Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- AIA Travel Insurance: Is It A Good Deal?

- High per item cover for baggage loss/damage

- Premier plan offers above average benefits for trip inconvenience & medical

- Provides golf and sports coverage

- Below average value for your money

Overall, AIA's travel insurance plans can be characterized as being solid policies that meet the industry standard in terms of the amount of coverage that each plan includes. However, AIA's plans are also among the most expensive in their class. Because there are stronger, cheaper alternatives on the Singapore market that offer consumers better bang for their buck, AIA travel insurance is difficult to recommend to fiscally-savvy Singaporean consumers.

Table of Contents

AIA Travel Insurance: What You Need to Know

Sports coverage, claims information.

- Summary of Coverage & Benefits

AIA's three-pronged travel insurance suite, which includes its budget Classic plan, mid-tier Deluxe plan and premium Premier plan, cover the bases with average coverage overall that meets the industry standard. All AIA travel insurance plans feature among the highest per item coverage for baggage loss/damage on the market, with the Premier plan also standing out for its high cover for medical expenses.

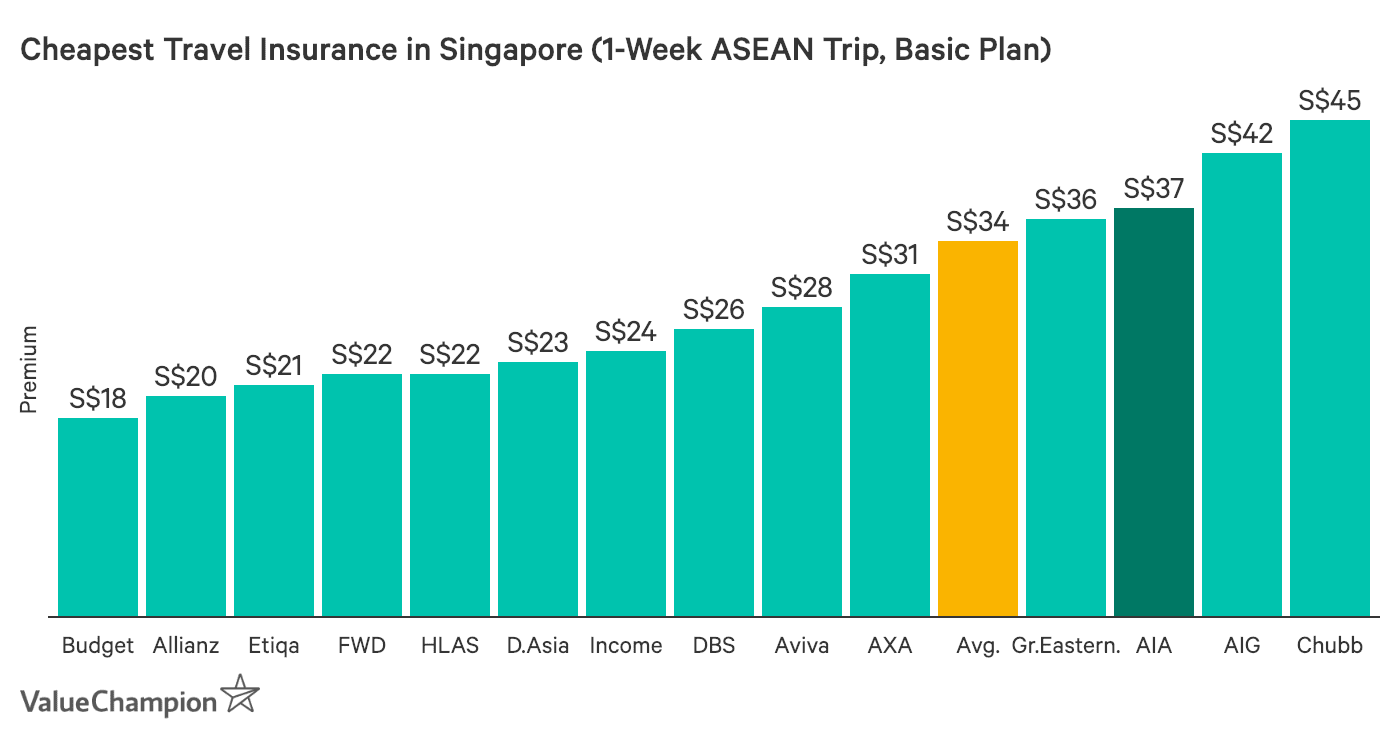

However, where AIA's travel insurance plans fall short is their pricing. Each of AIA's plans are among the most expensive in their class, along with AIG and Chubb. This means that while the level of coverage provided in the plan may be satisfactory, the value you're getting for your money with an AIA plan leaves something to be desired. There are alternatives on the market that give you much better coverage for less money, such as the generous and comprehensive policies from AXA , Allianz Global Assistance , and Aviva . Shoppers seeking a stronger emphasis on affordability as opposed to maximum coverage might also be interested in the travel insurance plans from Budget Direct , FWD , Etiqa and HL Assurance .

