Travel Insurance

to Purchase Travel Insurance

There are hundreds of circumstances that could cause you to cancel your trip, return home early or force you to seek emergency medical treatment while traveling.

To demonstrate the importance of purchasing travel insurance, and emergency travel services, here are 10 common examples of what could go wrong.

- It's 10 p.m. and you and your immediate family arrive at the airport for a connecting flight, only to find that your flight has been cancelled. Who can assist you with finding new flights to get everyone home?

- Your bag was lost with your insulin inside. You need help to locate your bag as soon as possible and have your emergency prescription filled. Who do you call?

- Your first visit to Europe, and your passport and wallet are stolen. Where do you turn for emergency cash, and how will you get your passport replaced?

- You're involved in an accident and adequate medical treatment is not available. Who will help arrange and pay for a medical evacuation?

- If your sister-in-law becomes seriously ill and you must cancel your trip, what happens to your non-refundable deposits or pre-payments?

- You arrive in Jamaica and your luggage doesn't. If it's lost, who will help you find it? If it's delayed, who will pay for your necessities? If it's stolen, who will pay to replace it?

- Your cruise line, airline or tour operator goes bankrupt. Who will pay for your non-refundable expenses? Who will help get you to your destination?

- You're walking down a street in Rio and twist your ankle. Who can help you find an English-speaking physician?

- Three weeks before your scheduled arrival, a terrorist incident occurs in the city to which you are planning to visit. Who will pay if you want to cancel your trip?

- You are at a beach resort in North Carolina, and you are forced to evacuate due to an approaching hurricane. Who will help you evacuate and who will reimburse your lost vacation investment?

Protect your vacations by purchasing travel insurance. Ask a BCD Leisure Specialist for assistance in selecting the best coverage for your travel needs.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

For the Frequent Traveler: The 11 Best Annual Travel Insurance Policies

Content Contributor

70 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

94 Published Articles 512 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3273 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

The 11 best annual travel insurance policies, what is annual travel insurance, is annual travel insurance worth it, how much do annual travel insurance policies cost, does credit card travel insurance apply annually, choosing an annual travel insurance policy, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you take multiple trips every year, insuring each one can be a hassle. There are forms to fill out, comparison shopping over and over again, and then remembering the policy documents for each specific trip. And then there’s the risk you might forget to take out travel insurance for one of your trips.

Plus, those costs add up. There must be a better way.

Enter annual travel insurance. Also known as multi-trip travel insurance, taking out an annual policy covers you for a whole year of travel. Not only is it simpler, it may be cheaper than taking out multiple single-trip policies. But is it right for you?

Annual travel insurance policies aren’t exactly the same as the trip insurance you’d buy for a weeklong holiday with your family. Here are the best annual travel insurance policies, what they do and don’t cover, and how to decide whether taking out a yearly policy might be right for you.

GeoBlue Trekker Choice

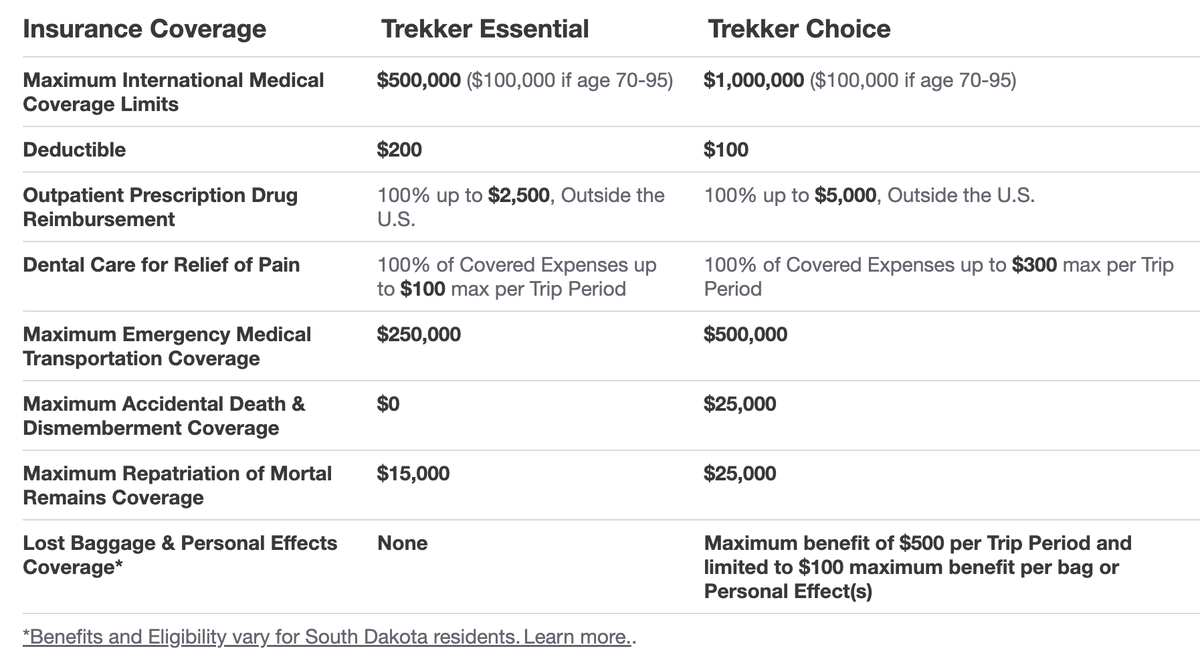

GeoBlue offers 2 Trekker plans for annual coverage, which are unique in several ways. These plans cover preexisting conditions, COVID-19, and all travel outside the U.S.

However, they don’t cover any trips inside the U.S. or provide any coverage for canceled, delayed, or interrupted trips. Instead, these are travel medical insurance plans . With the GeoBlue Trekker Choice plan , you’ll get higher maximum payouts in all categories and pay a lower deductible ($100). However, note that this is still secondary coverage .

You’ll get unlimited access to telemedicine and coverage for trips up to 70 days in length . Additionally, coverage is available up to age 95, which isn’t offered on most other policies.

GeoBlue Trekker Essential

The GeoBlue Trekker Essential plan offers the same pros and cons as the Choice plan. The main differences are the lower maximum payout values and the higher deductible ($200 instead of $100). You also won’t get the Choice plan’s lost baggage and personal effects coverage, which can provide up to $500 per trip. Again, this secondary medical insurance policy is only valid on trips outside the U.S.

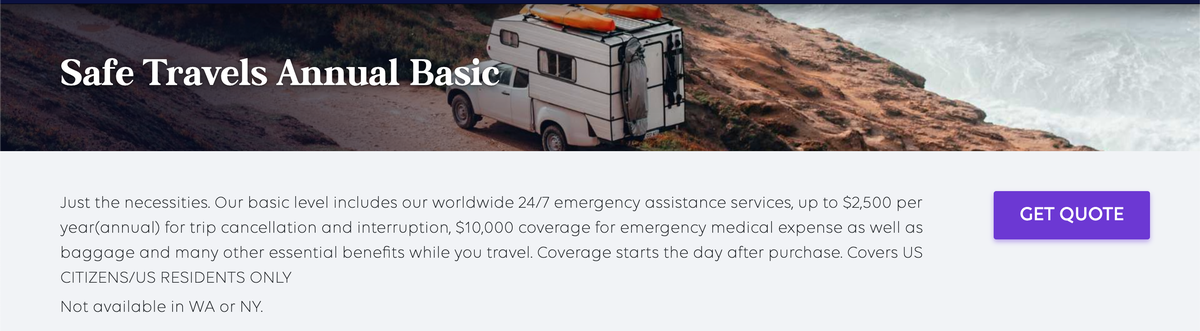

Trawick International Safe Travels Annual Basic

Trawick International offers 2 annual plans, and the Safe Travels Annual Basic plan is more economical. You’ll have coverage for everything you expect in a trip insurance policy , such as 100% coverage for trip cancellation or interruption (up to a $2,500 annual maximum) and coverage for delays, lost luggage, delayed luggage, and even medical expenses. To make up for the lower cost of the plan, coverage limits are lower than what you’ll find elsewhere . However, if you want peace of mind while traveling, you can get it for a year and cover trips up to 30 days in length.

