U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .

Trip cancellation, interruption and delay insurance Trip cancellation coverage can help you get reimbursement for prepaid travel expenses, such as your airfare and cruise fare, if your trip is ultimately canceled for a covered reason. Trip interruption insurance, on the other hand, kicks in to reimburse you if your trip is derailed after it starts. For instance, if you arrived at your destination and became gravely ill, it would cover the cost if you had to cut your trip short.

Trip delay insurance can help you qualify for reimbursement of any unexpected expenses you incur (think: lodging, transportation and food) in the event your trip is delayed for reasons beyond your control, such as your flight being canceled and rebooked for the next day. You will want to save your receipts to substantiate your claim if you have this coverage.

Lost, damaged, delayed or stolen bags or personal belongings Coverage for lost or stolen bags can come in handy if your checked luggage is lost by your airline or your luggage is delayed so long that you have to buy clothing and toiletries for your trip. This type of coverage can kick in to cover the cost to replace lost or stolen items you brought on your trip. It can also provide coverage for the baggage itself. It's even possible that your travel insurance policy will pay for your flight home if damages are caused to your residence and your belongings while you're away, forcing you to return home immediately.

Travel medical insurance If you find yourself sick or injured while you are on vacation, emergency medical coverage can pay for your medical expenses. With that in mind, however, you will need to find out whether the travel medical insurance you buy is primary or secondary. Where a primary policy can be used right away to cover medical bills incurred while you travel, secondary coverage only provides reimbursement after you have exhausted other medical policies you have.

You will also need to know how the travel medical coverage you purchase deals with any preexisting conditions you have, including whether you will have any coverage for preexisting conditions at all. Read more about the best travel medical insurance plans .

Evacuation insurance Imagine you break your leg while on the side of a mountain in some far-flung land without quality health care. Not only would you need travel medical insurance coverage in that case, but you would also need coverage for the exorbitant expense involved in getting you off the side of a mountain and flying you home where you can receive appropriate medical care.

Evacuation coverage can come in handy if you need it, but you will want to make sure any coverage you buy comes with incredibly high limits. According to Squaremouth, an emergency evacuation can easily cost $25,000 in North America and up to $50,000 in Europe, so the site typically suggests customers buy policies with $50,000 to $100,000 in emergency evacuation coverage.

Cruise insurance Travel delays; missed connections, tours or excursions; and cruise ship disablement (when a ship encounters a mechanical issue and is unable to continue on in the journey) are just a few examples why cruise insurance can be a useful protection if you've booked a cruise vacation. Learn more about the top cruise insurance plans here .

Credit card travel insurance It is not uncommon to find credit cards that include trip cancellation and interruption coverage , trip delay insurance, lost or delayed baggage coverage, travel accident insurance, and more. Cards that offer this coverage include popular options like the Chase Sapphire Reserve credit card , the Chase Sapphire Preferred credit card and The Platinum Card from American Express .

Note that owning a credit card with travel insurance protection is not enough for your coverage to count: To take advantage of credit card travel insurance, you must pay for prepaid travel expenses like your airfare, hotel stay or cruise with that specific credit card. Also, note that credit cards with travel insurance have their own list of exclusions to watch out for. Many also require cardholders to pay an annual fee.

Frequently Asked Questions

The best time to buy travel insurance is normally within a few weeks of booking your trip since you may qualify for lower pricing if you book early. Keep in mind, some travel insurance providers allow you to purchase plans until the day before you depart.

Many times, you are given the option to purchase travel insurance when you book your airfare, accommodations or vacation package. Travel insurance and travel protection are frequently offered as add-ons for your trip, meaning you can pay for your vacation and some level of travel insurance at the same time.

However, many people choose to wait to buy travel insurance until after their entire vacation is booked and paid for. This helps travelers tally up all the underlying costs associated with a trip, and then choose their travel insurance provider and the level of coverage they want.

Figuring out where to buy travel insurance may be confusing but you can easily research and purchase travel insurance online these days. Some consumers prefer to shop around with a specific provider, such as Allianz or Travelex, but you can also shop and compare policies with a travel insurance platform. Popular options include:

- TravelInsurance.com: TravelInsurance.com offers travel insurance options from more than a dozen vetted insurance providers. Users can read reviews on the various travel insurance providers to find out more about previous travelers' experiences with them. Squaremouth: With Squaremouth, you can enter your trip details and compare more than 90 travel insurance plans from 20-plus providers.

- InsureMyTrip: InsureMyTrip works similarly, letting you shop around and compare plans from more than 20 travel insurance providers in one place. InsureMyTrip also offers several guarantees, including a Best Price Guarantee, a Best Plan Guarantee and a Money-Back Guarantee that promises a full refund if you decide you no longer need the plan you purchased.

Protect your trip: Search, compare and buy the best travel insurance plans for the lowest price. Get a quote .

When you need to file a travel insurance claim, you should plan on explaining to your provider what happened to your trip and why you think your policy applies. If you planned to go on a Caribbean cruise, but your husband fell gravely ill the night before you were set to depart, you would need to explain that situation to your travel insurance company. Information you should share with your provider includes the details of why you're making a claim, who was involved and the exact circumstances of your loss.

Documentation is important, and your travel insurance provider will ask for proof of what happened. Required documentation for travel insurance typically includes any proof of a delay, receipts, copies of medical bills and more.

Most travel insurance companies let you file a claim using an online form, but some also allow you to file a claim by phone or via fax. Some travel insurance providers, such as Allianz and Travel Insured International, offer their own mobile apps you can use to buy policies and upload information or documents that substantiate your claim. In any case, you will need to provide the company with proof of your claim and the circumstances that caused it.

If your claim is initially denied, you may also need to answer some questions or submit some additional information that can highlight why you do, in fact, qualify.

Whatever you do, be honest and forthcoming with all the information in your claim. Also, be willing to provide more information or answer any questions when asked.

Travel insurance claims typically take four to six weeks to process once you file with your insurance company. However, with various flight delays and cancellations due to things like extreme weather and pilot shortages, more travelers have begun purchasing travel insurance, encountering trip issues and having to submit claims. The higher volume of claims submitted has resulted in slower turnaround times at some insurance companies.

The longer you take to file your travel insurance claim after a loss, the longer you will be waiting for reimbursement. Also note that, with many travel insurance providers, there is a time limit on how long you can submit claims after a trip. For example, with Allianz Travel Insurance and Travelex Insurance Services, you have 90 days from the date of your loss to file a claim.

You may be able to expedite the claim if you provide all the required information upfront, whereas the process could drag on longer than it needs to if you delay filing a claim or the company has to follow up with you to get more information.

Travel insurance is never required, and only you can decide whether or not it's right for you. Check out Is Travel Insurance Worth It? to see some common situations where it does (and doesn't) make sense.

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Carry-on Luggage and Personal Item Size Limits (2024)

Amanda Norcross

Just like checked bags, carry-on luggage size restrictions can vary by airline.

Bereavement Fares: 5 Airlines That Still Offer Discounts

Several airlines offer help in times of loss.

The Best Way to Renew a Passport in 2024

The proposed online passport renewal system is behind schedule.

The Best Carry-on Luggage of 2024

Erin Evans and Rachael Hood and Catriona Kendall and Amanda Norcross and Leilani Osmundson

Discover the best carry-on luggage for your unique travel style and needs.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