Notable Exclusions

AIA has standard exclusions including extreme sports (potholing, hunting trips, expeditions and ocean yachting), pre-existing medical conditions, travelling against the advise of your doctor, illegal acts and war. The table below summarises some of the common exclusions you should be aware of. However, it is always beneficial to read the full policy document.

AIA offers basic golf coverage at no extra charge, consisting of golf equipment coverage, unused green fees reimbursement and hole-in-one coverage. You are covered for participating in marathons (but not bi- or triathlons, scuba-diving, trekking below 3,000 metres, harnessed rock-climbing if done with a tour operator and available to the general public (below 6,000 metres), skiing and snowboarding. You should keep in mind that any equipment besides golf equipment is not covered.

AIA lets you submit your claims online (linked below) in a 30 minutes session. You will get a one-time password to use for your claim submission. Make sure you have documents that support your claim, your travel itinerary and mobile phone.

AIA Travel Insurance Coverage and Benefits

Hopefully, reading our review of AIA's travel insurance plans has helped you determine if this insurer has the right policy to meet your protection needs for your next business trip or holiday. But if you'd like to learn more about what else is out there, please consider reading our list of the best and cheapest travel insurance plans in Singapore .

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

AIA Covid-19 Travel Insurance Singapore Review: Price, Promotion, Claims (2022)

AIA may be one of the big insurance companies in Singapore, but AIA’s travel insurance plans have yet to become everyone’s go-to before jetting off on their latest holidays.

Unlike many of their competitors (even the massive brand names like NTUC Income , FWD , or AIG ), AIA has not really upped its travel insurance game to appeal to modern travellers that are now extremely savvy with price comparisons while waiting out for all sorts of promotions .

As you’ll see in this article, AIA travel insurance still has some way to go before they can jostle their way into the upper echelons of the best travel insurance rankings.

- AIA Covid Travel Insurance: Summary

- AIA Travel Insurance Covid-19 Coverage

- Disadvantages of AIA Travel Insurance

- Extreme Sports & Outdoor Adventure

- AIA Travel Insurance Claims

- AIA Travel Insurance Promotions

- AIA Travel Insurance Review

1. AIA Covid Travel Insurance Price

AIA’s travel insurance is called AIA Around The World Plus (II) and it comes in 3 plan tiers:

The plans can either be either a single-trip plan or an annual pas. What’s the difference between single trip and annual travel insurance ? If you drive up to Malaysia often or fly out to see your girlfriend or boyfriend every few weeks, get the annual pass. If you’re just going to Bangkok for a 5-day trip and dream of travelling more, just buy the single-trip first.

The price of your AIA travel insurance largely depends on the country you’re travelling to. AIA has divided their premiums into:

- ASEAN (cheapest): Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand and Vietnam

- Asia : Australia, China, Hong Kong, India, Japan, Korea, Macau, Mongolia, New Zealand, Sri Lanka, Taiwan, Timor-Leste, and all countries listed in ASEAN

- Worldwide (most expensive): Any countries outside Singapore

Here’s a summary table of AIA’s travel insurance coverage & premiums:

At $37 to $123 per week, AIA’s travel insurance is priced similarly to Sompo’s travel insurance ($52 to $132) and Great Eastern travel insurance ($65 to $118). Other super useful coverage that you will get from the AIA Around the World Plus (II) travel insurance plan includes allowance for pet hotel, pregnancy-related medical expenses, credit card fraud, and compassionate hospital visits:

- Flight diversion ($100/6 hours): Too real, I’ve been diverted to Haneda instead of Narita in Japan before. Had to disembark, take all luggages, walk all over, and take buses to Narita.

- Flight overbooking ($100/6 hours): United Airlines?

- Missed connecting flight : $200 to $500

- Travel agent closed down : $1,000 to $5,000

- Jewellery coverage : $100 to $1,000 if your jewellery gets robbed, stolen

- Credit card fraud ($1,000): Get this especially if you’re going to pickpocket hotspots like Paris where your wallet will always disappear in a jiffy.