Trawick International Safe Travels Annual Deluxe

While Trawick International’s Safe Travels Annual Deluxe plan offers higher maximum coverage limits than the Basic plan, its maximum payouts for medical and evacuation benefits are lower than what you’ll find with competitors . Where this plan shines is in the coverage for change fees, lost deposits on tours, and coverage for lost items if an airline misplaces your luggage.

You’ll be covered for up to $300 per trip for prepaid excursions, up to 100% of your trip cost (with an annual maximum of $5,000) for trip cancellations or interruptions, and up to $150 per item and $750 per trip for personal effects. After signing up for a plan, you’ll also get a 10-day free look period.

Allianz Travel AllTrips Basic Plan

If you want an annual plan with a low price tag , this could be what you’re looking for. The Allianz Travel AllTrips Basic plan covers you for unlimited trips up to 45 days each over the course of a year. Coverage includes emergency medical, emergency medical evacuation, baggage loss and delays, travel delays, rental car theft and damage, and travel accident coverage.

However, there’s a fair list of exclusions from this plan . That includes trip cancellation, trip interruption, missed connections, and change fees. As the name implies, you’ll get basic coverage at a basic price.

Allianz Travel AllTrips Prime Plan

The Allianz Travel AllTrips Prime option covers 365 days of trips, though the maximum trip length is just 45 days. While you’ll get coverage for all the standard travel insurance benefits, including trip cancellation, trip interruption, emergency medical, delays, and baggage mishaps, there are limits you should know about with this plan.

The travel accident coverage, which applies to death or the loss of a limb, maxes out at $25,000 per trip, baggage delay maxes out at $200, and baggage loss or damage maxes out at $1,000. The maximum coverage for emergency medical is $20,000, and costs can exceed that quickly in a true emergency.

However, this is a decent option if you want a fair amount of coverage across numerous categories without a high price tag.

Allianz Travel AllTrips Executive Plan

For those worried about expensive business equipment or losing points and miles, this plan has you covered. On top of higher maximum payouts in categories such as trip cancellation, emergency medical transportation, or travel delays, you’ll also get rental car damage and theft coverage, change fee coverage, and reimbursement for renting business equipment if yours is lost, stolen, damaged, or delayed during a trip.

Moreover, you can be reimbursed up to $500 to cover fees for reinstating your points and miles if a covered trip is canceled or interrupted. The Allianz Travel AllTrips Executive plan also provides coverage for preexisting medical conditions if you meet certain criteria and buy at least 14 days before the first trip.

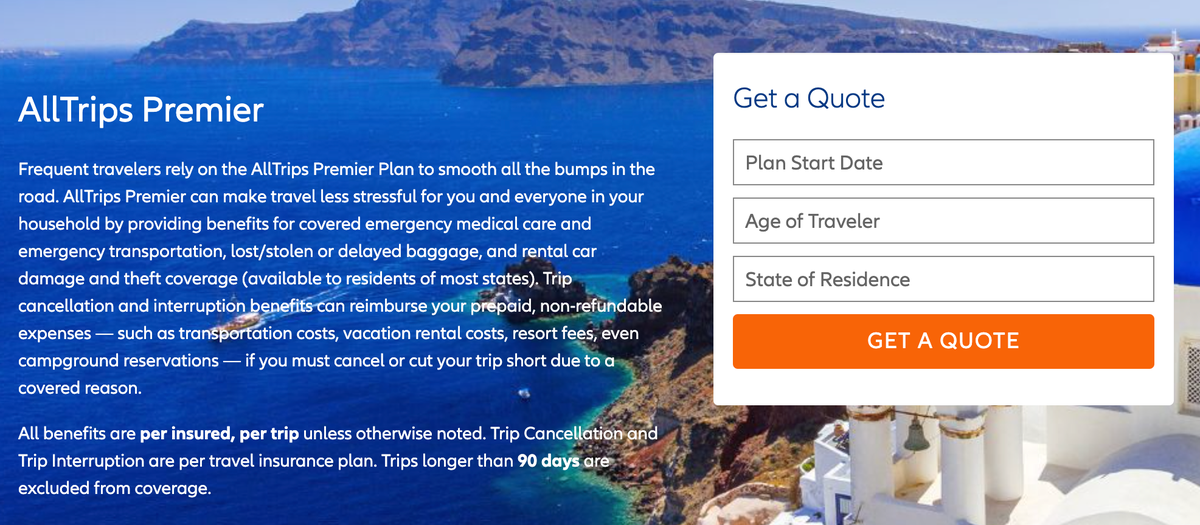

Allianz Travel AllTrips Premier Plan

Allianz also has a customizable AllTrips Premier plan , allowing you to choose between several payout tiers for trip cancellation and interruption. You’ll pay more when choosing higher maximums, but this allows you to choose exactly what you want in coverage and not pay for more than you need. Another positive is coverage for preexisting medical conditions if you meet certain criteria and buy your policy at least 14 days before your first trip.

You’ll also get rental car damage and theft coverage , $500,000 of emergency medical transportation coverage, $50,000 of emergency medical, and coverage for travel delay expenses after a delay of 6 hours or more. The baggage delay coverage is up to $2,000, but it requires a delay of 12 or more hours. The maximum trip length allowed is 90 days.

AIG Travel Guard Annual Travel Insurance Plan

The AIG Travel Guard Annual Travel Insurance plan isn’t available to Washington state residents. Still, it provides coverage for trip interruption, trip delay, lost baggage, delayed baggage, and missed connections, as well as both medical and security evacuation, accidental death and dismemberment, and travel medical expenses. However, the coverage limit for dental is just $500, and the maximum coverage for travel medical expenses is just $50,000. Those are lower limits than other plans. Additionally, trip cancellation isn’t included.

However, Travel Guard has some strengths. Trip delay coverage applies for up to 10 days and requires a delay of just 5 hours, and the missed connection benefit applies after just 3 hours. You get a “free look” period of up to 15 days to cancel for a refund, so long as you haven’t started your trip or filed a claim. Maximum coverage for any particular trip is 90 days.

USI Affinity Voyager Annual Travel Insurance

USI Affinity’s Voyager plan has a Silver and Gold option , and pricing is easy to determine from the chart. Simply find your age bracket and the associated cost. The key differences between the plans are in the higher maximum payouts for nearly every coverage type with the Gold plan, other than emergency dental and accidental death and dismemberment. However, the Gold plan also includes coverage types the Silver plan doesn’t: political and natural disaster evacuation, airline ticket change fees, and trip interruption. However, trip cancellation isn’t included with either plan .