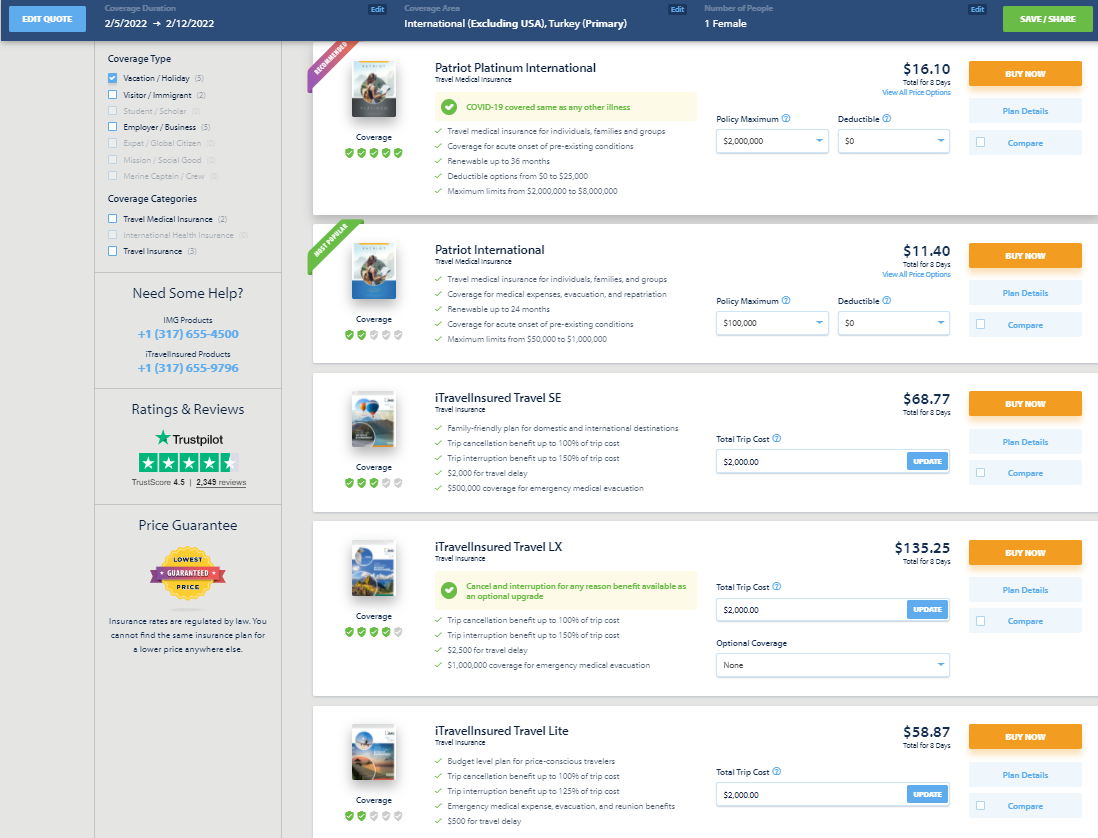

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

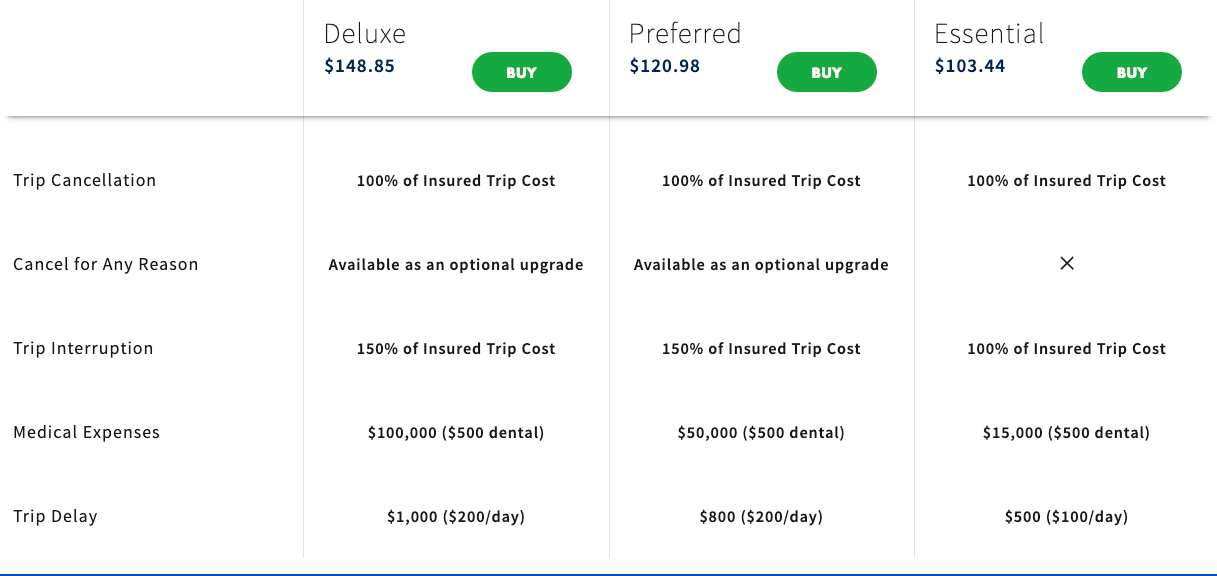

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

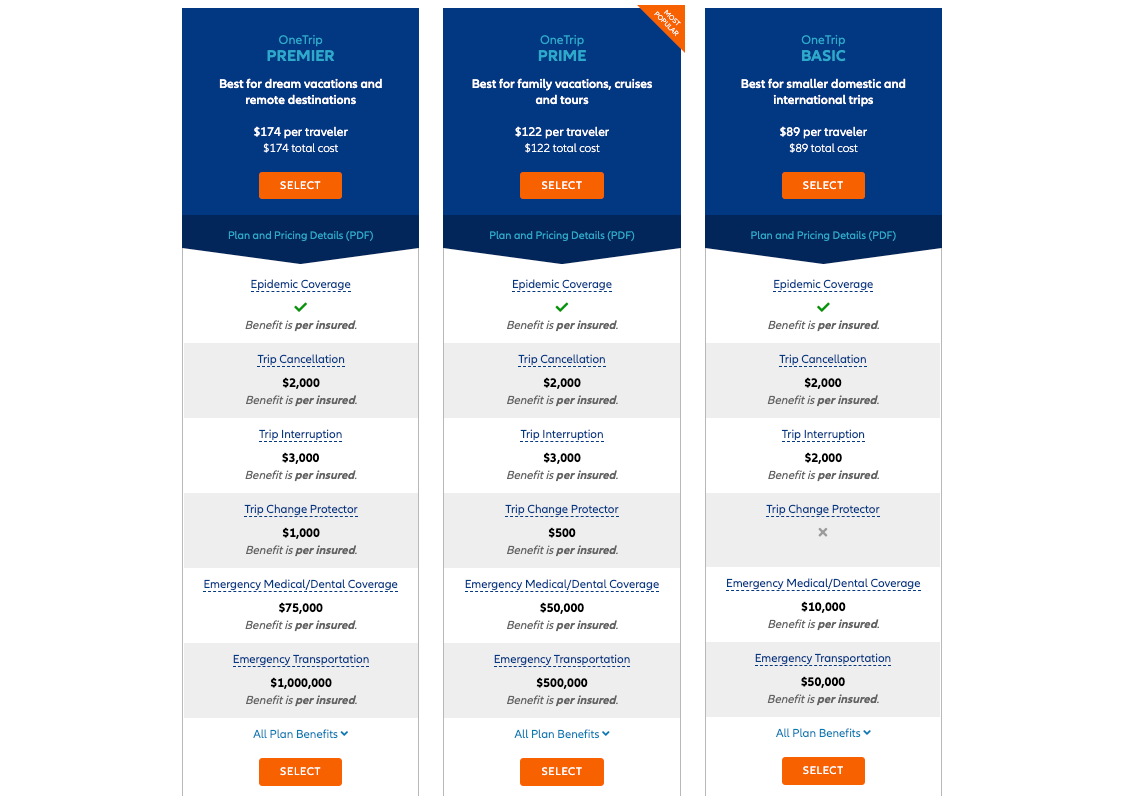

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

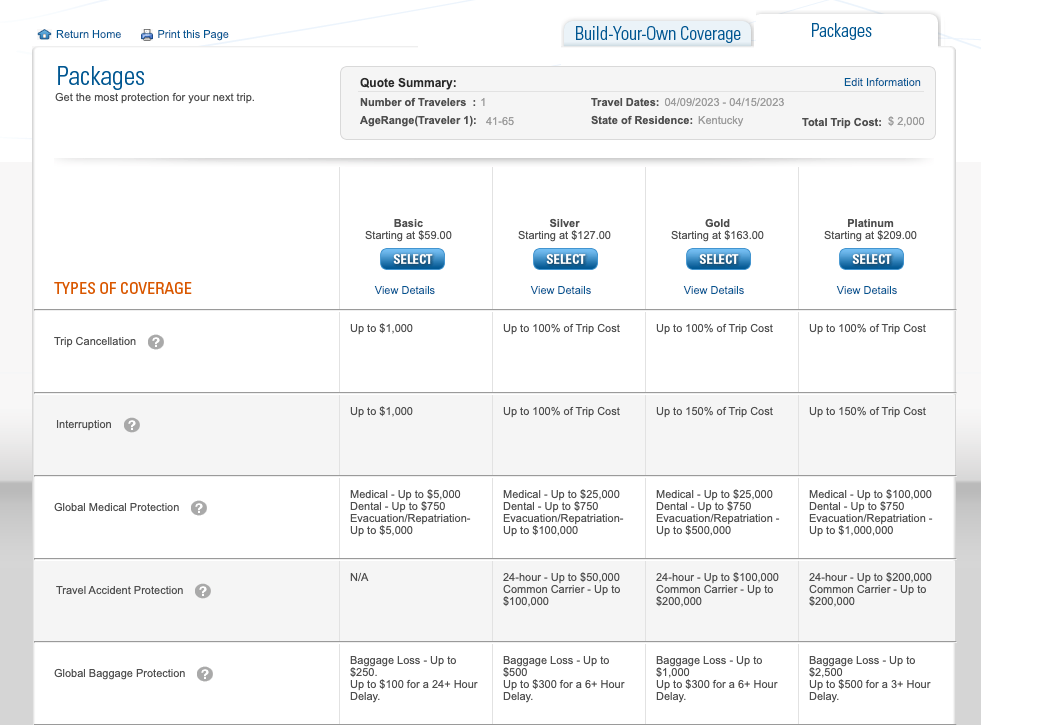

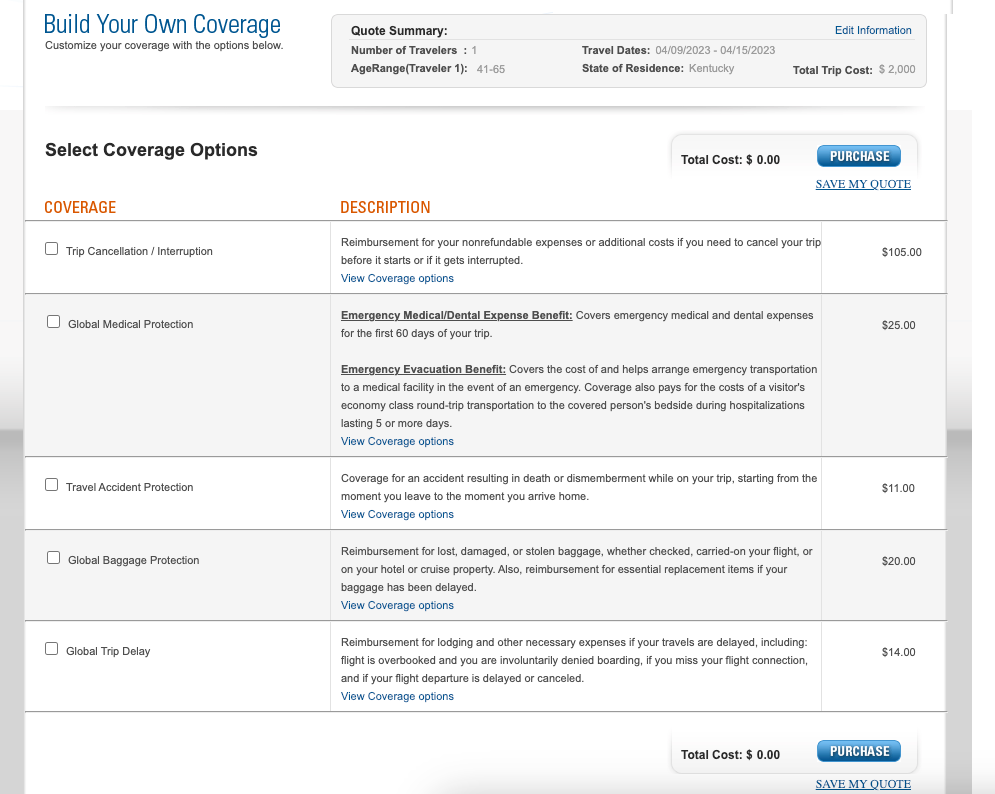

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

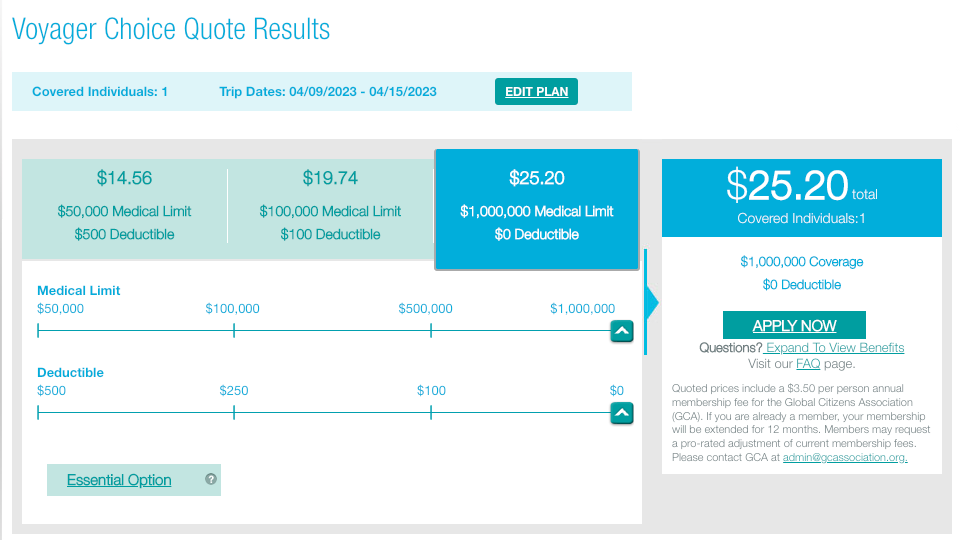

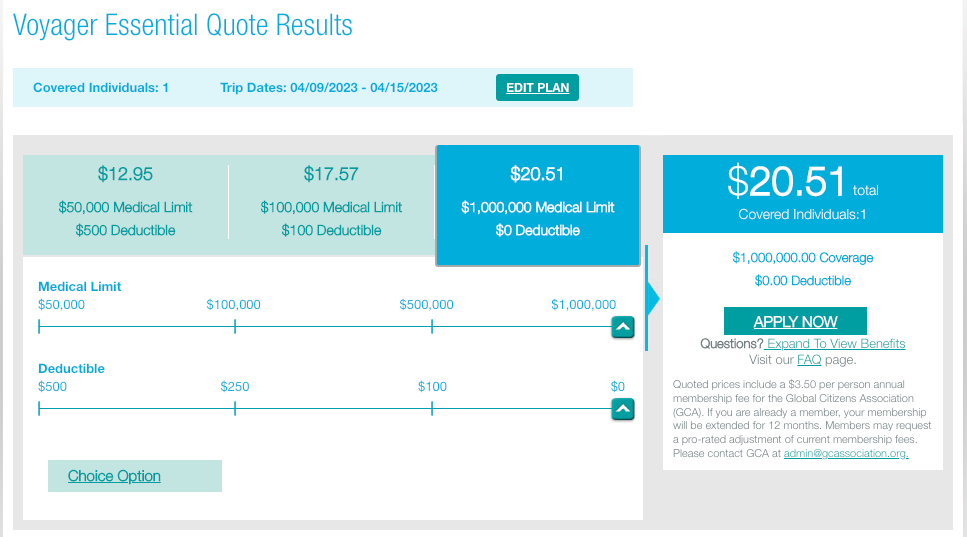

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

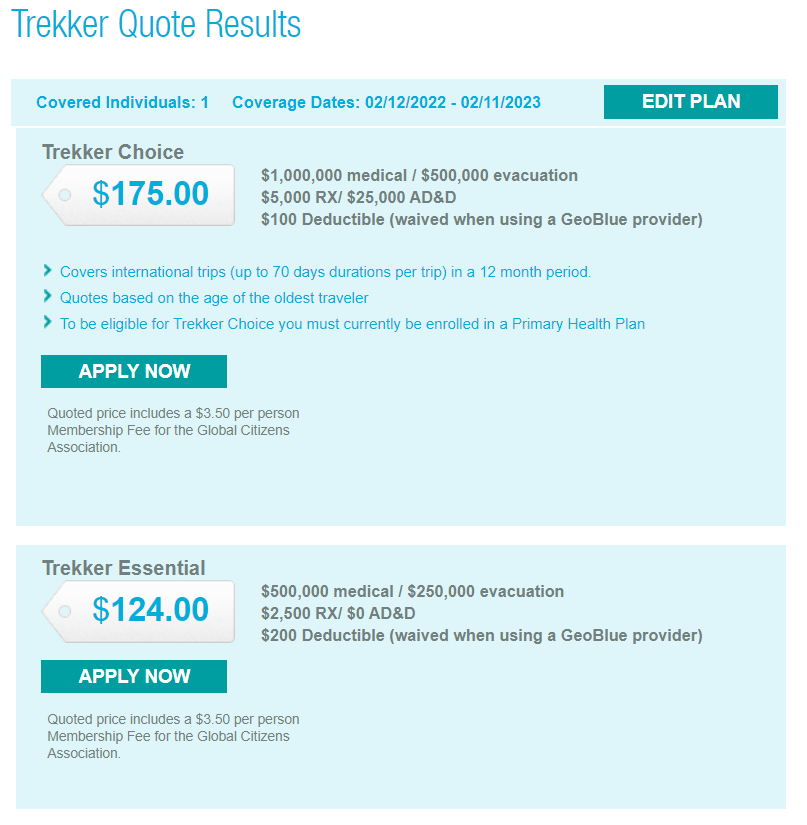

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

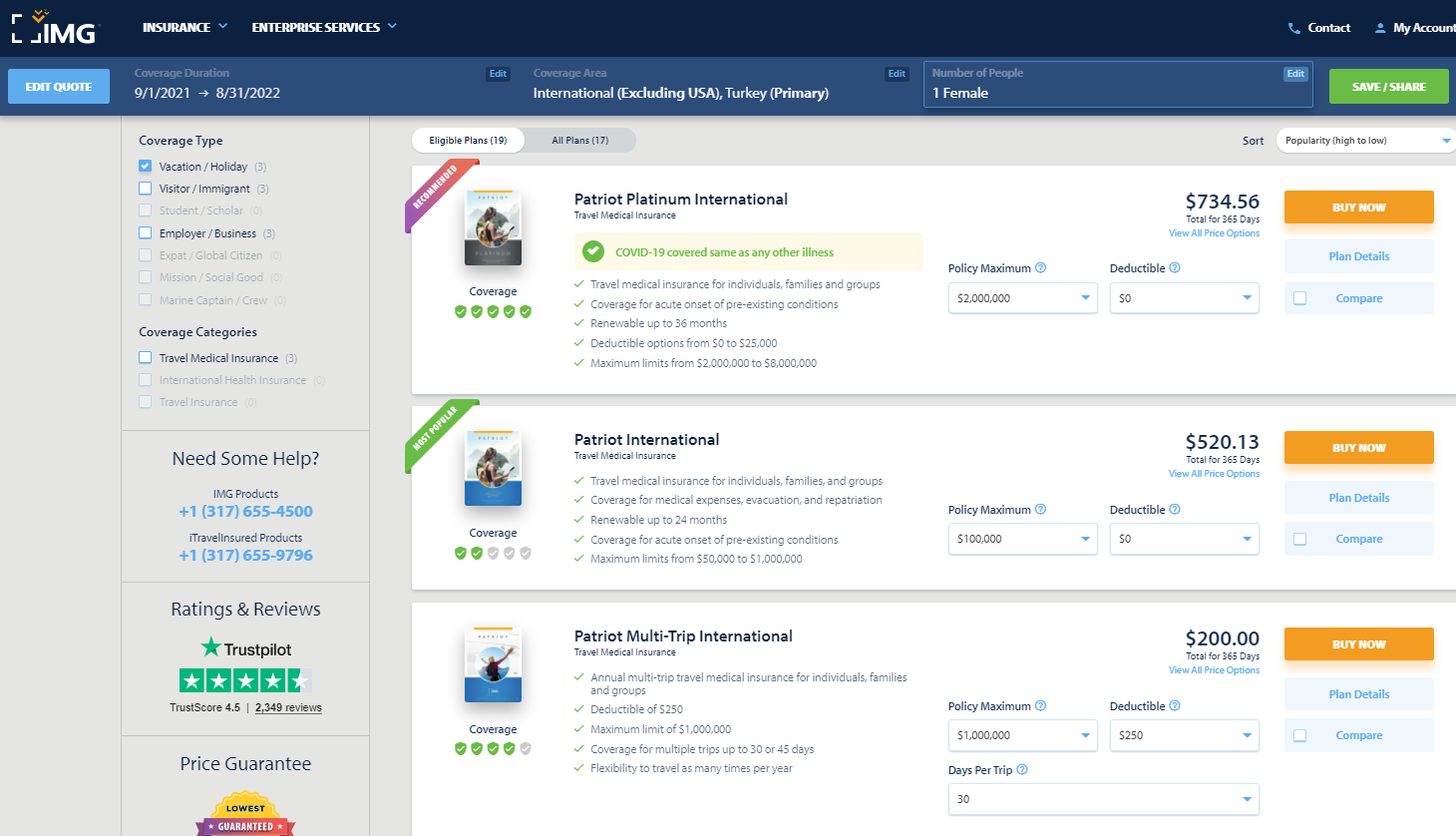

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

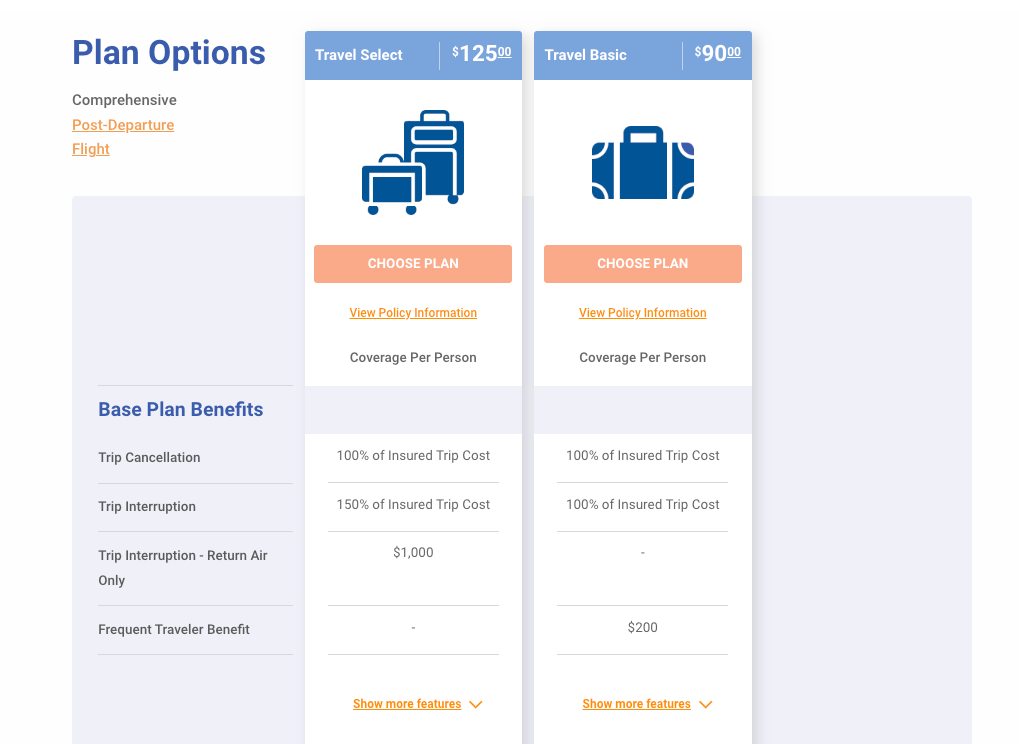

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

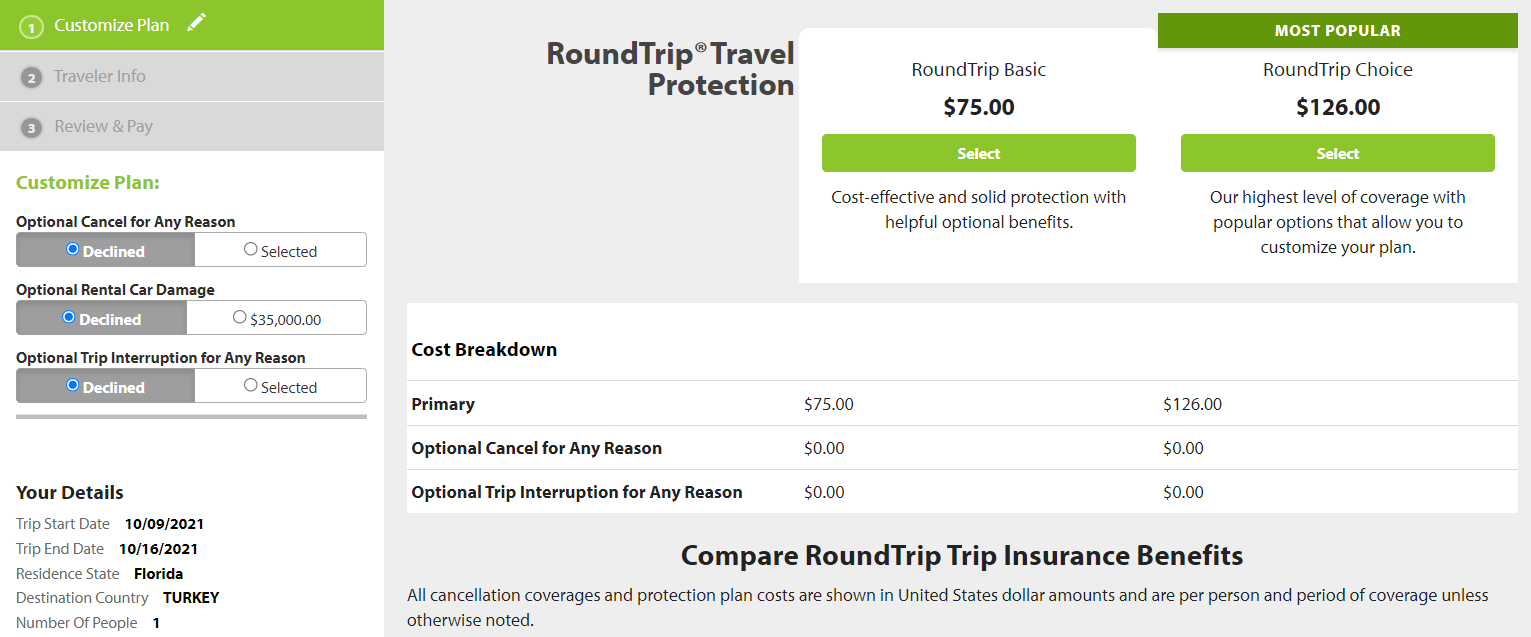

Seven Corners

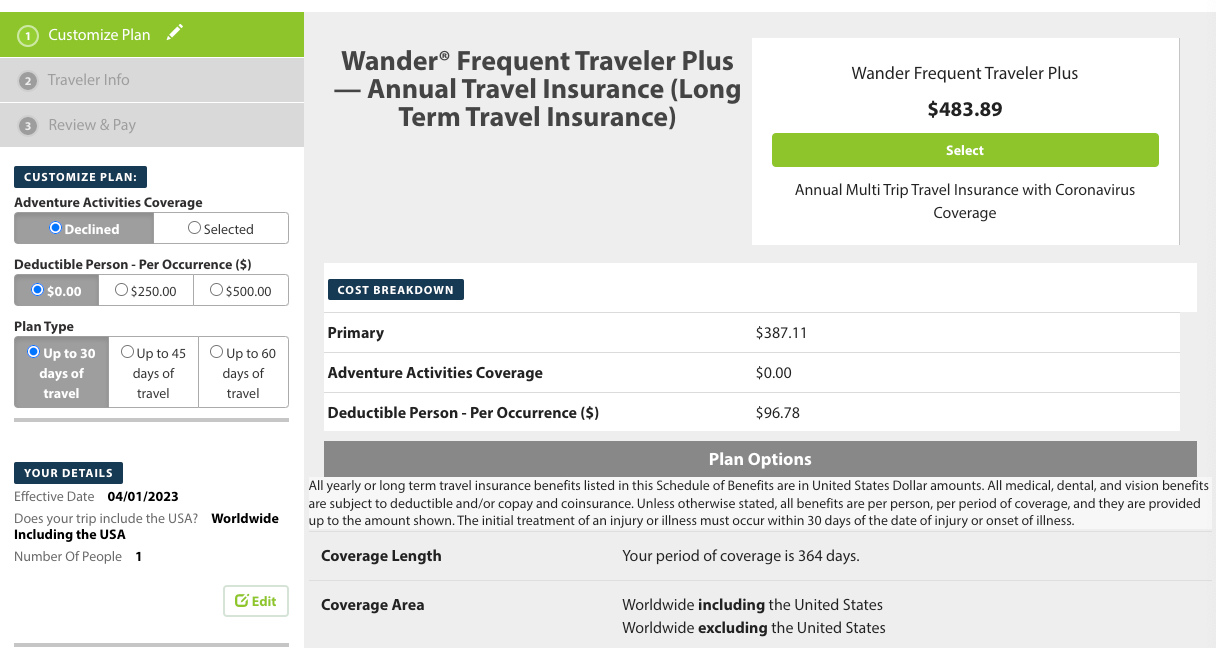

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Personal Finance

Best Travel Insurance Companies for April 2024

:max_bytes(150000):strip_icc():format(webp)/EricRosenberg-2023-Square-0224d594cbdc4555900b9c356d7b60b9.jpg)