- Kidnap and hostage : $250/day, $3,000 to $10,000

- Personal liability : $1,000,000

- Compassionate hospital visit : $5,000 to $15,000 to get a relative or friend to visit you if you’re hospitalised overseas alone

- Child protector : $3,000 to $10,000 to get a relative or friend to accompany your child back to Singapore when you’re hospitalised overseas alone

- Women’s overseas medical expenses : $2,000 to $8,000 if you get pregnancy-related sickness abroad and get medical treatment

- Complementary medical reimbursement : $100 to $500 if you come home to Singapore and get any follow-up medical treatment (within 30 days)

- Post-trip medical expenses in Singapore : $2,000 to $10,000 if you got ill overseas, and you get medical treatment in Singapore within 30 days

- Pet care : $50/6 hours, max $250 to $500 if your flight to Singapore is delayed and you’re late to fetch your pet from pet hotel

AIA’s travel insurance plan has also got one of the clearest and most user-friendly brochures.

2. AIA Travel Insurance with Covid-19 Coverage

Covid-19 coverage is automatically included in all AIA travel insurance plans.

If you got Covid-19, your trip was disrupted, and your airline refunds your tickets in credits, your hotel refunds your bookings in their hotel credits, you cannot claim from your AIA travel insurance plan. That’s great if you return to, say, Seoul every year. But really bad if you don’t want the credits. You might want to hit your hotel or airline with an email to check on their Covid-19 refund policy beforehand. Singapore Airlines, for example, allows refunds if you booked a refundable fare ticket directly from SIA within their refund policy dates. Sometimes, you may also be charged a refund fee.

Children above 12 years old must be legally fully vaccinated to be covered by the plan.

3. AIA Travel Insurance: Disadvantages

- Children & Seniors : Children under 19 years old and elderly above 70 years old will have lower coverage

- Length of Holiday : 182 days per trip for Single Trip plan, 90 days per trip for Annual Multi-Trip plan

- Waiting Period : You must book your AIA travel insurance plan at least 3 days prior to your trip else you won’t be covered for any trip cancellations, postponement.

- Extreme Sports : Not covered

- Pre-existing Conditions : Not covered

- Air Miles & Hotel Reward Points : You cannot claim for your air, bus, cruise tickets etc. if you use air miles or reward points to claim those tickets.

- Medical Treatment in Singapore : If you decide to come home to seek medical treatment, you must do it within 2 days upon arrival.

- Home Country : If you’re making a single trip back to your home country for more than 30 days, medical expenses will only be claimable up to 20% of the benefit amount. If you’re on an annual multiple trip plan? No cover.

4. Does AIA Travel Insurance cover extreme sports?

AIA’s travel insurance does not cover all extreme sports and sports in general. Its exclusions are very sketchy and ambiguous, e.g. saying they don’t cover ultra-marathons, but don’t mention if they cover marathons. They say they don’t cover unpatrolled skiing, but don’t mention if they cover normal patrolled resort skiing.

How to know if bouldering, usual hot air balloon rides are covered? Rule of thumb, travel insurers like AIA typically cover recreational activities that are open to public and can be done with a licensed tour operator, guide, and instructor.

5. AIA Travel Insurance: Claims

Before you purchase ANY travel insurance, one thing you must consider is the ease of claim. How complicated is the claims process? Got success stories from other clients before? Are they notoriously iffy and stingy about your documents and receipts?

A quick search on forums such a Reddit showed that your AIA travel insurance claims process largely depends on the AIA insurance agent you’re buying from. According to the AIA claims website, the claims process is somewhat dated: you need to download the AIA claims form , collect all the necessary supporting documents, and contact your AIA agent to help you with submission.

Otherwise, you can email all the documents to AIA directly at [email protected] . The catch here, is obviously, that you will have to keep checking in with AIA to check on the application status and understand which claims were not eligible and… perhaps try to appeal.

AIA Emergency Hotline : If you’re overseas and ran into an emergency, call +65 6338 6200 (24/7).

AIA Hotline: If you’re overseas, call +65 6248 8000 from 8:45am to 5:30pm on weekdays. Otherwise, the AIA general hotline is 1800 248 8000.

6. AIA Travel Insurance Promotion

There are no ongoing AIA travel insurance promotions for the AIA Around the World Plus (II) plan.