The maximum trip length is 90 days, and coverage for Silver and Gold plans lasts for 364 days. An unlimited number of international and domestic trips are covered, and you’re covered for trips as little as 100 miles from home. That’s a lower requirement than most other plans (which tend to require 150 miles).

Seven Corners Travel Medical Annual Multi-Trip

This plan is ideal for those who don’t live in the U.S., as other plans on this list are only available to U.S. residents and citizens. While the plan technically lasts for 364 days, Seven Corners’ Travel Medical Annual Multi-Trip plan is customizable. It lets you choose a maximum trip length of 30, 45, or 60 days and include or exclude coverage for the U.S. Note U.S. citizens and residents cannot add coverage for inside the U.S.

Seven Corners also provides coverage for travelers aged 14 to 75 years, though maximum payouts decrease in some categories for those aged 65 and older. If you receive medical care in the U.S., Seven Corners will pay 90% of the first $5,000 of covered expenses and 100% of the cost afterward. You’re covered 100% outside the U.S. Note that coverage doesn’t apply to your home country (which includes the U.S. if you’re a citizen, even if you live in another country) and isn’t available in Antarctica, Cuba, Iran, Israel, North Korea, Russia, Syria, or Ukraine.

A Plan That Didn’t Make Our List

We considered another plan. Here’s why this annual travel insurance policy didn’t make our “best of” list.

IMG Patriot Multi-Trip International : For trips inside the U.S., you may be on the hook for 20% of your medical expenses if you visit a provider outside IMG’s PPO network. Additionally, the maximum trip length is 30 days, and coverage limits are quite low in multiple categories. These include $50,000 for emergency medical evacuation and $10,000 for political evacuation, a maximum of $50 per item and $250 overall for lost luggage, a $100 maximum for dental treatment, and $25,000 for accidental death and dismemberment 24/7 coverage.

Annual travel policy plans vary considerably. Most provide secondary medical insurance, so you may need to submit to your other coverage (home healthcare plan, credit card insurance provider, etc.) first and then submit to your travel insurance provider for any remaining expenses or deductibles. If you won’t have other coverage, you may want to look for a plan that provides primary health coverage instead. Also, understand that most plans provide reimbursement, so you would pay out of pocket for overseas hospital visits and then submit to your insurance provider for reimbursement after the fact.

Annual travel insurance covers you for many trips over the course of a year (or sometimes 364 days). Rather than needing to buy a travel insurance policy for each trip separately — which can add up — you can buy a single policy that covers all your trips for the next year. It’s important to understand the terms of these policies, though. Some may require buying coverage in advance, such as 14 days before your first trip, while that requirement normally doesn’t exist on single-trip travel insurance.

It’s also important to note which types of trips and destinations are covered by your policy — and which aren’t. Look for how far from home you must travel to be covered and whether domestic trips are included. Moreover, consider what benefits you’re looking for. These can vary from medical-only to all the bells and whistles, such as baggage delay and medical evacuation. Once you know the type of coverage you want, you can find a policy or policies that align with your needs, helping you narrow down your options to conduct a more effective comparison.

How Annual Travel Insurance Works

Annual travel insurance works as an umbrella policy, covering all your trips during the policy period. You don’t need to inform the policy provider about each trip’s start and stop dates or destinations. You simply buy a policy, and then you’re protected for every trip that meets the conditions while your policy is in effect. Some regions may be excluded from coverage, and you may be subject to a maximum trip length.

Trip length is an important element to pay attention to. Annual travel insurance doesn’t cover you for a year-long trip. It covers you for a year for many small trips within that time, typically up to 30 or 45 days per trip. If you’re looking for a plan to cover you during a year-long trip to another country, you should look for specialized plans for study abroad, mission work, or other situations that apply to you. Traveling full-time? You may need a policy geared toward digital nomads and backpackers.

When To Buy an Annual Travel Insurance Policy

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and determine that the cost of insuring each alone would be higher than that of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want.

Considering that single-trip plans can sometimes be found for $10, yet an annual trip is likely to cost $150 or more per adult, you’d need 15 trips to justify the annual policy. However, that’s not really an apples-to-apples comparison, as a $10 basic travel insurance policy won’t provide as much coverage as you’re likely to find on even the most basic of annual policies.

It’s also not just about the number of trips you take but the types of trips, the complexity of the trips, and money at risk in nonrefundable costs. The more of these you foresee in your next year of travels, the more likely an annual plan would be good for you.

What Annual Travel Insurance Policies Do and Don’t Cover

We already highlighted that annual policies don’t cover traveling nonstop for a year due to their restrictions on the maximum trip length. Annual travel insurance policies also restrict how far you must travel for coverage to kick in. Driving to the next town over may be a trip in your kids’ eyes, but it’s probably not far enough for your travel insurance to kick in.

While coverage varies by policy, you’ll typically have coverage for sickness, accidental death and dismemberment, lost or delayed luggage, trip cancellation, and possibly injuries during skiing or snowboarding. However, it’s important to read the terms of each policy because coverage maximums and inclusions vary widely. Some policies only provide medical coverage, while others offer robust coverage across the board.

Understanding Trip Length Rules

Each policy specifies a maximum trip length. How trips longer than that are treated can vary. Most policies won’t cover any expenses related to a trip longer than the maximum trip length. Suppose you take a trip of 41 days on a policy with a maximum of 40 days. In that case, claims for delayed luggage or medical expenses may be rejected when the claim evaluator asks for your trip confirmation details.

However, GeoBlue covers the first 70 days of any particular trip. If something goes wrong during that time, you’re covered. You’re on your own for anything that happens on days 71 or beyond. Still, you’re covered on those first 70 days, despite taking a longer trip.

If you foresee long trips in the future, make sure you understand these rules.

For some travelers, yes, annual travel insurance is worth it. For others, it’s not.

Annual travel insurance is worth it when it costs less than what you’d pay to insure each trip individually. It’s also worth it if you think you might forget to purchase some of those individual policies throughout the year and would prefer to be done with them for another 365 days.

However, annual travel insurance isn’t worth it if you only take a few trips a year, they’re mostly domestic, and you don’t have major nonrefundable expenses. If you’re traveling within the U.S. with your standard health insurance policy in effect and you have credit cards that provide trip insurance for delays or cancellations, that coverage may be sufficient.

Costs will vary by your home state, age, and number of people included in the policy. Here are the “starting at” costs for our best annual travel insurance policies, sorted from lowest to highest:

Yes and no. Using a credit card to pay for your trip can provide some built-in protections. However, you should be mindful of annual maximums on any policy. You may run into limitations such as a maximum of 2 claims per 12-month period or similar exclusions. If you take many trips, that could be an issue.

To better understand what is and isn’t covered, check out our complete guide to credit card insurance .

To choose the right policy, look beyond the cost alone. Rather than immediately choosing the cheapest policy, find the policy or policies that provide the coverage types you want with payout maximums that cover your travel plans for the next year — both confirmed bookings and likely plans.

Consider your coverage needs. Will you be carrying expensive items such as scuba equipment for a trip to the Galapagos or top-notch camera lenses for a bird-watching tour in Papua New Guinea? How many extreme sports will you participate in?

Conversely, how many “never heard of this airline before” flights will you take to get off the beaten path? These are flights where you may be worried about cancelations that lead to extra costs or a misplaced suitcase.

