical to purchase annual insurance instead of individual policies for each trip. Annual insurance may also be a good idea if you regularly travel to developing countries, even if it’s only a few times a year.

Most annual policies provide medical evacuation coverage, benefits in the event of loss of life or limb, as well as minimums for lost luggage and treatment costs for illness or injury. These policies typically do not include trip cancellation coverage, but in some cases you may add this for an additional fee. Read more about annual travel insurance (and whether or not it could save you money) here .

Now that you know what kind of insurance you might need, you can read more here about how to buy travel insurance before your trip .

The Most Common Insurance Coverage Needs

When buying trip insurance, it’s important to keep in mind the situations that might arise that call for insurance help—and to make sure they’re covered as part of the policy you purchase. The most common incidents that travelers hope are covered on their travel insurance policy are weather-related delays and cancellations, including both winter weather conditions and hurricane-season natural disasters.

Winter weather issues typically covered by travel insurance include:

- Missing your flight due to weather problems that prevent you from physically getting to the airport on time

- Flights being canceled because of winter weather conditions preventing take-off

- Flights to or from your destination being delayed because of winter conditions either in your destination or at home, which may incur lost deposits and/or extra hotel stays

Generally, you shouldn’t wait until bad weather hits or is in the forecast to purchase insurance—it won’t cover known events. Read more here about buying travel insurance that will cover winter weather issues .

Hurricane travel insurance coverage also has to be bought well in advance, generally before a storm is known or named. Hurricane travel insurance plans (and most travel insurance plans) typically cover three primary scenarios, with different levels of coverage: advance cancellation, trip interruption, and delay. Each is fairly self-explanatory, but cancellation covers the full canceling of your trip prior to departure. Read more here about how to buy hurricane-season travel insurance.

Other common travel insurance coverage needs include:

- Missed connections

- General weather problems , not just winter or hurricane coverage

- Cruise insurance

Insurance Coverage Technicalities You Need to Know

Travelers with pre-existing medical conditions will need to be more careful about the travel insurance or healthcare coverage they purchase. Pre-existing medical conditions are often defined by insurance companies as: “Any injury, sickness or condition for which medical advice, diagnosis, care or treatment was recommended or received within the 180-day period ending on your date of departure. Conditions are not considered pre-existing if the condition for which prescribed drugs or medicine is taken remains controlled without any change in the required prescription.” Meaning: The insurance may only cover health problems that are proved to be unforeseen. Read more here about how to buy travel insurance when you have a pre-existing condition .

Since September 11, 2001, and many headline-making tragedies since then, many are looking to travel insurance to safeguard their trip against any unforeseen terrorist attacks at their destination, whether it be cancellation, delayed departure, or an emergency flight home. Many policies now have an “Acts of Terrorism” clause that will reimburse you if you miss or are delayed in getting to your destination because of acts of terrorism. Check to make sure acts of terrorism are included before purchasing; some policies specifically exclude them. Read more here about how to tell if your travel insurance covers acts of terrorism .

And then there are the seemingly random things that travel insurance policies simply will not cover. Among them are some inconspicuous healthcare categories, like dental care and pregnancy complications, as well as some topics you should now know better than to try getting covered—like named hurricanes and other natural disasters that have already made the news. Flights purchased with miles also might not be covered, among other items. Read more here about things your travel insurance probably won’t cover .

Checking the specific terms of your agreement is also generally a good idea, as technical jargon could be the difference between your policy covering that nightmare situation you bought it for and the insurance company dodging responsibility. For example, some policies list supplier “bankruptcy” as a covered reason; others say supplier “default.” Default protection is stronger : Companies often fail without ever officially declaring bankruptcy, and insurers can cite that as a way to weasel out of coverage. Read more here about the travel insurance jargon tricks to look for in your policy agreement .

Travel Insurance Companies and Comparison Sites

Here are several established travel insurance companies and comparison sites from which you can consider buying a policy:

- Allianz Travel

- SquareMouth

- Travel Guard

- TravelInsurance.com

- World Nomads

Be sure to read all terms and conditions carefully to be sure the policy provides the types of coverage you’re looking for and is valid in the countries you’ll be visiting. And don’t be afraid to ask an expert there to help you choose a policy—you are paying for it, after all. Read more here about the best independent sites for comparing and buying a travel insurance policy .

Readers: Have you ever been saved by travel insurance? Had a nightmarish travel insurance experience? Comment below.

More from SmarterTravel:

- 5 Common Travel Insurance Questions, Answered

- Travel Insurance Coverage: 18 Things Your Policy Won’t Cover

- The 8 Worst Travel Decisions You Can Make on Vacation

Editor’s note: This story was originally published in 2017. It has been updated to reflect the most current information. Shannon McMahon, Ed Perkins, and Carl Unger contributed reporting and editing.

You Might Also Like:

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Top Fares From

Don't see a fare you like? View all flight deals from your city.

Today's top travel deals.

Brought to you by ShermansTravel

Porto to Lisbon: 7-Nt, Small-Group Portugal...

Indus Travels

Greenland: Luxe, All-Incl. 11-Nt Exploration Small-Ship...