According to our research, Travelex is the best travel insurance company because its comprehensive coverage comes at a relatively low cost. We chose the best travel insurers in our list based on an analysis of 31 travel insurance companies across several areas that are most important to travelers, including options available for your coverage, claim and policy limits, what the policy does and doesn't cover, and typical policy costs. We took time to research insurance coverage limits and what the policies covered and rank companies accordingly.

Travel insurance is an important product to consider when booking a trip, especially if it's a pricy one or you believe there's a chance it could be canceled. If you're like the 40% of people who told Nationwide Travel Insurance they plan to travel more in 2024 than in 2023, then travel insurance could be key to making those plans a reality.

Our list of top travel insurance companies can help you choose the right provider, but you should also do your research to make sure the policy covers your particular trip. And if general travel insurance isn't enough, you may be able to add cancel for any reason (CFAR) travel insurance to your policy to ensure an unexpected situation comes up, like a last-minute work or family obligation, or safety concern.

- Best Overall: Travelex

- Runner-Up, Best Overall: Allianz Travel Insurance

- Best Value: InsureMyTrip

- Most Comprehensive Coverage: World Nomads

- Best for Older Adults: HTH Travel Insurance

- Best for Cruises: Nationwide

- Best for Medical Coverage: GeoBlue

- Our Top Picks

Allianz Travel Insurance

InsureMyTrip

World Nomads

HTH Travel Insurance

- See More (4)

The Bottom Line

- Compare Providers

- What Is Travel Insurance?

How to Get Travel Insurance

What does travel insurance cover.

- How Much Does Travel Insurance Cost?

- What Happens When You Cancel a Trip?

Best Overall : Travelex

- Number of Policy Types: 3

- Coverage Limit: Up to 100% up to $50,000 for cancellations

- Starting Price: $24

Travelex offers coverage (up to 150% for interruptions) for you or your family members at a competitive price—and kids are included at no extra charge. A relatively low price for the high levels of coverage made it our top choice. Look for the Travel Select plan for the best coverage.

Competitive pricing for comprehensive coverage

Multiple plan options with customizable features

Children younger than 21 covered at no extra cost

Mixed pre-existing medical condition coverage depending on the policy purchase date

No annual plan available

Basic coverage plan features minimal coverage

Travelex Insurance Services is a well-known travel insurance provider based in Omaha, Nebraska. Founded in 1996, Travelex offers several insurance packages depending on the coverage you need for your trip. Policies are underwritten by Berkshire Hathaway Specialty Insurance, which earns an A++ rating from AM Best and AA+ from Standard & Poor’s. Coverage is available to customers worldwide.

The Travel Select plan starts at about $36 and includes trip cancellation insurance, trip interruption, and emergency medical and evacuation, but there also are several ways to customize and upgrade coverage.

Travel is covered up to 100% up to $50,000 for cancellations. You can receive up to 150% of the trip cost, up to $75,000, for trip interruptions. Emergency medical limits are $50,000, and emergency evacuation coverage is good for up to $500,000.