Consider the types of trips you’ll take and the up-front money at risk if something goes wrong or you get delayed, then look at which plans align with your travels. From there, choose the best plan that aligns best with your needs, which may or may not be the cheapest one.

As an annual travel policy holder myself, I promise you that having the right plan is important when you wind up in a remote hospital in Tanzania with malaria.

Annual travel insurance isn’t right for everyone. However, it makes sense for those who travel often and could save money by taking out a single policy instead of many separate policies. It also makes sense if you’d prefer to avoid filling out paperwork numerous times throughout the year for each trip.

Annual travel insurance policies aren’t great for those who tend to travel closer to home, don’t have major nonrefundable travel expenses, or need to customize coverage for each trip because their travels tend to vary. For example, you might need different coverage for a backcountry ski trip with friends versus a 2-hour drive with your family.

Look at what annual policies do and don’t cover and see if these align with your travel goals and needs. Then, consider the prices for the plans that align well with your situation. After taking an informed look, you should have a good idea of whether an annual policy is right for your situation.

Frequently Asked Questions

Is yearly travel insurance worth it.

For some, yes. For others, no. Annual travel insurance is worth it when the cost is less than what you’d pay to insure each trip separately or you would prefer to just sign up once then be done for a year. However, annual travel insurance isn’t worth it if you only take a few, mostly domestic, trips a year where your healthcare coverage works, and you don’t have major nonrefundable expenses.

How much does annual trip insurance cost?

Costs vary greatly depending on the type of coverage you want. Annual travel insurance plan costs range from $140 to $500 for a single person. If you take a lot of trips, the cost can be worth it over the course of a year, but each person’s situation is different.

When should I take out annual travel insurance?

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and that the cost of insuring each alone would be higher than the cost of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want. Look at the different types of coverage and your expected costs for insuring each trip separately, then see if it makes sense for you.

Does annual travel insurance automatically renew?

It varies by policy provider, but some companies have an auto-renew feature to ensure you don’t have gaps in coverage.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

All you need to know about annual travel insurance policies

As demand for travel soars and everything from weather to staffing issues leads to higher prices and cancellations, it's more important than ever to protect your trip arrangements with travel insurance .

However, it's not always easy figuring out which type of plan to pick. There are standard policies that cover general delays, interruptions and cancellations; "cancel for any reason" plans that account for personal whims in addition to unforeseen circumstances; and lesser-known annual options.

In this article, I'll go over what you need to know about the third type: annual travel insurance coverage.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What is annual travel insurance?

Annual travel insurance plans (also known as multi-trip plans) last for one year and generally cover all trips taken within that period until either the policy expires or the maximum payout amounts are reached. The policy usually kicks in for trips that take you more than a certain distance from home.

For example, my Allianz AllTrips Prime annual plan remains in effect for one year following the purchase date of my policy. I'm covered on all trips during which I'm at least 100 miles from my residence.

This differs from standard travel insurance, which is purchased on a per-trip basis and covers only one specifically insured journey per policy. Standard policies begin when travel for the insured trip begins and end when the insured trip ends, rather than covering multiple travel experiences within a specific period of time.

What does annual travel insurance cover?

Coverage depends on the plan you purchase. There are usually several tiers from which to choose, with the lowest offering the least coverage and the highest offering the most.

Using my policy as an example, I'm covered for up to $3,000 per year in trip interruption expenses, including hotel room coverage at $250 per night, which I used when I was recently isolated for 10 days after testing positive for COVID-19.

My policy also offers a $3,000 annual trip cancellation benefit, $20,000 in emergency medical coverage, $100,000 in emergency transportation (including medevac services), $45,000 in rental car theft and damage protection, $25,000 in travel accident coverage and $1,000 for essentials in the event of baggage loss or damage, along with a handful of other small benefits.

Note that many annual policies do not include things like "cancel for any reason" coverage or trip interruption benefits. If those items are important to you, check with your provider before making a purchase.

How much is an annual travel insurance policy?

Sure, an annual travel insurance policy may sound great, but how much does one cost? I was surprised to find that insuring your trips for a whole year with an annual policy is often not much more expensive than insuring one or two trips individually, depending on the options you select.

A decent annual travel insurance plan will likely set you back a couple hundred dollars. The more coverage you add, the more expensive the plan will become. The cost also changes depending on variables like your age and where you live.

The best thing to do is contact your preferred provider for a quote or check out an aggregator like InsureMyTrip to compare premiums.

Which companies offer annual travel insurance plans?

The Points Guy recommends the following travel insurance providers , all of which sell annual or semi-annual policies:

- Allianz Travel Insurance .

- Seven Corners .

- Travel Guard .

- World Nomads .

When should I purchase annual travel insurance?

There are several reasons why annual travel insurance might be better for you than separate policies for individual trips. If you travel a lot — more than two or three times annually — it could be more cost-effective than purchasing separate policies for each journey.

For me, it makes sense because I travel for a living, often taking a dozen or more trips each year. Also, much of my travel is comped, which makes insurance more difficult to acquire. (If I haven't paid for a cruise, flight or hotel, I can't attach a dollar amount to it and, therefore, often can't insure it. I also wouldn't be able to provide purchase receipts in the event something went wrong and had to file a claim.)

Other factors to consider include your health, how adventurous your travels might be, whether you have coverage as a credit card perk and how much your travel arrangements cost versus how much coverage you can get with an annual plan versus individual policies.

Another consideration right now is COVID-19. For me, the annual plan made sense because most of Allianz's individual plans don't cover issues linked to COVID-19. However, the annual coverage I purchased does.

Other things to know about annual travel insurance policies

Here are a few additional tidbits I learned after filing a trip interruption claim under my annual travel insurance policy. Keep them in mind when deciding if an annual policy is right for you.

- Before committing to the purchase of any travel insurance plan, make sure to inquire about specific components that are important to you. For me, those were COVID-19 coverage, trip interruption benefits and medevac coverage.

- Know that your coverage does not reset each time you travel when you opt for an annual policy. So, if you have a trip that goes awry, you file a claim and you max out the benefit allowed by your plan, you won't have that benefit available to you for the remainder of your policy year.

- Depending on your policy, you might have to return home between travel sessions in order for each trip to be covered. Taking several back-to-back trips could prevent them from qualifying for coverage under your annual insurance plan, so be sure to read the fine print, and plan accordingly.

- If you purchase annual or multi-trip travel insurance, keep your policy card and provider phone number with the other important documents you bring when you travel so they're easily accessible in a pinch.

- If you find yourself in a covered situation for which you'd like to seek reimbursement, keep all receipts and take photos that will help to support your claims when they're submitted.

- Don't assume all your expenses will be reimbursed, even if you think they'll be covered. It doesn't hurt to try, but in my case, my Allianz plan only partially covered the hotel expenses I submitted.

MoneySmart Financial is an Exempt Financial Adviser and Registered Insurance Broker licensed by Monetary Authority of Singapore ("MAS").

Get the Best Annual Travel Insurance in Singapore 2024

Compare Travel Insurance prices on MoneySmart to get the best deal to cover you against coronavirus (COVID-19), lost baggage, medical emergencies, flight delays, pre-existing conditions, pregnancy claims and more.