Swan Hellenic

Ohio: Daily Car Rentals from Cincinnati

Trending on SmarterTravel

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

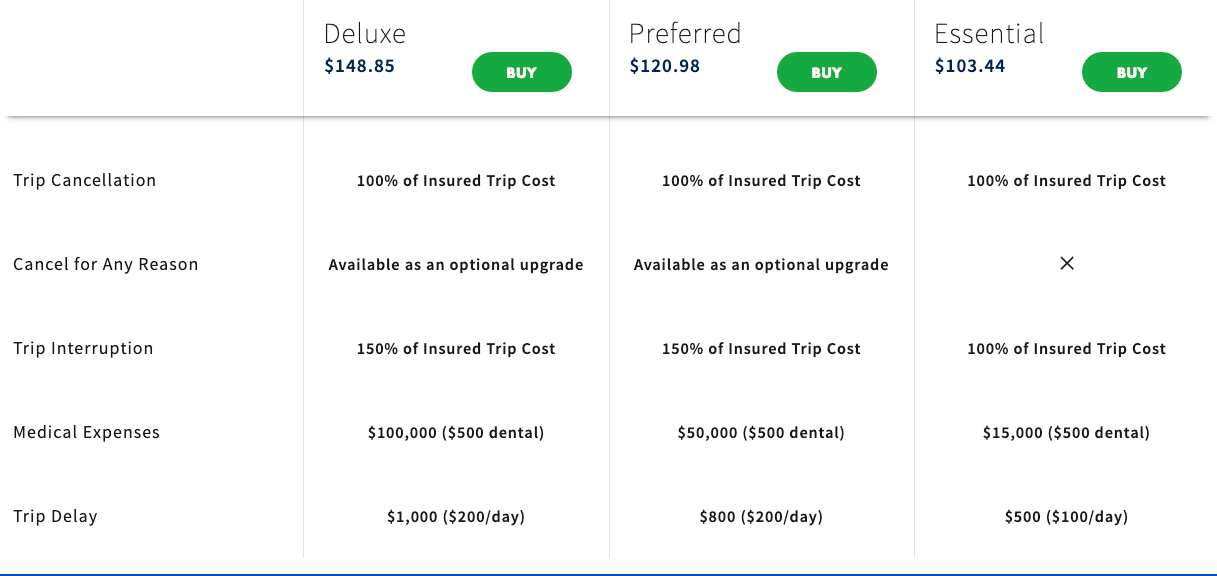

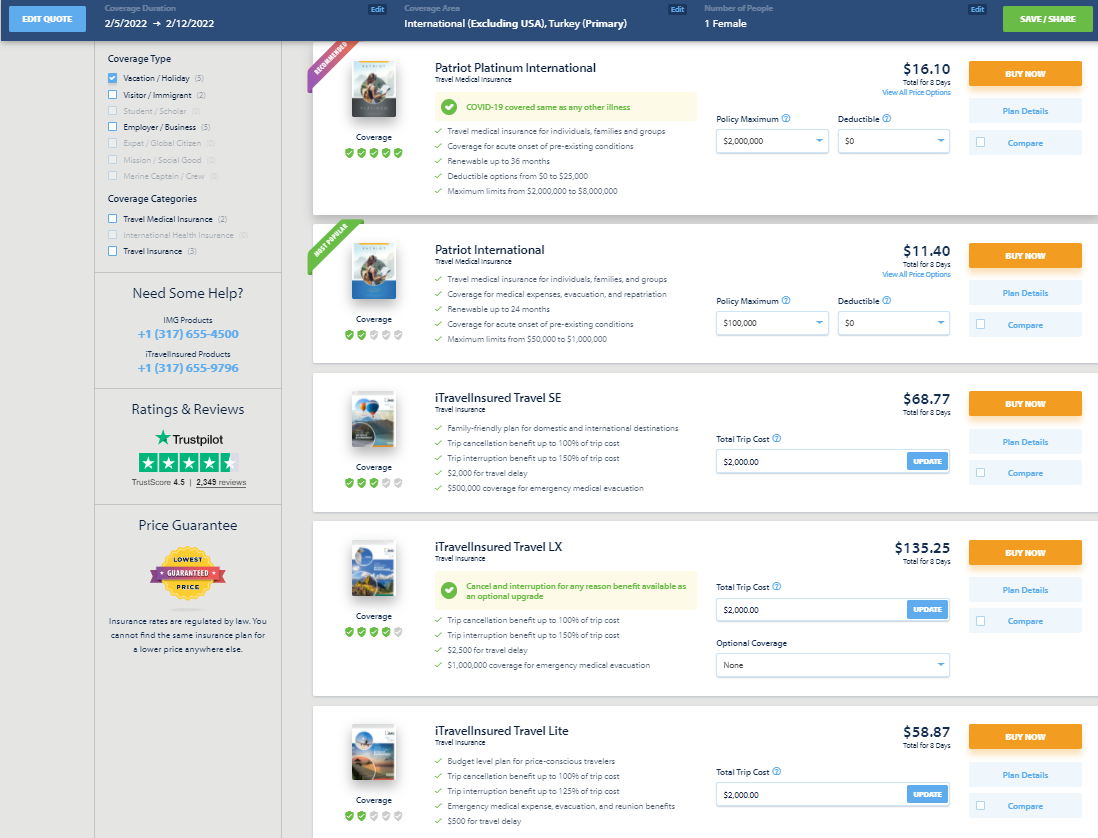

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

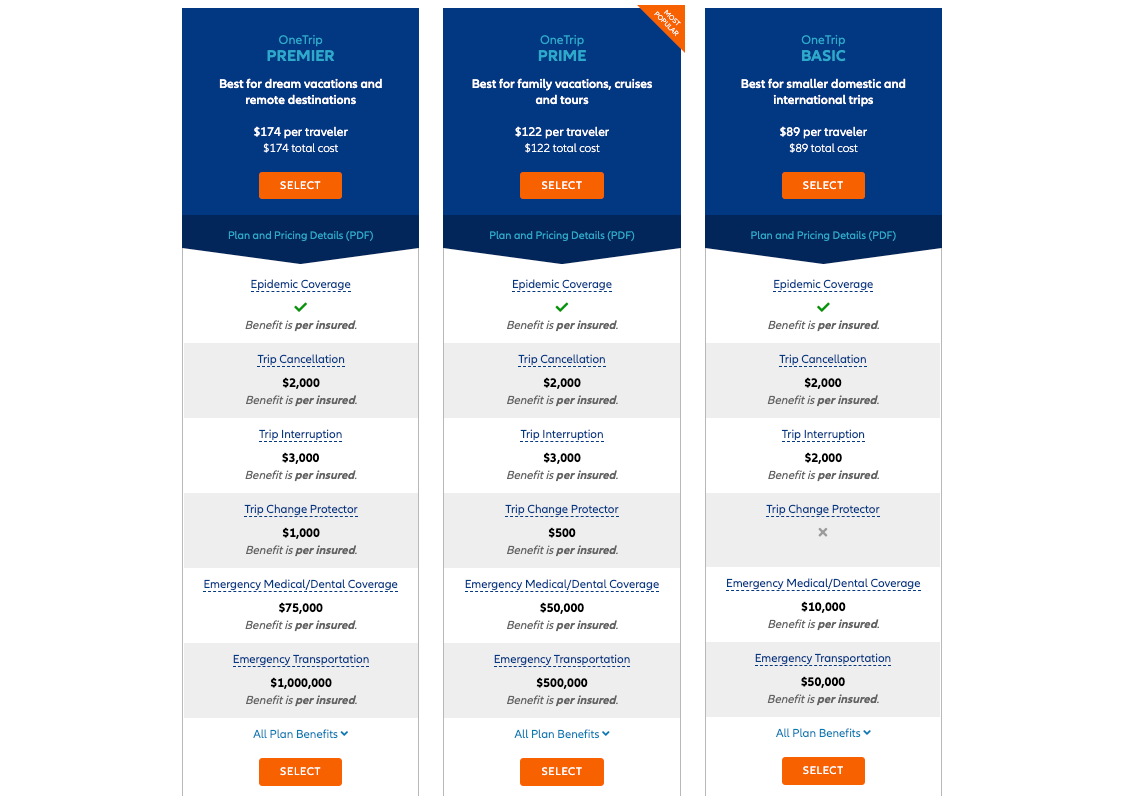

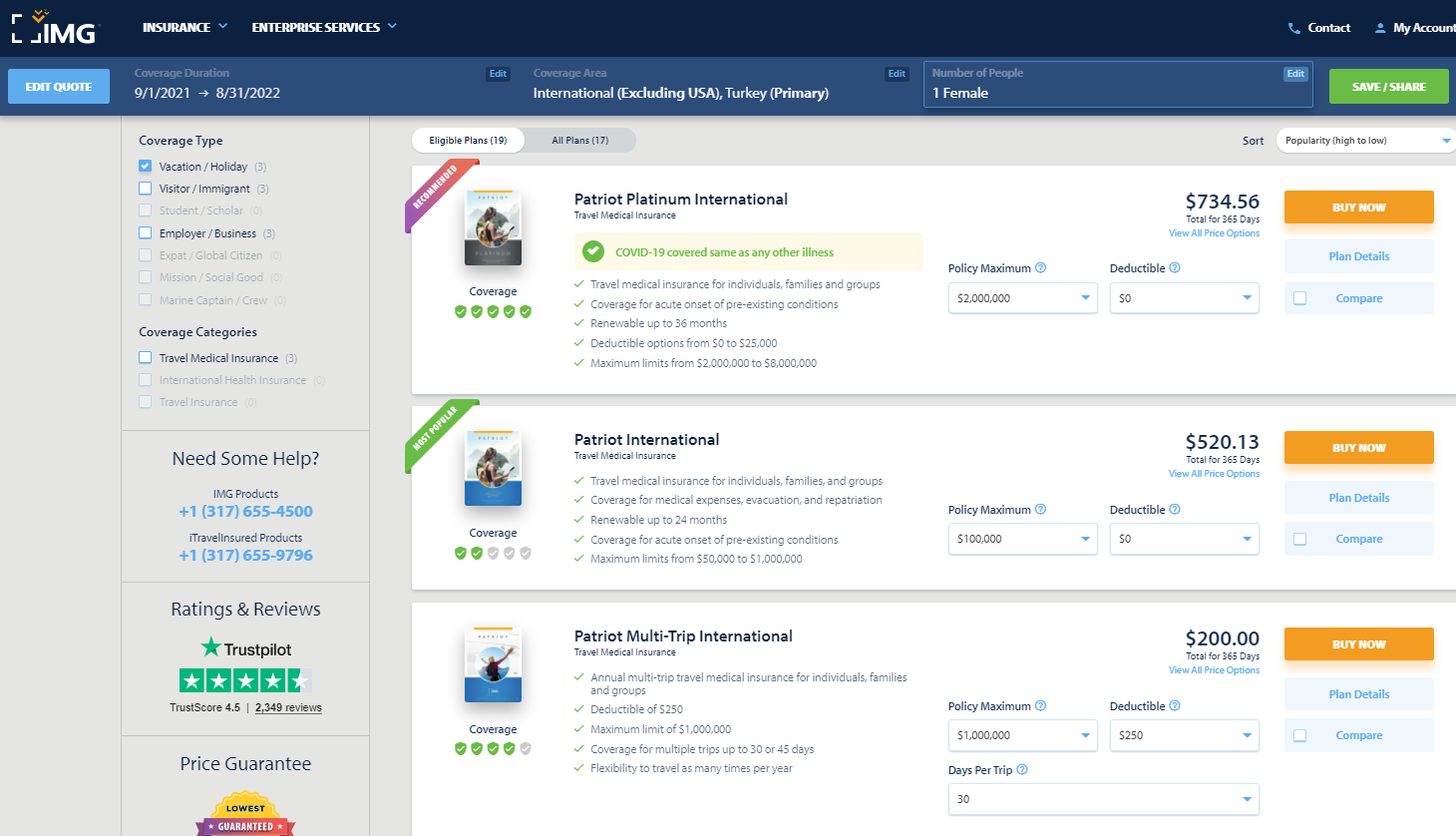

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

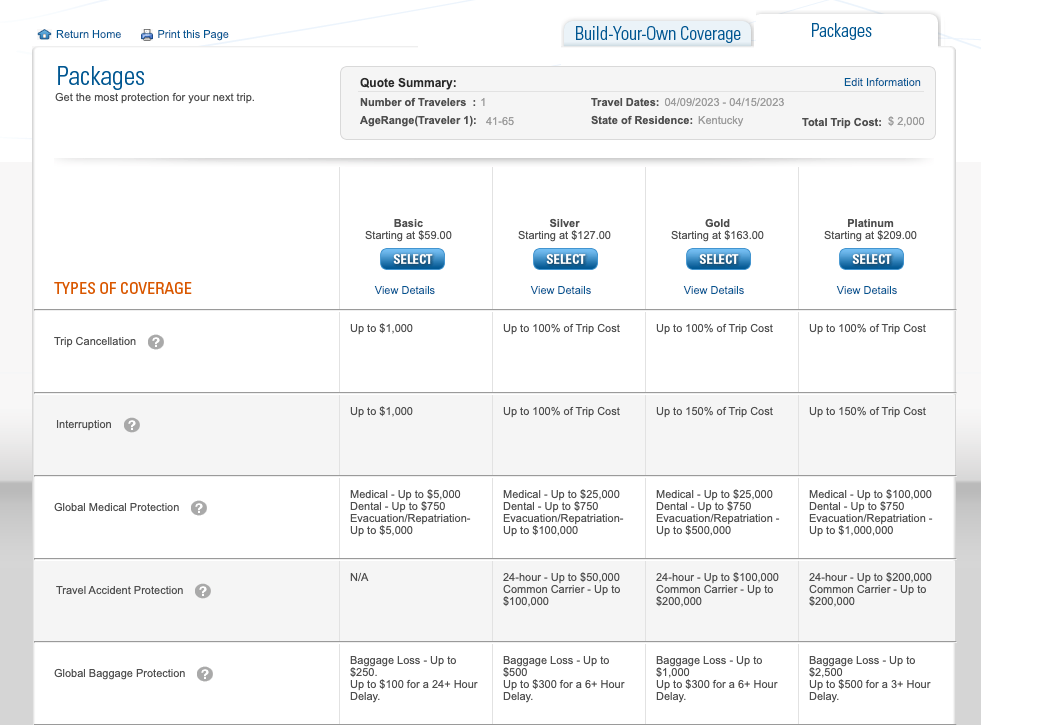

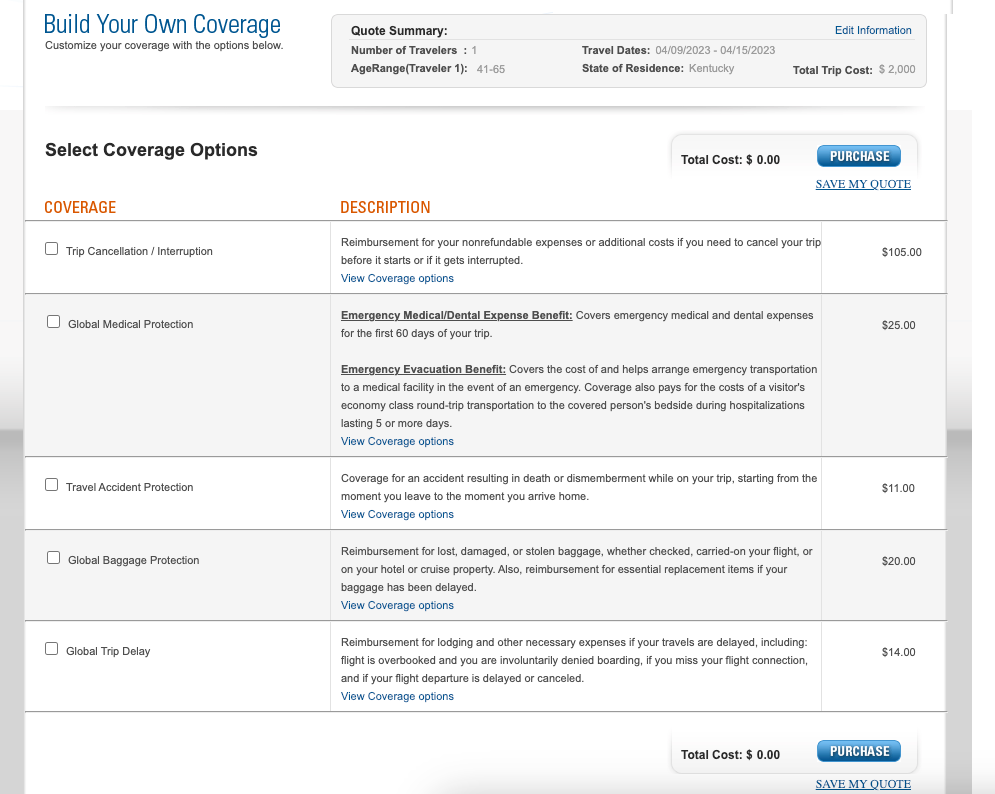

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