However, AIA is offering a free “mini” travel insurance plan called the AIA Supercharge Travel Cover that is valid from 29 April to 30 June 2022 (travel before 31 Dec 22). You’ll need to be a Singapore resident, between 18 to 65 years old, fully vaccinated, and provide your details for AIA’s marketing use. There are only 3 coverage you will get:

- Pre-Trip Tele-ART test at discounted rate of $9

- Covid-19 Medical Expenses Overseas: Max $1,000

- Covid-19 Quarantine Allowance Overseas: $50/day, up to 5 days

- Covid-19 Death: $10,000

Not bad since it’s free, especially if you’re on an extreme shoestring budget and are not able to shell out $110+ for a comprehensive Covid travel insurance .

7. AIA Travel Insurance Review

AIA does offer some of the highest compensation limits for loss of personal items and damage to your belongings – up to $800 per item or set – so if insuring your iPad Pro, Chanel bag, and matching Rimowa luggage set is important to you, this is the plan for you.

All the usual travel-related coverage: emergency evacuation, repatriation, natural disaster-caused trip cancellation, flight delay etc. are pretty decent and will pay all your necessary bills.

However, AIA’s Covid travel insurance gives you high coverage for medical expenses, medical evacuation, and pretty decent quarantine allowance of $50 to $100/day. However, if you get Covid-19 before your trip, note that the coverage is very low from $1,500 to $4,000.

Another thing you should note is the fact that you MUST buy all AIA travel insurance via AIA agents.

Looking for the cheapest travel insurance ? Compare all the best travel insurance in Singapore here.

Related articles

Travel Insurance Promotions & Other Money-Saving Hacks

The Best Travel Insurance in Singapore: Review

5 Best Annual Travel Insurance Policies in Singapore

About – AIA

At AIA New Zealand, we have a range of insurances to make life easier if something should happen to you. It means you can rest assured that you and your family will be financially protected no matter what life may bring.

We have an appetite for innovation

Thousands of clients trust us to make their travel needs a reality every day, and their journey is what inspires us to transform ourselves and our brand to create positive experiences. To meet vast and varied needs, we constantly offer a suite of products and services from which our customers can pick and choose to build their own truly-customised insurance programme.

Meeting the requirements and the demands of today’s travel world, our clients deserve to have a product that will cover them in the event of an emergency. This can happen to anyone of us. Rather know and have peace of mind that you are covered in this event.

Services – AIA

AIA Life Cover provides your loved ones with the financial support they need in the event of your death. AIA Life provides travel insurance to New Zealanders on their holiday or travelling on business. Having the right cover through our travel insurance when away from home can provide you with more that peace of mind. How do you know if you need it? If you are travelling across the country, or out of the country, this is a wise decision. If you want a cover as protection that offers loss of luggage, theft, injury and illness, then this is the cover for you.

Knowing that you will have a stress free travel, and should any hiccups occur, our travel insurance has you covered. Get a discounted rate should you want to cover more than a certain amount of people, be it a group booking or a family retreat. If you travel frequently, you can also receive a special premium. You get to choose how much cover you want and need.

Summary of Services

- Health Insurance

- Income Protection Insurance

- Critical Illness Insurance

- Permanent Disability Insurance

- Life Insurance

- Income Insurance

- Rent Insurance

Physical Address

Postal address, opening hours.

- Monday : 8 –

- Tuesday : 8 –

- Wednesday : 8 –

- Thursday : 8 –

- Friday : 8 –

- Retirement Plans

Travel Insurance

Planning a getaway is so exciting that you don’t want to imagine anything going wrong. But even the best laid travel plans can suddenly go awry due to illness, family emergencies, weather, or other unpredictable circumstances. Before embarking on your next adventure, protect yourself and your investment with travel insurance.

Travel Insurance Select through USI Affinity offers three different levels of coverage based on your trip. Your benefits and services may include:

- Coverage for trip cancellation or interruption

- 24-hour access to emergency assistance services

- Travel delay or missed connection compensation

- Medical expense reimbursement

- Emergency medical evacuation and medical repatriation

Take the next step Learn more from our provider

Questions? (800) 937 1387

A.M. Best Company has affirmed the Financial Strength Rating (FSR) of A for United States Fire Insurance Company.

Travel Insurance: What is Covered?

Product guides.

Start a firm

Plan retirement

New AIA members

AIA components

Sign up for our newsletter .

Ranked #1 Travel Insurance for Schengen Visa

Travel insurance, let’s get you started on your travel insurance journey.

Picture this – you’re about to set off on an exciting holiday. You’ve got your travel visa, your tickets, hotel bookings and everything else in order. You land at your destination and find that your luggage has been misplaced. Or worse, you’re the victim of theft and you are left in a foreign country without your passport or any cash! Dealing with these situations can be expensive and difficult – especially if you’re in a country where you don’t speak the language. But that’s precisely why travel insurance is so crucial!