- Korea, Republic of

- United States

- Afghanistan

- Aland Islands

- American Samoa

- Antigua and Barbuda

- Bonaire, Sint Eustatius and Saba

- Bosnia and Herzegovina

- Bouvet Island

- British Indian Ocean Territory

- Brunei Darussalam

- Burkina Faso

- Cayman Islands

- Central African Republic

- Christmas Island

- Cocos (Keeling) Islands

- Congo, The Democratic Republic Of The

- Cook Islands

- Czech Republic

- Côte D'Ivoire

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Falkland Islands (Malvinas)

- Faroe Islands

- French Guiana

- French Polynesia

- French Southern Territories

- Guinea-Bissau

- Heard and McDonald Islands

- Holy See (Vatican City State)

- Iran, Islamic Republic Of

- Isle of Man

- Korea, Democratic People's Republic Of

- Lao People's Democratic Republic

- Liechtenstein

- Macedonia, the Former Yugoslav Republic Of

- Marshall Islands

- Micronesia, Federated States Of

- Moldova, Republic of

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Norfolk Island

- Northern Mariana Islands

- Palestine, State of

- Papua New Guinea

- Philippines

- Puerto Rico

- Russian Federation

- Saint Barthélemy

- Saint Helena

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- Saint Pierre And Miquelon

- Saint Vincent And The Grenedines

- Sao Tome and Principe

- Saudi Arabia

- Sierra Leone

- Sint Maarten

- Solomon Islands

- South Africa

- South Georgia and the South Sandwich Islands

- South Sudan

- Svalbard And Jan Mayen

- Switzerland

- Syrian Arab Republic

- Tanzania, United Republic of

- Timor-Leste

- Trinidad and Tobago

- Turkmenistan

- Turks and Caicos Islands

- United Arab Emirates

- United Kingdom

- United States Minor Outlying Islands

- Venezuela, Bolivarian Republic of

- Virgin Islands, British

- Virgin Islands, U.S.

- Wallis and Futuna

- Western Sahara

- No matches found! Please try another search.

Refine Your Results

Total Premium

Starr TraveLead Comprehensive Silver

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | FLASH DEAL] • Enjoy 50% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$50 via PayNow OR 1 x Apple AirTag (worth S$45.40) and up to S$20 iShopChangi e-vouchers with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Are your trip details correct?

Destination: Thailand

Duration: 14 Jun 2024 - 16 Jun 2024

FWD Premium

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | MoneySmart Exclusive] • Enjoy up to 25% off your policy premium. • Get S$20 iShopChangi e-voucher and Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

DirectAsia Voyager 1000 Annual Plan

[ Score a Rolex, Apple iPhone, MVST Luggage & More! | FLASH DEAL] • Enjoy 40% off your policy premium • Receive up to S$25 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are over S$19,600 worth of gifts to be given away: • 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • 1x Apple iPhone 15 Pro 128GB (worth S$1,664.25) • 5x MVST TREK Aluminium Large Suitcase (worth S$790) • 1x Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) and many more! Increase your chances of winning when you refer friends today. T&Cs apply PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Great Eastern TravelSmart Premier Classic

[GIVEAWAY | MoneySmart Exclusive] • Enjoy up to 30% off your policy premiums • Get S$10 iShopChangi e-vouchers with every policy purchased. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Singlife Travel Plus

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy 25% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$30 via PayNow and up to S$20 iShopChangi e-vouchers with eligible premiums spent. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

AIG Travel Guard® Direct - Supreme

[GIVEAWAY | Receive your rewards as fast as 30 days*] • Enjoy 10% off your policy premium. • Get up to S$20 iShopChangi e-voucher with eligible premiums spent. • Additionally, receive an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

Allianz Travel Basic

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy an exclusive 57% off your policy premium • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$40 via PayNow and up to S$20 iShopChangi e-vouchers with eligible premiums spent. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply.

[GIVEAWAY | MoneySmart Exclusive | FLASH SALE] • Enjoy 40% off your Single Trip policy premium and 80% off Covid-19 add-on for Annual Plans. T&Cs apply • Get S$10 iShopChangi e-vouchers with every policy purchased. T&Cs apply. PLUS, score S$100 iShopChangi vouchers in our giveaway on top of existing rewards. T&Cs apply. New to Tiq? Get FREE Travel Insurance (worth S$30) from Tiq . T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Total Premium*

The Wise Traveller Premium

Starr TraveLead Comprehensive Bronze

Great Eastern TravelSmart Premier Elite

Allianz Travel Platinum

DirectAsia Voyager 250 Annual Plan

The Wise Traveller Secure

FWD Business

AIG Travel Guard® Direct - Enhanced

Starr TraveLead Comprehensive Gold

Allianz Travel Silver

.png)

Singlife Travel Lite

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

Buy Travel Insurance Plan Online

What customers say about their travel insurance purchase, review by doreenngsk ng.

"Purchased travel insurance on Moneysmart with cash rebate deal. Great value after discount. MS is good platform to peruse available travel policies to choose from, giving us choices to consider appropriate for our requirements."

As seen on Google

Review by Ron Tay

"I always use MoneySmart when i need a travel insurance..... It easy and convenient to use, let me easy to compare each travel insurance package..... Highly recommended!"

Review by Jodel Tan

"Purchasing travel insurance was easy, fast and smooth... had a good deal of getting cashback by purchasing the insurance. Steps from claiming to receiving the cashback was simple too. A good experience overall."

What Do Travel Insurance Plans Cover?

While pricing is a an important factor when comparing travel insurance plans, other features such as overseas medical coverage, trip cancellation coverage and many other related aspects are as important. These benefits and the extent of coverage for each type of benefit usually varies from insurer to insurer. Here are a few aspects you’ll want to look out for when it comes to choosing a suitable travel insurance with adequate coverage .

Overseas medical expenses

In the event you get diagnosed with some sort of unexpected disease, you’ll be able to claim for the necessary and reasonable overseas medical costs incurred within a certain number of days of your trip (usually 90 days) up to the limit as specified according to your selected plan. For some plans there are also tiered coverage limits for different age groups.

In-hospital cash overseas or allowance

Reimbursements for in terms of cash for hospital stays is another benefit that many insurers include in their plans now, especially after the Covid-19 pandemic.

Emergency medical evacuation and emergency medical repatriation

This is one of the fundamental aspects of every coverage plan. Any costs incurred for emergency medical evacuation and repatriation (including repatriation of mortal remains back to Singapore) that are related to your severe injury/illness diagnosis will be covered.

Keep in mind to have someone on your behalf to contact the insurer’s emergency service to provide your full name, dates of trip, NRIC/FIN number, policy number, name of the place and the telephone number that your insurance provider can reach you, as well as the nature of help required during the emergency, in case you are unable to do so during the emergency.

Trip cancellation/alteration/interruption/delay

Trip cancellations, postponements, delays, and interruptions are often covered if you as the traveller or you relatives travelling with you are diagnosed with a severe illness/get severely injured before the date of departure, subject to terms and conditions.

Pre-existing conditions

This benefit is not commonly included in most travel insurance plans, but currently there are several insurers providing such plans and they include MSIG TravelEasy® Pre-Ex, Income Insurance Enhanced PreX® (formally known as Income) and Etiqa Pre-Ex. The premiums are higher than regular plans, but they provide overseas medical expenses that cover pre-existing conditions.

Does Travel Insurance Cover Cancelled Flights?