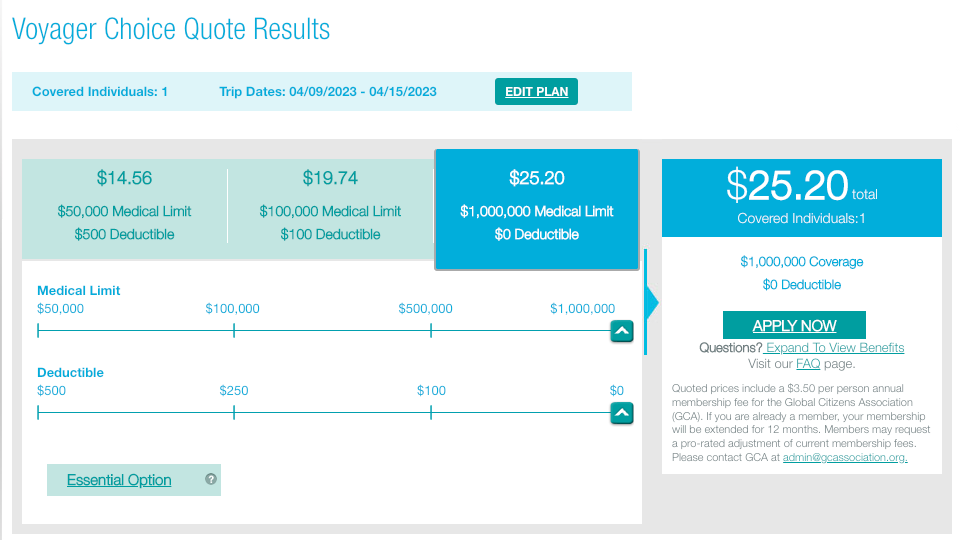

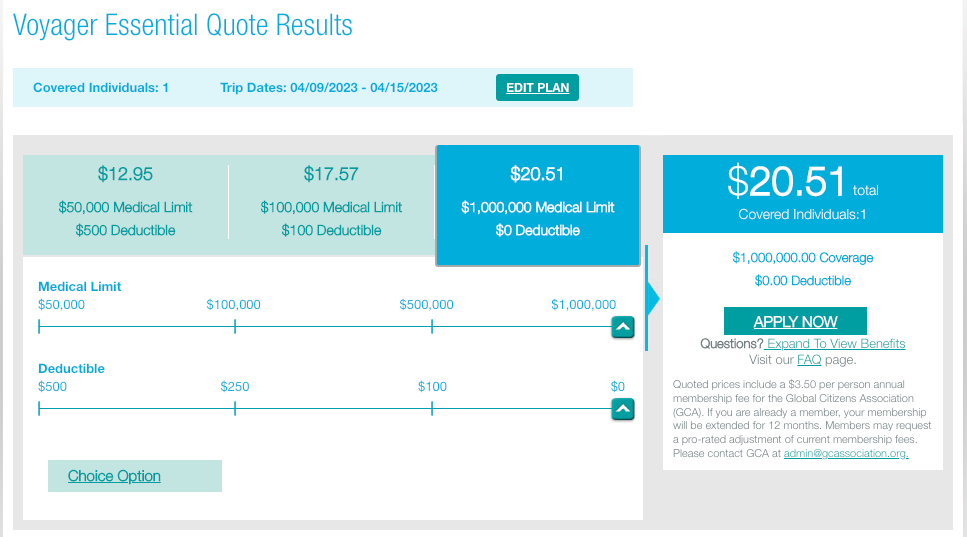

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

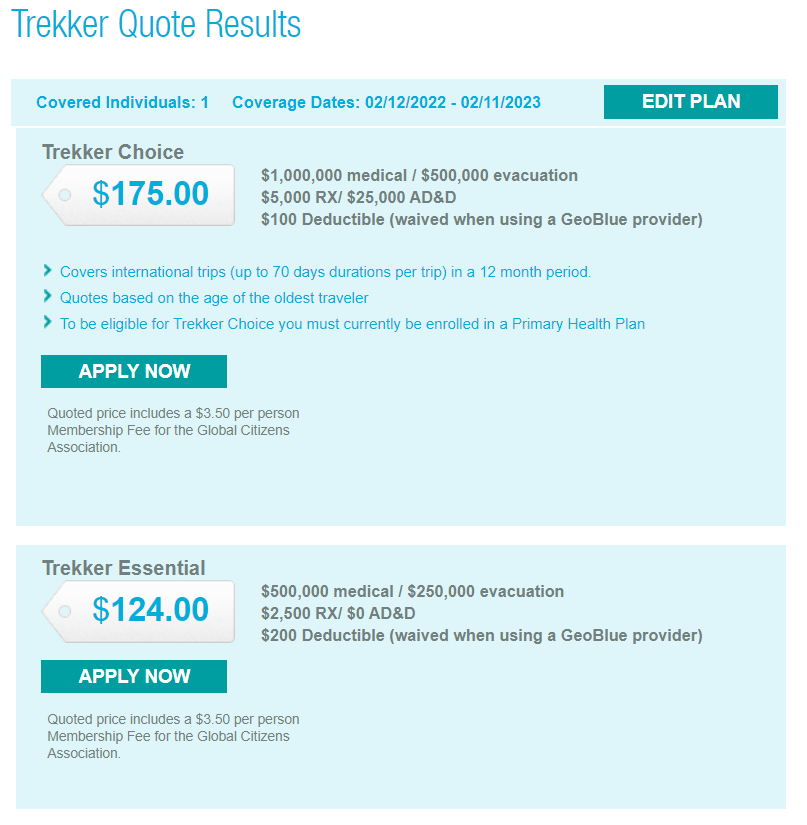

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

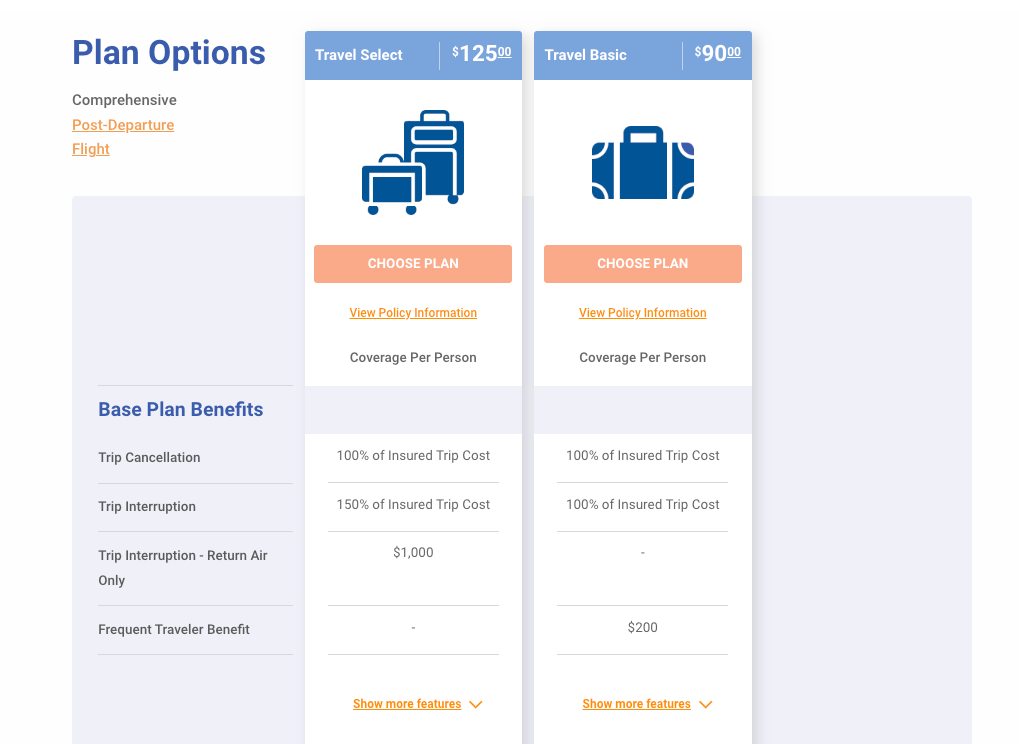

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

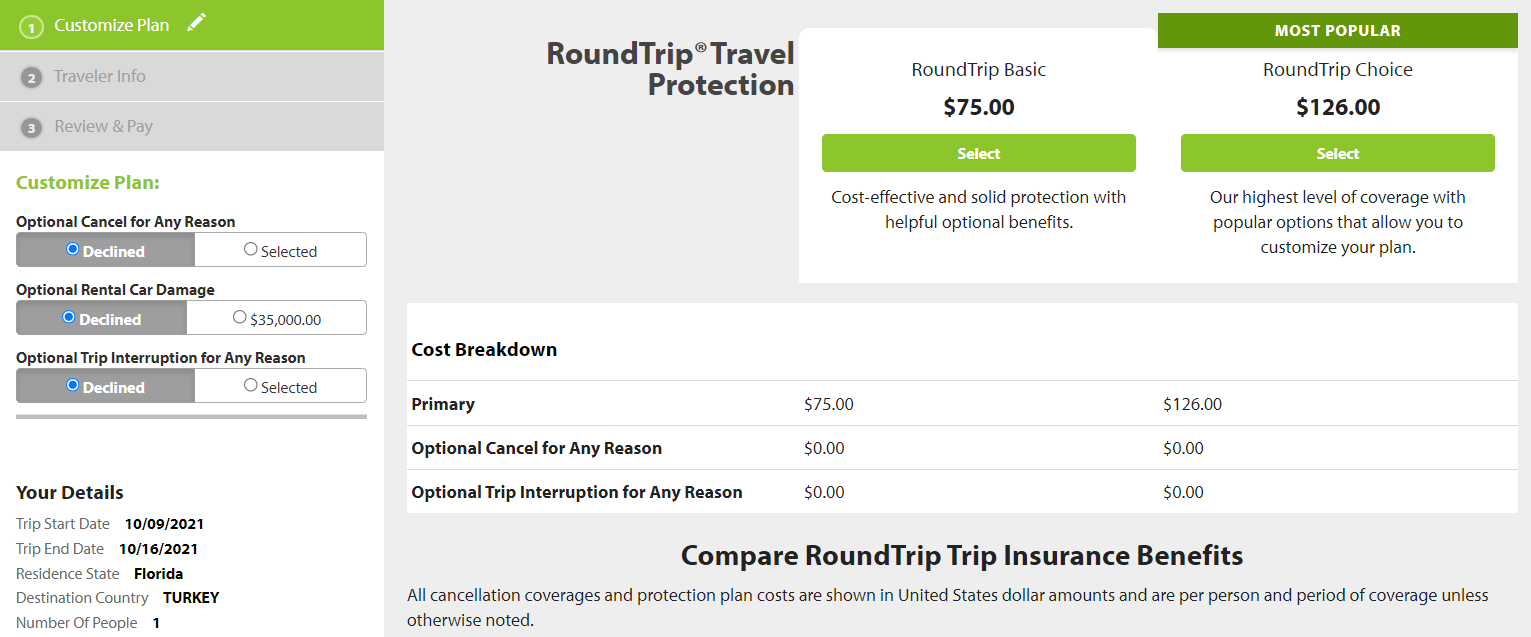

Seven Corners

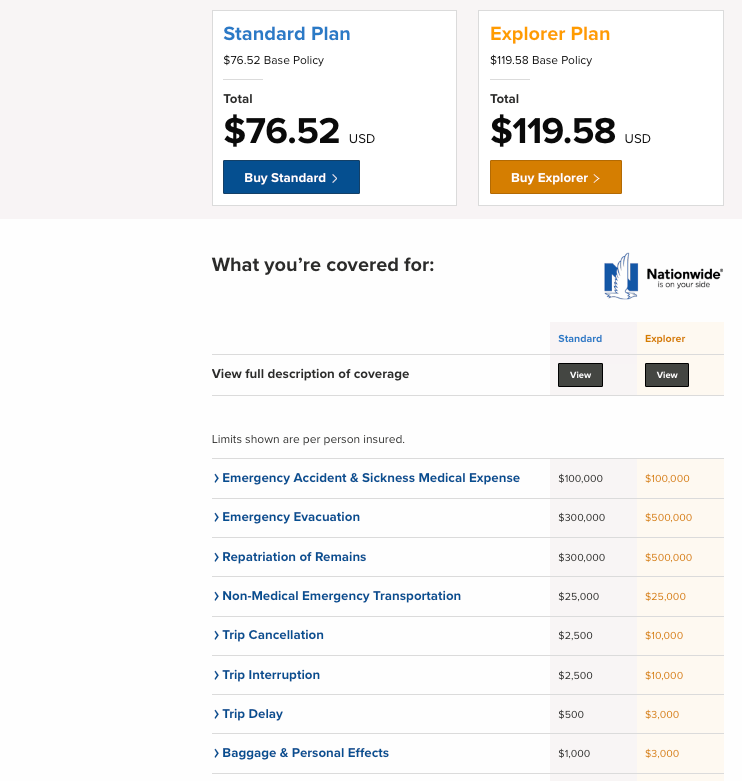

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