Travel insurance is the assurance that your journey will be protected and insured from possible risks that may come unexpectedly on unknown lands. Travel insurance is a unique product that offers you financial help in case something were to go wrong while you’re travelling. It covers a range of scenarios, including medical and dental emergencies, theft of your money or passport loss , flight cancellation and misplaced or lost luggage.

Depending on where you’re going, the purpose of your visit and how often you travel, you can select a travel insurance policy that best suits your needs. A single-trip travel insurance plan is ideal if you’re travelling domestically or internationally and only travel once in a while, a single trip travel insurance can be purchased for yourself or for your family, for more information, check our family travel insurance . If you travel often for work, you may want to opt for a multi-trip travel insurance plan or an annual travel insurance plan. This way, you can save on the hassle of applying for a new travel insurance policy before each trip. We also offer customised travel insurance plans for senior citizens and students who are heading abroad to continue their education. No matter what your travel needs, we’ll find a travel insurance policy for you

Travel Insurance With COVID-19 Covered*

Start every journey with a travel insurance plan, what’s covered under tata aig travel insurance, our travel insurance policy will help you take care of a number of situations, ensuring the mental peace you truly deserve:, covid-19 covered.

Accident & Sickness Medical Expense Under the Accident & Sickness Medical Expense, Travel insurance with COVID-19 covered compensates for the medical expenses incurred by the insured because of being diagnosed with COVID-19 outside the Republic of India during the trip duration & is hospitalized. The policy provides coverage against Medical expenses upto the limit mentioned in the policy schedule.

Trip Cancellation Compensation benefit under Trip Cancellation is offered if the insured, the insured’s Travel Companion or The Immediate family of the insured or the Insured’s Travel Companion are diagnosed with COVID-19 before commencing their international trip. They cannot travel until they have received a negative COVID-19 report. If one has a valid travel insurance plan and they cancel a booked trip as a result of COVID-19, we will reimburse you the unused and non-refundable amount of your prior bookings, such as hotel booking, and ticket costs. You would be eligible for these benefits only if you booked and paid for such services before being diagnosed with COVID-19.

Trip Curtailment/Interruption Benefits If you are travelling with Travel insurance with COVID-19 covered and you, your Travel Companion, your immediate family or your Travel companion’s immediate family are diagnosed with COVID-19 during your trip, as a result of which, your trip has to be cut short, we will reimburse the trip interruption expenses. These expenses will be inclusive of the pre-paid and unused portion of travel and accommodation expenses, which are non-refundable; additional accommodation and travel expenses incurred due to trip interruption, subject to the sum insured limit.

Automatic extension Given the current circumstances, it is too early to predict if a lockdown will be enforced in the future. Consider the possibility of being trapped on vacation overseas because the country announced a statewide lockdown due to COVID-19. Flight delays or cancellations are extremely dangerous under such circumstances. Tata AIG Travel insurance coverage will cover your trip extension for a maximum period of 7 days if a lockdown is imposed in the destination country and no alternative mode of transport is available. Subject to Terms & conditions.

Baggage Covers

Delayed Baggage Almost everybody has a story about a time when they travelled and their luggage was accidentally sent elsewhere or unnecessarily delayed. If this happens and you have our travel insurance policy, you can rest easy. Your travel insurance plan will help cover the cost of any necessary personal items that you need to purchase until your bag can reach you.

Lost Baggage Having your baggage delayed is one thing, but if your bag is lost or stolen, managing the situation can be incredibly difficult. Luckily, our travel insurance policy can help you deal with this issue. Depending on the travel insurance policy terms, we will help reimburse you for the items in your luggage.

Journey Covers

Lost Passport Obtaining a new passport in a foreign country isn’t always easy. Your international travel insurance policy will help you with the necessary and reasonable expenses that are attached to getting a new passport made.

Assistance While Travelling If things go a bit wrong when you’re out of the city, you may need some assistance. Our travel insurance plan will help provide you with all necessary assistance required, right from legal help to getting lost luggage and passports replaced. Our travel policy will even help with emergency travel services, cash transfers and advances.

Personal Liability Accidents can happen at any time under any circumstance. If you happen to be involved in an accident where somebody else is harmed or injured, it could cost you quite dearly. Our travel insurance policy will help cover any damage caused to any third-party individual or property while you’re travelling. It’s important to remember that the travel policy will not cover your family members or individuals who live with you.

Hijack Help Our travel insurance policy will offer something known as distress allowance in case the flight that you’re travelling on is hijacked.