In addition, Travel Select has a 15-day pre-existing medical condition exclusion waiver. If you purchase your policy within 15 days of paying for your trip and insure the full cost of the trip, your pre-existing injury or illness is likely covered.

Runner-Up , Best Overall : Allianz Travel Insurance

- Number of Policy Types: 10

- Coverage Limit: Up to $10,000 per insured, per year for trip cancellation

- Starting Price: $138

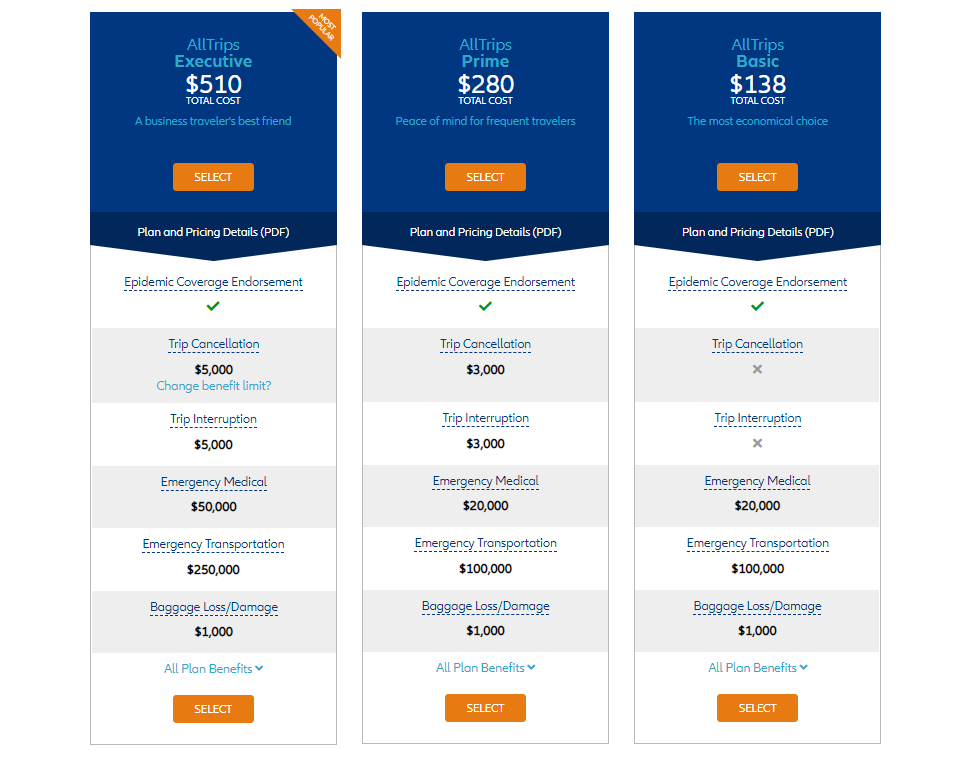

Allianz gets the runner-up spot because it offers coverage for frequent travelers with a low cost per trip. Get the best coverage from the AllTrips Executive Plan. Individual trip coverage is also available.

Annual- or single-trip plans are available

Many policy types fit varying needs

Cover yourself and your household all year even if you’re not traveling together

Does not cover extended travel periods

Some annual plans have per-trip limits while others have annual limits

Limit for emergency medical transportation coverage is only $250,000

Allianz Travel is a subsidiary of Allianz, which traces its history back to 1890 in Germany. Travel policies are underwritten by insurers with AM Best ratings of A to A+ and are available only to legal U.S. residents.

Travelers who want to hit the road many times per year should consider annual travel insurance rather than individual per-trip policies. Allianz Travel offers four different annual plans with varying benefit levels. We particularly like its AllTrips Executive Plan, which has the highest limits and coverage.

The AllTrips Executive Plan provides tiered limits starting at $5,000 for trip cancellation insurance or interruption coverage. It also offers $50,000 for emergency medical and $250,000 for emergency transportation per insured per trip. There is a lengthy list of exclusions, including extreme sports, so make sure to read the fine print before jumping into adventure activities.

Quotes for a single traveler, a couple, and a family of four had a price point of $500 per traveler per year. If you pay for comprehensive coverage at $120 per person per trip and are going to travel at least five times per year, you will break even with this plan. If you’re looking for lower costs, the AllTrips Basic, Premier, and Prime options are also available from Allianz.

Best Value : InsureMyTrip

- Number of Policy Types: Multiple options from over 20 providers

- Coverage Limit: Varies

- Starting Price: $25 to $100

Compare policies from more than 20 different travel insurance providers with one form so you know you’re getting a good deal for the coverage you need. You can find low-cost trip coverage or customize a plan to meet your needs so you don’t overpay for coverage you won’t use.

Search for quotes from multiple reputable insurers

Shop around with one application for multiple trip types

View multiple plans from eligible insurers for your planned trip

Many popular insurers are not included in listings

Initial listing pages don’t show policy limits

Includes some policies with low coverage limits

Founded in 2000, InsureMyTrip is a travel insurance comparison website that searches from more than 20 insurers using one intake form. It offers an easy-to-use sign-up tool to quickly compare multiple policies based on your specific needs. Filters are available to pick policies that cover adventure sports, higher limits, increased medical coverage, and more.

A quote for a family of four taking a 14-day trip that costs $4,000 and includes plane and hotel expenses resulted in three suggested plans with costs of around $100 to around $400 for varying levels of travel protection. Basic features included luggage coverage, travel delay, and medical care. Note that rates will differ based on where customers are originating from and where they are vacationing, as well as other variables.

The insurers you'll find while using InsureMyTrip have earned a variety of industry ratings and are generally considered reputable and financially stable. Still, as with policies bought directly from insurers, it’s a good idea to read the policy details before clicking the buy button. Each underlying insurer has different claims processes, exclusions, and limits. InsureMyTrip makes it easier, however, to be an informed travel insurance buyer.

Most Comprehensive Coverage : World Nomads

- Number of Policy Types: 2

- Coverage Limit: Up to $10,000 for trip cancellation

- Starting Price: $100 to $200

Adventure travelers and digital nomads receive good trip protection from this plan, which offers coverage of up to $100,000 for accidents for some of the most extreme adventures.

Extensive coverage with high limits for medical and emergency evacuation

Protects your bags, computers, and sports equipment when traveling

Explorer plan covers adventure sports

Only single-trip plans are available

Most pre-existing medical conditions are not covered

Not all policies cover adventure sports

World Nomads is a good insurer for those looking for adventure. The Australia-based provider was founded in 2000 and is a solid choice for worldwide travel with few excluded activities. Policies are underwritten by various insurers including the financially strong and well-known Nationwide Mutual Insurance Company, Generali Global, AIG, and Lloyd’s.

Coverage includes terrorist attacks, assault, medical repatriation, equipment and baggage, and overseas medical and dental. The high-end Explorer Plan covers activities including snow sports, water sports, aviation, motorsports, athletics, and high-adventure experiences. It names more than 200 activities, many of which other insurers specifically exclude.

For the Explorer Plan, a solo 35-year-old would pay around $200, depending on inputs like state of origin, for a month in Thailand, which is reasonable for such extensive coverage. The Standard Plan costs around $100 for the same trip, but it makes sense to choose higher coverage levels if you’re worried about something going wrong.

This U.S.-based policy is underwritten by Nationwide (rated A by AM Best) with a $100,000 limit for emergency accidents and illnesses, $500,000 for emergency evacuation, $10,000 for trip cancellation insurance (or interruption), and much more.

Though it doesn’t have the same insurance reputation as some other providers, it works with reputable companies to underwrite policies.

Best for Older Adults : HTH Travel Insurance

- Number of Policy Types: 5

- Coverage Limit: Up to $50,000 for trip cancellation

- Starting Price: Varies

Medical coverage may be important to older adults who need excellent travel protection with flexible options while on a budget. This is where HTH Worldwide stands out. Older adults can get high levels of medical coverage.

High levels of medical coverage for adults up to 95 years old

Up to a $1,500 allowance for someone to visit you in the hospital

May be expensive depending on your needs

Best plan for older adults requires existing health insurance

Lowest policy has a $50,000 maximum benefit per person

Headquartered in Pennsylvania, HTH Worldwide was founded in 1997, and HTH Travel Insurance offers plans with high levels of medical coverage. That’s a big concern for older adults leaving the country , as they could end up in a doctor’s office or hospital with an expensive bill to follow. HTH Travel Insurance offers up to $1 million in total coverage for medical.