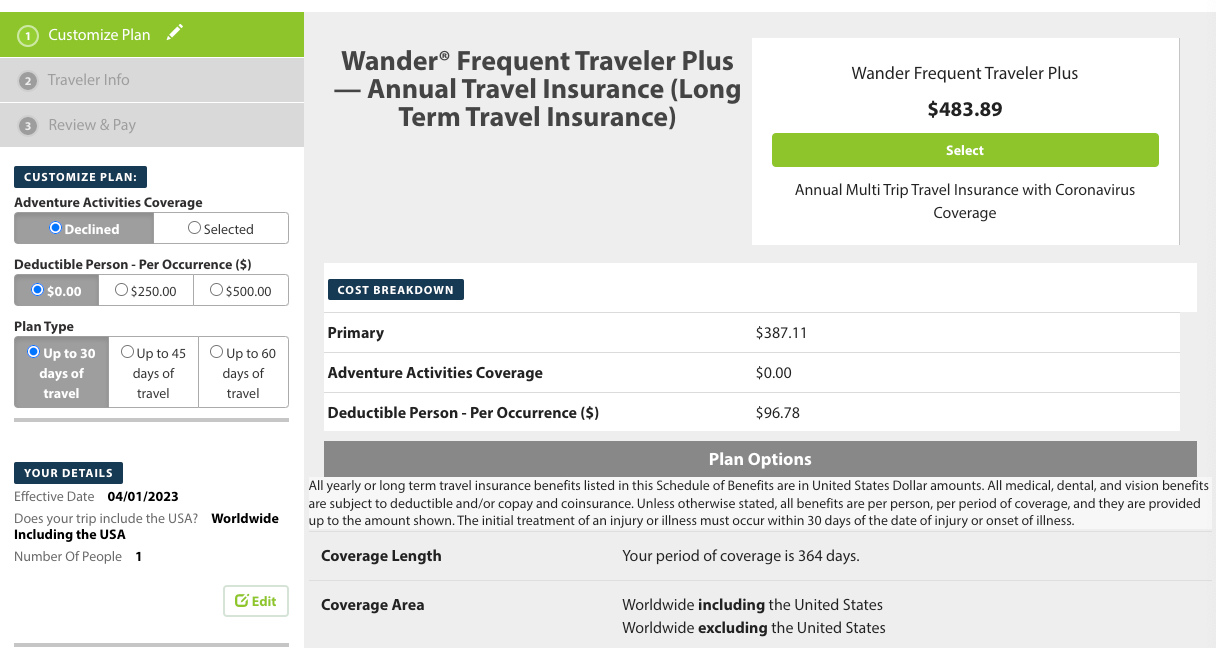

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Annual Travel Insurance in 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re a frequent traveler, annual travel insurance may be something you’ve been considering. Unlike single-trip insurance, annual travel insurance plans can cover you for an entire year, no matter how often you’re on the road.

Let’s look at the best yearly travel insurance companies, why we choose them and the coverage you can expect.

Factors we considered when picking travel insurance companies

We used the following criteria when choosing which companies we thought were best:

Cost . Annual plans can be expensive — depending on the type of coverage you choose — so we wanted ensure that they stayed affordable.

Types of coverage . Travel insurance for annual travelers can be limited in its coverage. We picked the ones with the broadest range of coverage for possible travel disruptions.

Coverage amounts . Annual trip insurance isn’t worth much if your limits are too low. Instead, we wanted plans with reasonable coverage amounts.

Customizability . If your travels take you to different places, you’ll want the ability to customize your plan. The best annual travel insurance plans can provide this.

» Learn more: What does travel insurance cover?

An overview of the best annual travel insurance

We gathered quotes from various travel insurance companies to determine the best annual travel insurance policies. In these examples, we used a year-long trip by a 22-year-old from Alabama. We indicated the main countries of travel as France and Malaysia, and when asked, put the total trip costs at $6,000.

The average cost for an annual travel insurance plan came out to $220. The plans ranged from $138-$386.

Let’s take a closer look at our top recommendations for annual travel insurance.

1. Allianz Travel

What makes Allianz travel insurance great:

Lower than average cost.

Provides health care and travel insurance benefits.

Includes rental car insurance up to $45,000.

Here’s a snippet from our Allianz Travel insurance review :