Not always! While all travel insurance policies have a "Trip Cancellation" benefit, you can only claim for this if it's for an insured event, such as a serious illness or accident, or unforeseen events such as riots or natural disasters. However, different insurers exclude different scenarios, so it's best to read the policy wording carefully. The following are types of flight cancellations that are NOT covered by travel insurance.

Flight Cancellation Due to Known Event

Flight cancellations due to events which are already made known as public knowledge are not covered by travel insurance, as you are expected to have known about these at the point of buying your tickets. However, if you bought your flights and activated your travel insurance before they became public knowledge, you might still be able to make a claim.

Flight Cancellation with Refund / Replacement

If your flight was cancelled but you were put on a replacement flight, or your fare was refunded, you will not be able to make a travel insurance claim under the trip cancellation benefit. In general, travel insurance is only for unrecoverable costs. However, you may claim for trip delay benefits, such as an extra night's accommodation or extra meals.

You Cancelled Your Own Flight / Trip

Travel insurance typically covers insured events that are beyond your control. If you are the one who changed your mind about your trip, you generally won't be able to claim anything - unless your insurer offers a "Cancellation for Any Reason" benefit. However, in public health emergencies like the COVID-19 outbreak, airlines usually waive the usual penalties for flight cancellations, out of goodwill.

Different Types Of Travel Insurance Coverage

Single trip plans.

If you’re thinking of only taking one or two trips in a year, single-trip travel insurance is probably more suitable for you. As the name suggests, single-trip insurance plans are made for individual travellers, and those who are travelling as families, who need travel coverage for a single trip or holiday, especially for long overseas trips (usually up to 180 days).

It makes more economic sense for those who don't travel very often, plus, single-trip insurance plans can be purchased easily online, with less time in planning and consideration as compared to annual multi-trip plans. But on the flip side, you’ll face the hassle of getting a new travel insurance policy every time you go on an overseas trip. For some, a single-trip insurance plan can get relatively expensive if the trips are short.

Annual Multi-trip plans

Annual travel insurance plans, which are also known as multi-trip travel insurance plans, are designed for those who travel several times in a year. The great thing about this kind of travel insurance is that you only need to do the purchase once, and you’re covered for the next 12 months. It is a good option if you’re a frequent traveller who intends to make many long trips or short weekend getaways abroad in a year.

Individual plans

Going solo as an occasional traveller or frequent traveller means that you’ll most likely need a single-trip individual travel insurance plan or an annual multi-trip travel insurance plan, depending on the frequency of travel.

Family plans

Family travel insurance plans usually cover you and the members of your family who travel with you on your trip, with a maximum number of adults and children to be insured per policy purchased. The people who are insured under a family travel insurance plan may comprise of you and your spouse, and/or your children or grandchildren.

You may want to consider purchasing a family travel insurance plan if you are travelling with your family and thinking of getting a single policy for your family members who are travelling with you, as getting a family travel insurance plan can be more cost-effective than getting separate single trip plans for each family member. What if you and your loved ones are travelling very often as a family? Some travel insurers also offer annual multi-trip travel insurance for families who are frequent travellers.

Single-trip or Annual multi-trip plan - Which one should you pick?

Now that we've detailed out what the different types of travel insurance plans are, it’ll be easier for you to make a decision. If not, here are some examples to help you understand better.

Joshua flies frequently in and out of the country for his business trips. As he works as a legal advisor, his job requires him to travel between Singapore and Thailand twice or once a month. Each trip will last for about a week. In this case, multi-trip travel insurance works best for him as he wouldn't have to keep getting travel insurance before every trip.

Lisa and Amanda are university friends planning to take a long post-graduation trip to Australia. They seldom travel and even if they did, they go on overseas vacations once a year with their own families. For them, the single travel insurance policy is a more suitable choice Australia .

How Do I Choose The Best Travel Insurance?

When choosing travel insurance plans for your holiday or business trips, there are several factors to consider, depending on your priorities. Here are four simple steps to pick a suitable travel insurance plan.

Check general coverage

Instead of deciding solely by price, you should compare the benefits and reimbursement limits for common claims like medical expenses, trip cancellations, flight delays and baggage theft and/or damage.

Compare policy premiums

How much your travel insurance costs depends on your destination and length of stay. Most travel insurance companies have 2 to 3 tiers of plans at different price points, with varying comprehensiveness and reimbursement limits.

Special activities coverage

The breadth of coverage needed largely depends on your itinerary. For instance, if you’re planning to go skydiving, make sure you get a policy that covers aerial sports like MSIG’s TravelEasy® Standard, Elite and Premier plans. Or if you’re going golfing overseas, pick a policy that insures your equipment.

Consider the trip duration

This is one of the important determining factors of which kind of travel insurance you get. Single trip travel insurance plans are usually for short trips. If you’re the kind who travels far and for months, it might be worthwhile to consider buying annual travel insurance.

Unlike single trip travel insurance, annual travel insurance often charges a flat premium and insures you for an entire year of travel. It usually costs about $200 to $300 per year, which is more suitable for a frequent traveller who is probably going to travel overseas more than 7 or 8 times a year, at least.

Best Travel Insurance Plans in Singapore Benefits Coverage

Travel insurance recommendations.

- Best Travel Insurance with Pre-Existing Coverage

- Best Pregnancy Travel Insurance for Expecting Mothers

- Best Covid-19 Coverage Travel Insurance

- Best Travel Insurance For Flight Cancellation Coverage

- Best Extreme Sports/ Adventure Sports Travel Insurance

- Best Cruise Travel Insurance

- Best Travel Insurance for Seniors and Elderly

- Best Travel Insurance For Phones, Laptops, Tablets

- Best Travel Insurance For Roadtrips

- Best Bali Travel Insurance (Indonesia): Top 7 Value Plans

- Best Malaysia Travel Insurance: JB, KL, Penang & more

- Best Japan Travel Insurance – Best Value, Cheap Plan s

- Best Thailand Travel Insurance– What To Look Out For

- Best Australia Travel Insurance– Plan Benefits, Travel Tips

- Best Korea Travel Insurance To Get– Most Affordable

- Best Travel Insurance To Buy Travelling To The UK: Top 5 Plans

- Best Taiwan Travel Insurance– Cost, Coverage, Compare

- Best Vietnam Travel Insurance

- Batam Travel Guide: What To Do, Where To Go

Travel Tips

- Travel Essential Packing List 101

- How To Renew Your Singapore Passport

- Top Travel Hacks To Save Money

- 15 Rookie Mistakes To Avoid While Travelling in Europe

- 10 Cost Savings Tips For Your Year End Holiday

- Travel Safety: Tips for Women, LGBTQ+, and Persons with Disabilities

- Best Travel Insurance Plans For Female Solo Travellers

- Should I get travel insurance from all-in travel agency packages?

- Moneysmart's Travel Insurance Promotion

- Starter Guide :How To Claim Travel Insurance

- Top 5 Reasons Why Travel Insurance Claims Are Rejected

- Are Travel Aggregators Harder to Claim From?

Travel Surveys

- Top 12 Airlines With Most Cancellations and Delays

Travel Insurance Claims

How do travel claims work.

Before you make a claim from your travel insurance provider, there are several important things to take note of, whether it is for claims related to your COVID-19 diagnosis, loss of baggage, trip cancellation, or other reasons. These include knowing what type of plan you purchased, when did the incident/illness occur (pre-trip, during-trip or post-trip), what belongings or items to claim for, and who are involved.