Delayed Flights Bad weather or a local strike could delay your flight by more than 12 hours. If this is the case, you might have to book another night’s stay at a hotel or incur some other additional expenses. Our travel insurance policy will help you take care of these expenses if your flight happens to be delayed.

Policy Extension Your travel insurance policy term often depends on the length of your trip. But, there are certain situations in which your flight may be cancelled or delayed for several days. We will automatically extend the term of cover of our travel insurance policy for seven days in case your flight is cancelled or delayed and you don’t have any other travel options available.

Trip Curtailment or Cancellation In case there’s an emergency and you have to travel back or cancel your entire trip, don’t worry. Our travel insurance plan will reimburse you for any unused, non-refundable hotel and travel expenses.

Medical Covers

Medical Emergencies Your travel insurance policy will help you deal with the financial implications that come with meeting with an accident or falling ill while you’re travelling. The policy will cover everything right from a regular illness that requires hospitalisation to dental emergencies and even fatalities. If you happen to fall ill or meet with an accident at the tail-end of your journey, you don’t have to worry. If you’re in hospital and your policy expires, we will continue to cover you for the next 60 days or until you are discharged, whichever is earlier.

Medical Evacuation Your travel insurance policy is your friend in times of need. If you require emergency medical evacuation to the nearest hospital, this policy will take care of that. In case you need to be evacuated and brought back to India for medical treatment, the travel insurance policy will look after that as well.

Accidental Death and Repatriation We don’t want to think about it, but it’s possible that an accident or medical emergency abroad could end up being fatal. TATA AIG’s travel insurance policy will provide your nominee with the full sum insured amount if this happens. We will also take care of the cost of repatriating the insured individual’s remains back to their city of residence.

Compassionate Visit If you need somebody to help you out when you’re in hospital, we’ll provide a two-way ticket for a family member to come and take care of you.

Interruption of Study If you’ve purchased a student travel insurance policy , this is especially for you. If have to interrupt your education because you or a family member are ill, we’ll reimburse you any unused tuition fee.

*Kindly check the policy wordings for a complete understanding of the product offerings, inclusions and exclusions.

Advantages Of TATA AIG Travel Insurance

When you’re travelling abroad, we’ll help you take care of the cost of treatment for COVID-19 if you test positive in the middle of your trip & re quires hospitalization

Affordable International Policies

Our travel insurance policies will not cost you too much. You can enjoy care-free travel for as little as INR 40.82 per day when you’re travelling internationally.

Affordable Domestic Policies

Explore the many beauties scattered across India and get travel insurance cover for just INR 26 per day!

Instant Policy Purchase

You can buy a TATA AIG travel insurance policy online with just a few easy clicks. We don’t need extensive paperwork on a health check-up!

Hassle-Free Claim Procedure

We actually mean it when we say we make travel insurance claims simple. Tata AIG understands how much money and time you have already invested in your travel. That is why we have kept all of our procedures extremely easy, fast, and paperless since we believe that everything should be digital. As a result, there is no need for hardcopy evidence. For us, a simple upload on our portal works.

24/7 Customer Assistance

A decent travel insurance coverage is unaffected by time zones. Whatever time it is in your corner of the world, competent support is only a phone call away owing to our in-house claim settlement and customer assistance team. We are ever-ready to assist you every step of the way.

What Our Customers Are Saying

Ease of doing business

Online policy, very fast and immediately policy certificate, great n superb experience

The website is friendly and easy to use.

Seamless experience

The buying of the policy had to wait till we received the Covid-19 Negative from diagnostics though we both have taken first and second Vaccination Doses.

The buying process has been exceedingly convenient.

Hope your claims payment (if at all we need any) is as good and fast as the buying of the policy has been.

I TRUST in TATA AIG and have insured my cars too.

Really smooth...and great clean interface... God forbid we have to use the policy during travel...I hope the support for same is as good or better.

Value for money

User friendly site

Trust in TATA product. Keep the faith in the Indian customer.

Good processing and excellent insurance

I am not sure if there is any other insurance company in india which is providing Covid 19 coverage for travel insurance

Ease of processing very good. Policy document provided all the details given while filling the online application form

Best of the rest

Easy and convenient

Great Buying Experience

its very fast, easy to get. No hassles

The Perfect Travel Insurance Plan

A good and user-friendly travel insurance package will make your vacation a memorable one. It protects you at various stages, with financial coverage being the primary focus. Selecting the finest travel insurance package for your family and yourself should not be rushed. Choose intelligently and save money by not taking the first choice you see for hassle-free and safe travel. A travel insurance policy acts as a cushion to absorb the impact of a misstep, making your vacation more enjoyable and memorable.