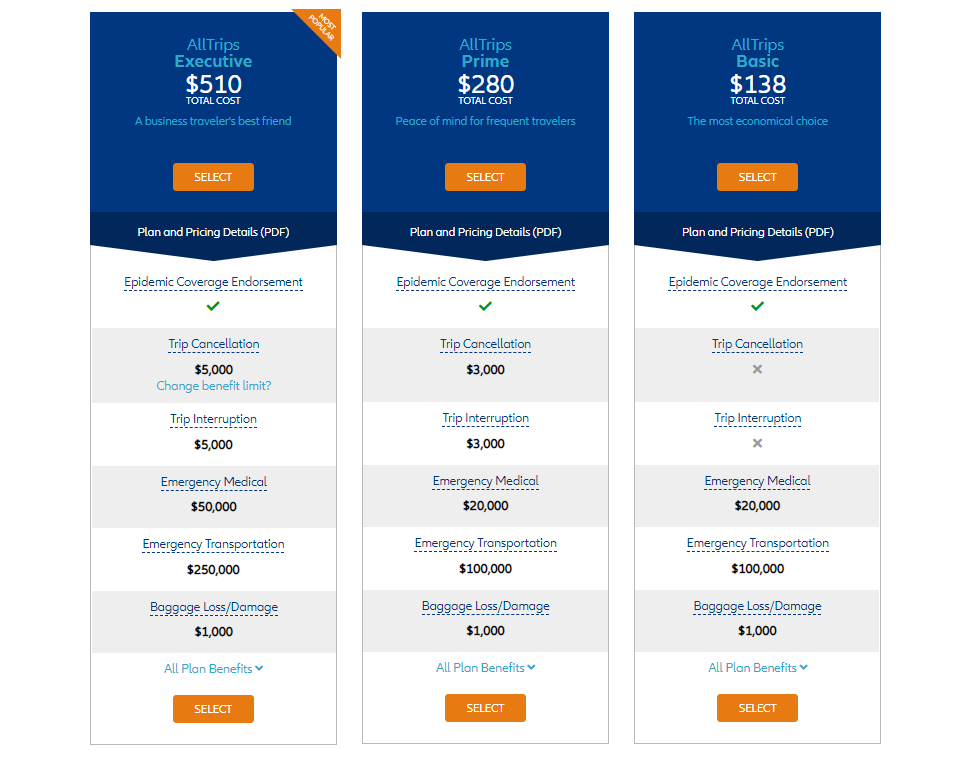

“AllTrips Basic (annual plan) is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.”

2. Seven Corners

What makes Seven Corners great:

Offers up to $20,000 for acute coverage of pre-existing conditions.

Includes up to $1 million for emergency medical evacuation.

Optional add-on for adventure sport activities.

$0 deductible available.

Here’s a snippet from our Seven Corners review :

“Seven Corners offers one annual policy called Travel Medical Annual Multi-Trip. The policy can be customized depending on how long you plan to be away from home for any one trip. You can travel as much as you like during the 364 days, so long as any one trip doesn’t exceed the option selected — 30, 45 or 60 days.”

What makes IMG great:

Good customizability with medical evacuations and sports coverage.

Low $250 deductible.

Includes coverage for semi-private hospital rooms.

Here’s a snippet from our IMG review:

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

4. Trawick International

What makes Trawick International great:

100% coverage for trip cancellation and trip interruption.

Emergency medical evacuation included.

Trip delay reimbursement coverage.

Here’s a snippet from our Trawick International review :

“Trawick International is a comprehensive travel insurance provider that offers trip delay and cancellation insurance, baggage delay coverage, medical coverage and medical evacuation, rental car damage protection, and even COVID-19 coverage among its various policies.

Trawick covers trips for worldwide destinations, including for foreign nationals coming to the U.S.”

What does travel insurance cover?

You’ll find a wide variety of coverage types offered by travel insurance policies. This is true whether you're purchasing a single-trip or annual travel insurance plan. Here are some common types you can expect to find:

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip interruption insurance .

How to choose the best annual travel insurance policy

While we’ve highlighted some of the best annual travel insurance companies, the truth is that the best plan for you isn’t going to be the best plan for someone else. If you’re interested in buying annual travel insurance, you’ll want to collect a variety of quotes to see which policy best fits your needs.

This may mean opting for a plan that covers pre-existing conditions or one that specifically includes high-risk activities. Or, if you’re in a country where health care is notoriously expensive, you may want to choose a policy with higher maximums.

Many credit cards come with complimentary travel insurance .

Whatever the case, do your research first and review all the plan details before making your purchase.

» Learn more: How to find the best travel insurance

If you want to buy annual travel insurance

Annual travel insurance can be a great option if you’re often out of town. With such a wide range of policies available, selecting a plan that fits your needs is easy. We’ve done some of the work for you by choosing the best annual travel insurance companies, all of which made the top of the list for their cost, customizability, types of coverage and plan maximums.

Like any travel insurance policy, the cost of your plan is going to vary. Factors that may affect the cost of your annual travel insurance include your age, where you’re going, how long you’ll be traveling, your policy maximums and whether preexisting conditions are included.

Although not all travel insurance providers offer annual travel insurance, many of them do. We’ve gathered together the five best, including Allianz Travel, World Nomads, Seven Corners, IMG and Trawick International.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Understanding What Travel Insurance Covers

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠. The details for these products have not been reviewed or provided by the issuer.

- Travel insurance is intended to cover risks and financial losses associated with traveling.

- Coverage can include trip cancellation, baggage protection, medical care, and emergency evacuation.

- When filing a claim, be specific and comprehensive in your documentation to ease the process.

Whether it's a trip across the world or a trip across the state, having travel insurance provides major relief if things go awry. Flight delays, lost baggage, illness, injuries, and other unforeseen events can disrupt even the best-laid plans. With a major disruption comes the potential for unanticipated expenses.

Travel insurance and the coverage it offers can help keep you protected and save you money in the long run.

Overview of Travel Insurance Coverage

Travel insurance policies protect travelers from financial losses should something go wrong during their trip. You can customize which coverages you want to include, and there are several to choose from.

"Common types of coverage include trip cancellation, trip interruption, baggage protection, coverage for medical care if you get sick or hurt during your trip, and emergency medical evacuation," says Angela Borden, a travel insurance expert and product strategist for travel insurance company Seven Corners.

Travel insurance plans offer nonrefundable payments and other trip-related expenses. While monetary compensation is a primary benefit, there is another valuable perk of travel insurance. It can provide peace of mind.

What does travel insurance cover?

Your specific travel insurance plan (and its terms and conditions) will determine the minutia and specifics of what is covered. As with most other forms of insurance, a general rule of thumb is the more you spend, the better your coverage.

"Travel insurance can be confusing, so it's best to research a reputable company that specializes in travel insurance and has a long history of successfully helping travelers all over the world," says Borden.

Trip cancellation and interruptions

A travel insurance policy can reimburse you for a prepaid, nonrefundable trip if it is canceled for a covered event, such as a natural disaster or a global pandemic.

Trip interruption insurance covers you if you're already on your trip and you get sick, there's a natural disaster, or something else happens. Make sure to check with your travel insurance providers to discuss any inclusions, coverage, and more.

Travel delays and missed connections

Travel delay insurance coverage provides reimbursement for any expenses you incur when you experience a delay in transit over a minimum time. Reimbursements can include hotels, airfare, food, and other related expenses.

Medical emergencies and evacuations