Policies for travelers with existing primary insurance enjoy 100% coverage for typical hospital charges, including surgery, tests, office visits, inpatient hospital stays, and prescription drugs outside of the U.S., among other coverage.

Medical evacuation is available up to $500,000, but trip interruption and baggage coverage are pretty light. Most people will choose this plan for medical rather than travel benefits. This policy is available to applicants who are 95 years old or younger.

Travel insurance is also available for people without existing health coverage. Most older adults in the U.S. are covered by some existing coverage, such as Medicare, but Medicare doesn’t work outside of the United States, leaving people uninsured when abroad. HTH Travel Insurance provides policies for those without existing medical coverage. The age limit is 95, but there is a 180-day pre-existing medical condition exclusion.

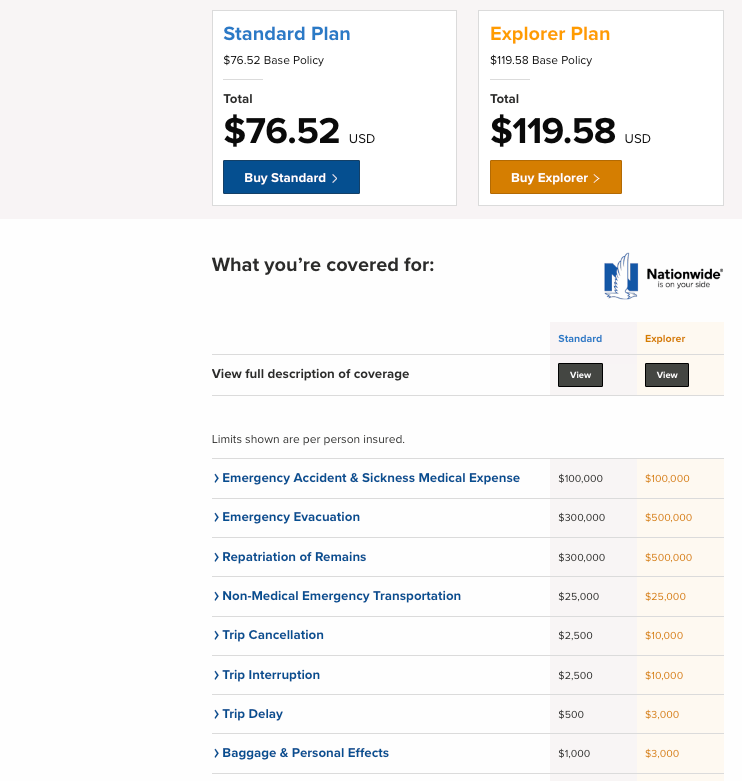

Best for Cruises : Nationwide

- Number of Policy Types: 8

- Coverage Limit: Up to $30,000 for trip cancellation

- Starting Price: $100

Multiple options protect your cruise vacation with tailored coverage for common cruise trip issues. This makes Nationwide a good pick for those who take to the high seas for their vacations. Make sure to review the benefit levels so you pick the right coverage for your needs.

Large insurer with a strong reputation

Three different cruise insurance plans to choose from

Coverage for common cruise issues like missed connections and itinerary changes

Some plans have low coverage levels for some incidents

Benefit limits are low for trip interruption for any reason

Pre-existing medical conditions may not be covered

Nationwide has been around since 1925. The Columbus, Ohio-based insurance company offers the most popular types of insurance including auto, home, and life. It also offers a few types of travel insurance coverage for individual trips, multi-trips, and cruises.

For single trip protection, Nationwide offers trip cancellation insurance of up to $10,000 with its Essentials plan and $30,000 with its Prime plan. Travelers may also get an annual travel insurance package for just $59 a year to cover delays, medical expenses, medical evacuation, lost luggage, and travel assistance.

Its custom-tailored plans for cruises, however, are what landed it in this category. The Universal Cruise plan, Choice Cruise plan, and Luxury Cruise plan make it easy to pick the right coverage for your individual needs. The cost for a couple on a 10-day cruise to Mexico, for example, was quoted at around $200 for both the Universal and Choice plans.

Cruise insurance from Nationwide covers what you worry about most with a cruise. Things like broken-down ships and itinerary changes can lead to missed excursions and flights or other costs. For the Universal Cruise plan, emergency medical expenses are covered up to $75,000 with medical evacuation benefits up to $250,000.

Additionally, all plans include coverage for the weather, an extension of school sessions, work emergencies, and terrorism. The luxury plan also covers the Centers for Disease Control and Prevention warnings in effect at your destination.

Travelers in 2024 have concerns over trip cancelations due to unprecedented events. Nationwide's survey showed that 51% are still worried about a resurgence of COVID-19, while 54% worry about weather-related delays or cancellations. Other worries include technology issues (38%), unruly fellow travelers (37%), and employee strikes (25%). Travel insurance can help alleviate some stress about a trip being canceled.

Best for Medical Coverage : GeoBlue

GeoBlue offers multiple options to buy travel medical insurance coverage for a lower price than a full travel insurance package. It offers medical coverage on its own if you don’t want or need additional travel coverage.

Up to $1 million in medical coverage

Gives a la carte medical coverage when other trip costs are already covered

Different policies allow you to cover various needs and pre-existing medical conditions

Primarily covers medical costs

Additional primary medical coverage required

GeoBlue, headquartered in Pennsylvania, is part of Worldwide Insurance Services, and policies come with a license from Blue Cross Blue Shield Association. Policies are issued by 4 Ever Life International Limited, a company with a history of more than 60 years and an A rating (Excellent) from AM Best.

If you just need coverage for medical needs, GeoBlue is a good choice. This insurer offers only travel medical coverage. Paying for medical coverage means you aren't paying for the rest of your travel insurance, which you already may have covered. If you already have a credit card with travel insurance included, your card's terms likely protect things like lost luggage and missed flights, for example. Instead, you get covered just for medical, and the costs for that are as low as a few dollars per day.

Because you’re mostly getting travel medical coverage, you will pay a lot less than most other insurers on this list. Just make sure you completely understand what it does and doesn't cover. You will receive only minimal luggage protection and travel interruption coverage with GeoBlue's plans.

GeoBlue has two general plans for single trips, multiple trips, and long-term travel. Additionally, there are five specialty policies for niche travel medical insurance needs, like study abroad. It doesn’t cover everything related to your trip, but it makes medical coverage much more affordable.

Travelex is the best travel insurance company because it offers competitive pricing for comprehensive travel insurance. Policies from Travelex cover everything from canceled or interrupted trips to medical emergencies and evacuations. It also features a 15-day pre-existing medical conditions waiver, which means that as long as you book your trip several weeks in advance, you and your family members will likely still be covered.

There are many options to choose from when it comes to travel insurance. It can provide you with peace of mind and save you thousands of dollars if your travel plans are canceled or interrupted at the last minute. With world events like pandemics, natural disasters, and wars that could easily throw an unexpected wrench in your travel plans, travel insurance helps you to stay prepared. Overall, our top choice for travel insurance is Travelex.

Why You Can Trust Our Expert Recommendations for the Best Travel Insurance

Investopedia collected several key data points from over 30 travel insurance companies to identify the most important factors for readers choosing a travel insurance company for their trips. We used this data to review each company for cost, coverage limits, exclusions, customer service, and other features to provide unbiased, comprehensive reviews to ensure our readers make the right decision for their needs. Investopedia launched in 1999, and has been helping readers find the best travel insurance companies since 2020.

Compare the Best Travel Insurance Companies

Travel insurance covers common problems when traveling. From trip interruptions to full cancellations, it can help protect the money you put down for your travel experience.

Common coverage includes more than just an unexpected trip stoppage. It can also cover lost or damaged luggage and changes to your itinerary for covered reasons, among other benefits.

Medical coverage is an important factor to consider because your current health insurance may not work away from home. The best travel insurance includes coverage for medical treatment, dental emergencies, and medical transportation. If you have any pre-existing medical conditions or are at risk, it’s important to make sure your policy covers these, too.

Tips for Picking the Best Travel Insurance for You

When picking the best travel insurance policy, there are a few things you should consider. Here are some tips and factors to think about:

- Look for low pricing and good coverage : Pricing is one of the most significant factors when comparing travel insurance policies. Look for a provider that offers low rates and doesn’t skimp on coverage.