This is why TATA AIG offers multiple travel insurance plans. We have specialised travel insurance policies for domestic and international travel. Additionally, we have customised travel insurance policies for senior citizens and students who are heading abroad to expand their horizons. Let’s take a look at what each travel insurance policy offers, so you can find the right one for you. To know what to look for in a Travel Insurance, check our Best Travel Insurance Plan Guide. To Understand the various types of Travel Insurance Plans we offer & to understand how to compare in between them, check our Compare Travel Insurance resource.

International Travel Insurance

Travelling to a foreign country, whether for work or vacation , doesn’t have to be stressful. With our international travel insurance policies, you can rest easy knowing that we’ll help you out should anything go wrong. Right from small inconveniences, such as having your bag arrives late, to serious issues like medical emergencies and evacuation, TATA AIG’s international travel insurance plan will be with you at every step of the journey. We highly recommend this travel insurance policy for everybody headed outside the country. If you’re likely to make multiple trips in a single year, we recommend our multi-trip travel insurance plan.

Domestic Travel Insurance

Just because you aren’t travelling abroad, it doesn’t mean you don’t need travel insurance. This travel insurance plan will help you deal with various situations while you’re travelling across India. Right from reimbursing you for the cost of lost tickets to taking care of you after an accident while you’re out of town, this travel insurance policy is your ideal travel partner! If you travel very often, we recommend that you opt for our multi-trip travel insurance policy. This makes it easier for you to go on quick trips without having to apply for a new travel insurance plan each time.

Student Travel Insurance

We would like to support you as you follow your dreams. This is precisely why we’ve created a specialised student travel insurance policy. If you’re between the ages of 16 and 35 and you’re about to head abroad to further your education, this is the travel insurance plan for you. Apart from the usual travel insurance cover, this policy additionally provides cover for unique situations, such as reimbursing students the tuition fee if they’re unable to complete a semester due to a medical emergency. This travel insurance plan also provides cover for compassionate visits, ensuring you don’t have to be alone if you’re hospitalised!

Senior Citizen Travel Insurance

Why should young people have all the fun? Travel insurance for senior citizens is suitable for people over the age of 70, much like health insurance is adapted to the age factor. The elderly enjoy travelling after retirement, and they frequently travel alone or in pairs. This sort of plan shields them against unforeseen events. Senior citizens over the age of 70 can travel and enjoy the world just as much as their children and grandchildren. Our senior citizen travel insurance policy has been created keeping their needs in mind. This travel insurance plan offers additional cover for medical emergencies, including dental coverage, emergency medical evacuation and the repatriation of remains.

What’s Not Covered By TATA AIG's Travel Insurance Plan?

Even while we would prefer to cover all conceivable risks, many circumstances are simply not practical. We prefer total openness with our consumers. So here is what our travel insurance plans don't cover:

Baggage Exclusions

- Loss of baggage will not be covered in cases where you have shipped the items separately or before your travel date.

- It will also not be covered in cases where your travel insurance policy does not cover the geographic region. For example, under a student travel insurance policy, if the bags are lost in India, it will be not be covered.

- If you do not report that your luggage, documents or personal belongings have been stolen to the relevant authorities, you cannot make a legitimate claim for them against your travel insurance policy.

Journey Exclusions

Under certain circumstances, we will not be able to settle claims against your travel insurance policy. These circumstances include:

- Involvement in illegal activities, including felony, theft, deceit or other malicious acts.

- Participation in adventure sports, like skydiving, scuba diving, or mountain diving will not be covered under our travel insurance plans.

- Undertaking manual labour or work that could potentially harm you or be dangerous for your health.

Medical Exclusions

Your claim request against your travel insurance plan will not be entertained if

- You have travelled against the advice of your doctor

- You suffer from a complication or require assistance due to a pre-existing health condition

- You have injuries that are self-inflicted

- Your claim is for pregnancy or a related issue, including birth control or surgical procedures

- The issue is related to a sexually transmitted disease, mental disorder, and injuries due to the consumption of alcohol or drugs that were not medically prescribed.

Did Not Find What You Were Looking For?

When, where and how to choose travel insurance, purchasing a travel insurance policy requires a lot of thought and consideration. to help you with your decision, here’s a look at some important factors you must consider before choosing a travel insurance policy:, destination.