Here are 3 simple steps to submit your travel insurance claim

Get your supporting documents ready.

Most travel insurers require claims within 30 days. Submit via mail, WhatsApp, their app, or online portal to avoid policy breaches. Keep originals for 6 months in the event the travel insurance provider needs to sight them. Required documents often include personal info, medical reports, ownership proof, trip records, and reports (e.g., police, airline).

Fill in your details and attach your supporting documents in your submission

Log in to your insurer's claims app or portal. Fill in your info, and the necessary details for the claims (email address. policy number, departure date or policy purchase date), upload soft copies of your documents and submit. Alternatively, mail hard copies of your original documents.

Receive an acknowledgement email and await for settlement

After submitting, you'll receive an acknowledgment email. Your claim will be reviewed. For COVID-19-related claims, contact the provided hotline or email. Upon approval, your insurer will coordinate payments, often offering cashless reimbursement through PayNow or iBanking for speed and convenience.

Frequently Asked Questions

What is travel insurance and how does it help me, what's the difference between single-trip or annual multi-trip travel insurance.

When you buy travel insurance you can choose from 2 types of policies, either the single trip or annual multi-trip travel insurance plan. Single trip travel insurance covers you for a single trip and is usually for individual travellers, or those who are travelling as families, who need travel coverage for a single trip or holiday, especially for long overseas trips (usually up to 180 days).

Annual travel insurance plans, which are also known as multi-trip travel insurance plans, cover you for all trips starting and ending in Singapore, and are designed for those who travel several times in a year, each trip lasting for about less than 180 days. You should consider buying Annual Travel Insurance if you travel frequently (more than 10 times a year). You will enjoy significant savings, and you won't have to worry about purchasing travel insurance every single time as you’ll be covered for the entire year.

Are family travel insurance plans cheaper?

Can i buy travel insurance once i'm overseas, how do i compare travel insurance policies, what are the best travel insurance for east and southeast asia countries.

We have written a quick guide on buying the best travel insurance to the nearby countries whether you are travelling to Malaysia , taking a weekend trip to Thailand , holidaying in Bali , planning a trip to Japan or a getaway to South Korea . Before jetting off, here are the 5 must have list of travel essentials that you will need when on holiday.

Does travel insurance cover flight cancellation due to illness?

Is there a difference between family travel insurance plans and group travel insurance plans, we asked singaporeans about flight disruptions, and they answered..

Find out the worst airlines with delays and cancellations according to Singaporean travellers.

Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- Liberty Travel Insurance: Who Should Get it

- Covers emergency medical evacuation due to pre-existing conditions

- Above average prices for below average coverage

Liberty's TourCare travel insurance exhibits low value due to its high prices and below average coverage amounts. Therefore, it may not be all that enticing to the cost-conscious or deal-seeking traveller. However, travellers with life-threatening pre-existing conditions may find some comfort with these plans, as there is pre-existing medical emergency repatriation and evacuation cover.

Summary of Liberty TourCare Travel Insurance

Table of Contents

- Liberty TourCare Travel Insurance: What You Need to Know(#what)

Liberty TourCare Sports Coverage

Claims information, summary of coverage and benefits, liberty tourcare travel insurance: what you need to know.

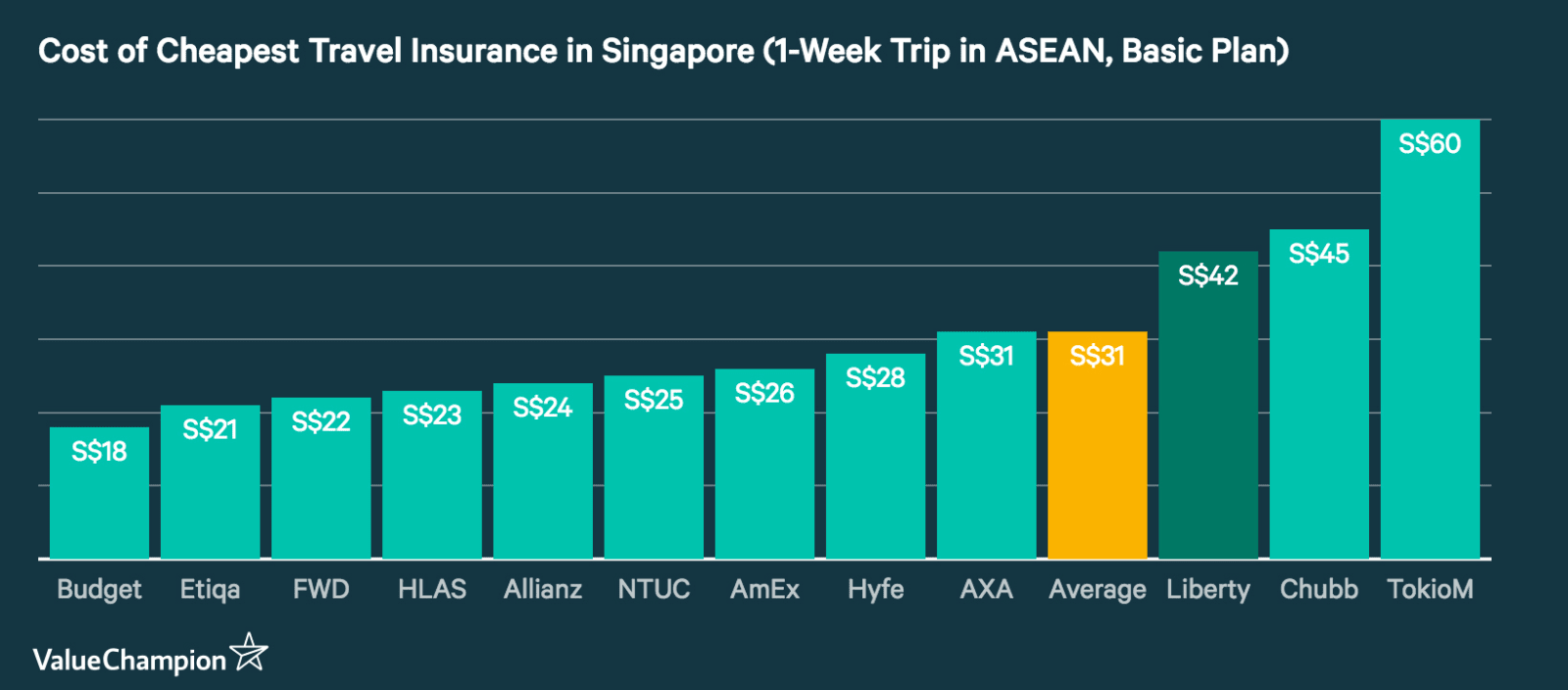

Liberty TourCare's above average prices and lackluster coverage makes it difficult to entice high-value and cost-conscious consumers. Its basic plan is so expensive that there are top-tier plans on the market that cost up to 25% less while offering better coverage. Liberty lets you choose from two plans: Standard and Supreme. You can buy either family or individual plans with premiums set based on trip duration. Annual plans are offered only for the Asia and global regions.

However, if you are looking for a plan that will give you the most coverage for your dollar, Liberty's TourCare insurance may not be the best fit. Its coverage is below average for medical, trip inconvenience and personal accident by about 5-10% for basic plans and 50-70% for top-tier plans. This lack of coverage, doubled with high prices, gives Liberty's travel insurance very low value. Additionally, if you are looking for golf or sports coverage, TourCare doesn't give you much beyond including S$500 of golf and sports equipment in their baggage damage/loss cover. If these benefits are important to you, you may benefit a lot more with plans from insurers like FWD and Aviva , who are cheaper but have more abundant coverage.