- Don't settle for the first policy type : Depending on where you’re traveling and how long you’re staying there, different types of travel insurance policies may work best for your situation. For instance, you may need a different policy for a weeklong trip than you would if you plan to travel abroad for several months.

- Match your coverage limits to your travel costs : Travel insurance plans have coverage limits for trip cancellation, interruption, and medical expenses. Look for a plan whose coverage limit matches the amount you’ve spent on your travel plans.

- Don't forget to look at the exclusions : Some travel insurance plans come with exclusions. If you’re worried about a particular event or accident, make sure it’s covered before you pay for a plan.

- Look for high customer satisfaction ratings : Customer satisfaction is also an important factor when purchasing a travel insurance plan. Look for a provider with high customer satisfaction ratings and a history of good customer service.

"As someone who is always purchasing travel insurance, and has been for years, the thing that matters to me the most is mainly coverage and customer service. I want to know what my policy will cover, especially if I am taking a trip that involves a lot of activities, as well as how easy it will be to contact the company should I need to do so.I have found in the past that the price is always very reasonable and you can shop around, so it has never been the biggest concern for me." -Alice Morgan, Senior Digital Art Director, Dotdash Meredith

- Select a travel insurance company.

- Apply for the travel insurance plan of choice on the company's website or over the phone.

- Provide basic info about who is traveling and travel plans, like name, age, location of trip, and travel expenses and costs like hotels or airfare.

- Wait to be approved.

- Create an online account for easy access while you travel. Some companies may have an app, too.

- Enjoy your trip, and file a claim online or over the phone if needed.

When you’ve selected a travel insurance plan that meets your needs, the next step is to apply for travel insurance. You’ll need to provide the insurance company with some basic information about yourself and your travel plans, including your age, where you live, the date and location of your trip, and your total travel expenses, including things like flights and hotel stays.

Many insurance companies let you apply for a policy entirely online. When your application has been approved, you can typically manage your account online and add details about your trip. If you do need to file a claim, you can typically complete the process online.

Travel insurance may include many different benefits. Here’s a look at some common situations covered by many travel insurance plans:

- Trip cancellation

- Trip interruption

- Missed connection

- Baggage and possession loss, damage, and theft

- Delayed luggage

- Emergency medical treatment

- Emergency medical evacuation

- Accidental death and dismemberment (AD&D)

Emergency medical treatment may include things like ambulance services, x-rays, doctor bills, dental work, lab work, and more. It'll depend on the travel insurance company, so be sure to ask before paying for the insurance and/or additional benefits.

There are additional specialty coverages as well, such as customized policies for cruises. It’s a good idea to shop around and compare before making a final decision.

What Does Travel Insurance Not Cover?

Just as homeowners insurance often excludes damage from things like earthquakes and floods, travel insurance has common exclusions you need to know about. Here are some types of coverage you may not get with travel insurance:

- Weather-related cancellations and delays

- Trip cancellations or changes due to acts of terrorism

- Trip cancellations or changes due to a pandemic

- Injuries from extreme sports and high-adventure activities

Though most policies have limits and exclusions around these circumstances, not all do. Some insurers on this list have special coverage for these exact causes or include them in standard plan terms. Again, this is why it’s so important to read your policy documents before paying for and locking in your policy.

Travel insurance costs vary widely by coverage and insurer. You can expect to pay anywhere from a few dollars a day to more than $10 a day for short-term and single-trip coverage. The cost of your trip is another major factor in the insurance rate.

That means insurance for a single trip could cost anywhere from around $20 to hundreds of dollars. Annual policies cost around $500 per year for high levels of coverage.

There are many inexpensive travel insurance plans available, but most travelers are best protected with comprehensive coverage. It costs a bit more, but if you need to file a claim, you’ll be glad you have it.

Is Travel Insurance Worth the Cost?

If you pay a lot for a trip or vacation, then travel insurance should be worth the cost because you don't want to lose out on that investment. It won't always be necessary, but if travel insurance costs just a fraction of what you paid for the trip, then you'll be happy you had it if you have to cancel a trip worth hundreds or thousands of dollars. For example, if you book a European vacation worth $4,000 and your travel insurance costs just $400, it might be worth it so that if anything happens and you need to cancel, you still get $3,600 back in your pocket.

How Does Travel Insurance Work When You Cancel Your Trip?

When canceling your trip, you'll want to contact the travel insurance company right away. The policy and travel insurance company you selected will cover certain parts of your trip. It's important to review this policy and details to understand exactly what you need to do to get your money back for your trip.

Don't cancel your trip until you read your policy and know what is required for your claim.

For example, if you are ill and a doctor tells you not to travel, you may need to get a written note from the doctor and submit it with your trip cancellation claim.

Before you submit a claim and cancel your trip, consider if you can delay it and reschedule it instead. If you can't, then make sure you have all the required documents (receipts, proof of hotel booking, airline ticket confirmation, etc.). Once you submit your claim, it could take days (Allianz says up to 10 business days, sometimes) for you to receive notice that the claim was processed.

Frequently Asked Questions

In which countries is travel insurance required.

Travel insurance is not mandatory or required by all countries, but some do. For example, Cuba requires people traveling from the U.S. to Cuba to have non-U.S. medical insurance, which may be covered through travel insurance or an airline. Other countries that may require or strongly encourage travel insurance include Antarctica, Egypt, Chile, Turkey, and more. Check a country's specific travel requirements before booking your trip to understand if travel insurance is required.

Does Travel Insurance Really Pay?

Travel insurance might not be worth the cost for lower-cost trips and low-risk vacations. However, expensive international trips or large family vacations can make additional travel insurance a reasonable investment.

If you spend thousands of dollars on a trip, it is probably worth spending a couple of hundred more to make sure you get your money back if the trip doesn’t go as planned. If something goes wrong, which can lead to expenses valued at tens of thousands of dollars, it’s good to have a financial backstop so you don’t have to pay for everything out of pocket.

That said, you should check to see what coverage is already available to you through other venues. For instance, many credit cards cover the cost of lost or delayed luggage if you purchase your airfare using that card. Your primary health insurance may cover your medical insurance needs, especially for domestic travel.

Do I Need Travel Insurance for a Cruise?

Just as with any kind of trip, whether you need cruise insurance largely depends on the cost of the trip, and where you're going. If you're paying more than $1,000 for a cruise, travel insurance is probably worth it. For instance, you may want international medical insurance if you're traveling to other countries because some health insurance policies do not cover international travel—Medicare and Medicaid in particular.

Just be aware that if you buy cruise insurance (as opposed to a general travel insurance policy), it may not cover travel before and after the cruise, such as your flight to the port and any hotel expenses you may have pre- or post-trip.

Does State Farm Offer Travel Insurance?

State Farm does not offer travel insurance. State Farm offers car insurance, motorcycle insurance, boat insurance, motorhome insurance, off-road vehicle insurance, homeowners insurance, renters insurance, condo insurance, life insurance, liability insurance, small business insurance, and more.

Can You Buy Travel Insurance After Booking a Flight?

Yes, you can book travel insurance after booking a flight. This may be a great time to book travel insurance because you'll know what coverage you need in case something happens and your trip is canceled. Signing up for travel insurance as soon as possible will always be your best bet.

Which Travel Insurance Is Best?

The best travel insurance company is Travelex because it offers comprehensive coverage at a relatively low price. Travelex has multiple plan options and family members younger than 21 are covered at no extra cost. Another perk is Travelex's Travel Select plan which has a 15-day pre-existing medical condition exclusion waiver. If you purchase your policy within 15 days of paying for your trip and insure the full cost of your trip, your pre-existing injury or illness is likely covered.

Does Travel Insurance Cover Canceled Flights?

Most travel insurance covers canceled flights, as well as delayed flights. If your flight is delayed by a certain number of hours, your travel insurance may reimburse you for the additional money you spent as a result of that delay or cancelation.

What Is the Best Rate for Travel Insurance?

The best rate for travel insurance will be whatever it costs for comprehensive coverage for your trip. While you can get travel insurance that costs just $10 per day, it may not come with the coverage you need for your trip—especially if it's an expensive trip or if you're worried it could be canceled or interrupted.

How We Found the Best Travel Insurance Companies

To come up with this list of the top travel insurance providers, we looked at more than 30 different travel insurance companies and plans. Major areas of focus included coverage options, claim and policy limits, what’s covered, and typical insurance policy costs.