Despite its uncompetitive price and general coverage, Liberty offers a couple of unique benefits that may be beneficial depending on your circumstances. The first is S$200,000 of medical repatriation and S$50,000 of evacuation cover due to preexisting conditions. This is notable since it is only one of two insurers on the market that allows some form of coverage for pre-existing conditions. If you are injured and cannot return home on time, its benefits are automatically extended for 7 days and coverage for infectious disease quarantine in Singapore, rental car excess and home contents cover, in addition to the usual trip inconvenience and medical coverage.

Notable Exclusions

Liberty's exclusions are standard as it doesn't cover medical expenses for pre-existing conditions, extreme sports, mental conditions, intentional self-injury, mysterious disappearance and travelling to a country against the advice of the media or government.

Liberty's plans do not outrightly offer sports or golf coverage. There is no cover for extreme sports such as grade 4 or above white water rafting, canoeing and kayaking, bungee jumping, outdoor rock climbing, mountaineering, expeditions, trekking/hiking above 3,000 metres and off-piste skiing. You can scuba dive with a guide or if you have your certification if you do not go below 30 metres. However, there is a S$500 item loss/damage cover that can include your golf or sports equipment.

To file a claim with Liberty, you have to download their pdf form (linked below) and mail it to them within 30 days from the end of your trip. All documents must be original.

Finding the best deal on your travel insurance policy can be daunting due to the sheer number of choices available. Below, you will find a table that compares Liberty's TourCare prices and benefits to the industry average. If you would like to see how Liberty stacks up to some of our top picks for travel insurance, you can read our guide to the best travel insurance in Singapore.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- Do You Really Need Travel Insurance?

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- How to Pick the Best Travel Insurance

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Seniors & Retirees: 5 Top Picks

Allianz Travel Insurance »

Trawick International »

GeoBlue »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Allianz Travel Insurance

- Trawick International

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

Which travel insurance options work best for seniors? There are many travel insurance plans that were created with retirees in mind, although you'll want to compare them side by side. For example, you may want to look at coverage limits for medical expenses and coverage for preexisting conditions above all else.

U.S. News editors compared more than 20 of the top travel insurance companies to find the best plans for seniors. This list does the heavy lifting for you as you search for the best senior travel insurance of 2023, so read on to learn about the top picks.

- Allianz Travel Insurance: Best Annual Coverage

- Trawick International: Best Premium Travel Insurance for Seniors

- GeoBlue: Best Travel Medical Coverage for Expats

- IMG Travel Insurance: Best for Short-Term Travel Medical Coverage

- WorldTrips: Best for Flexibility

Available to senior travelers of all ages

Coverage for preexisting conditions is offered

Relatively low limits for emergency medical expenses

- Coverage for COVID-19

- Trip cancellation coverage up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical evacuation coverage up to $100,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $200

- Travel delay coverage up to $600 ($200 daily limit)

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

- 24-hour hotline for assistance

- Concierge service

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

SEE FULL REVIEW »

Customize plan with optional CFAR coverage

Incredibly high limits for medical expenses and emergency evacuation

Coverage is for trips up to 30 days if you're age 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- $750 in emergency dental coverage

- $2,000 in coverage for baggage and personal effects

- $400 in baggage delay coverage

- 24/7 noninsurance assistance services

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Get overseas medical coverage for single trips or multiple trips

Plans were created with seniors and retirees in mind

Lower maximum coverage limits for travelers ages 80 and older

Limited nonmedical travel insurance benefits

- Inpatient and outpatient medical coverage such as for physician visits, hospitalization and surgery

- Emergency and nonemergency medical evacuation coverage

- Coverage for emergency reunions

- Return of mortal remains

- Trip interruption coverage worth up to $5,000

- Lost luggage coverage worth up to $250 (up to $50 per item)

- Coverage for terrorism worth up to $50,000

- Accidental death and dismemberment coverage worth up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Since seniors and retirees are more likely to face a medical emergency during a trip, most travel insurance plans for seniors include coverage for emergency medical expenses and emergency medical evacuation. Coverages vary among plans, as do limits, so make sure to compare options before you book a trip overseas.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg, a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Can You Buy Travel Insurance for Road Trips?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How road trip insurance works

How to choose between road trip travel insurance companies, best plans for road trip travel insurance, other tips for road trip travel insurance, top cards with travel insurance for road trips, road trip travel insurance recapped.

There’s nothing quite like breezing down a highway with the windows down, the wind in your hair and a cooler full of sodas in the back seat. Whether you’re traveling alone or enjoying a road trip with friends or family, you’ll want to be sure that you’re covered with travel protections on your drive. This is as true whether you're embarking on a classic American road trip — like U.S. Route 66 — are or braving the roadways in a foreign country, in your own car or a rented vehicle.

Let’s take a look at road trip travel insurance, how it works and the best plans for auto travel insurance to suit your needs.

Road trips aren't immune to disruptions, and road trip insurance works similarly to travel insurance . Most plans require purchase before your trip begins and cover your prepaid expenses.

For rental cars

Not all third-party travel insurance policies automatically include coverage for a rental vehicle. Seek out plans that provide rental car insurance specifically — or book your car with a credit card that offers these specific protections .

Rental car travel insurance policies generally protect against damage to the rental vehicle only. Causes not within your control, such as collision, theft, vandalism, windstorm, fire, hail or flood damage are typically covered.

Because of the limited scope of rental car insurance, know that you may be on the hook if you’re liable for damage to other vehicles or if there’s bodily injury.

When picking up your rental car, you will likely be offered the insurance sold by the rental car company at the counter, typically called a Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW). You can decline this protection if you have sufficient coverage elsewhere (e.g., via a third-party policy or a credit card).

For your personal vehicle

Getting road trip insurance for your own vehicle isn't as common as travel insurance for rental cars , but it can still be a valuable consideration depending on your situation. For instance, access to roadside assistance can provide peace of mind if you are driving for long stretches in rural areas.

Finally, road tripping doesn’t end at driving a car. Other trip protections you may consider including in a travel insurance policy include medical evacuation, trip cancellation insurance, trip interruption coverage and accidental death and dismemberment (AD&D) insurance . This is true whether you opt to drive your own vehicle or rent one for your trip.

» Learn more: How to find the best travel insurance

With several travel insurance companies out there, it can be difficult to narrow down the one you really need. Before buying, always get quotes from multiple businesses.

This is because coverage levels and prices can vary dramatically. Insurance aggregators such as InsureMyTrip or Squaremouth (a NerdWallet partner) allow you to generate multiple quotes at once, plus they include filters for sorting so you can find the right policy for you.

Here are a few things to consider when looking for road trip insurance:

Whether you’re renting a car.

Where you're traveling.

Whether you already have car insurance.

What types of coverage you’re interested in.

If you’re also planning on flying, cruising or using a ferry.

How long you’ll be gone.

The cost of the plan.

To figure out the best road travel insurance, we combed a variety of insurance providers to check out their offerings.

Our quotes were built using a hypothetical 37-year-old from California taking a road trip throughout the United States. The total trip time was 15 days, and the total trip cost was $2,700. Here were the top contenders.