Your travel insurance policy will depend largely on your destination. For starters, you must decide whether you’re travelling internationally or domestically. Based on this, you can narrow down your options. If you’re travelling internationally, it’s important that you check the travel insurance requirement of various countries. For example, certain countries will not issue you a travel visa unless you can show that you have sufficient cover in your travel insurance policy.

Travel Frequency

The kind of travel insurance policy you buy will depend on how often you intend to travel. If you travel very frequently, a multi-trip travel insurance plan might be ideal for you. These plans allow you to enjoy multiple trips without you having to apply for a new travel insurance policy each time. On the other hand, if you only travel once in a while, then a single trip travel insurance policy might be better for you. You can easily apply for your travel insurance policy online and have it issued without the need for a pre-policy check-up.

Duration Of The Trip

While picking a travel insurance plan, you must keep the length of your trip in mind. It’s a good idea to pick a travel insurance policy of a duration that slightly exceeds your actual trip dates. Ideally, you should be able to find a plan that offers cover for more days without it affecting your premium. This way, if you have to extend your trip for a few days, you don’t risk losing your cover.

People Travelling

If you’re travelling alone, you can purchase a travel insurance policy just for yourself without any worries. If you’re travelling with your family, you should add each member to your insurance policy. Make sure you tell us how many of you are travelling before you purchase the policy and we’ll do the needful. This makes it much easier for you to keep track of everybody’s paperwork.

Claim Limit

This is possibly one of the most important factors that will influence your decision. Every travel insurance policy has a limit as to how much they will pay for various claims . For example, you will receive a specified sum in case your bags are lost or stolen. Even in medical emergencies, you must keep your sum insured amount and claim limit in mind. If you have a low claim limit, it may not be enough to take care of all kinds of medical emergencies while you’re travelling. Depending on where you’re going and how long you’re travelling for, you should pick a suitable sum insured for your travel insurance policy. A higher sum insured will lead to a higher premium, but it will come in handy if you require to file a claim while you’re travelling.

How To Buy Travel Insurance Online?

Purchasing a travel insurance policy requires a lot of thought and consideration. To help you with your decision, here’s a look at some important factors you must consider before choosing a travel insurance policy: To understand the factors that effect your travel insurance premium, check our Travel Insurance Premium Calculator

If you like, you can read about our various plans and take a look at what each offers. Or, you can decide to purchase travel insurance right away.

If you’re heading to multiple cities or countries, don’t worry. We offer plans for that as well. Type in all the countries or cities you’re visiting and how long you’ll be travelling for. We’ll use this information to curate the best travel insurance policy options for you.

If you’re travelling alone, you just need to enter your date of birth. If you’re travelling with family members, you can add them to the same travel insurance policy. You have the option to add your spouse, children and parents to the policy as well. Let us know who you’re travelling with and their dates of birth as well.

Depending on your needs, we’ll curate three plans for you. If you aren’t sure how the plans differ, you can use our ‘Compare’ option to see what kind of additional benefits or different sums insured each travel insurance plan offers. If you’re concerned about the cost, you can also view our premium break-up, so you know exactly what you’re paying for. After comparing the plans, you can pick the one that best fits your needs.

The last thing you need to do is provide us with a few more details and pay the premium amount. The minute you do this, we’ll issue your travel insurance policy and send a copy to your email inbox!

How Can I Make A Travel Insurance Claim?

For Policies that Cover Only India Travel Give us a call on +1 800 11 99 66 from BSNL/MTNL Landline Call these local helpline numbers in your respective cities from any other line: Mumbai - 66939500 Pune – 66014156 Delhi – 66603500 Bangalore – 66272829 Chennai – 66841050 Hyderabad – 66629882 Ahmedabad – 66610201 If you are a senior citizen, give us a call on + 1 800 22 99 66 Or, send an email to [email protected]

Domestic Claim

International claim (non america travel).

For Non - Americas Policies:

- Call: +91 – 022 68227600 (Call back facility available)

- Email: [email protected]

- E-claims: https://eclaimsuat.europassistance.in/nearestLocations4

International Claim (America Travel)

For Americas Policies Number

- Call: +1-833-440-1575 (Toll free within US and Canada)

- Email: [email protected]

Related Articles

Why Senior Citizen Travel Insurance is a Must?

Long-distance travel plans for senior citizens can result in critical issues that are hard to handle. There are several risks related to senior travelers, especially when they travel overseas.

A List of Documents Required for an Indian Passport

A Passport is an Official Document issued by the Government, that provides the holder the verification of identity, ability to travel to and from foreign countries & allows the holder to avail of consular services while overseas.

A Detailed Guide To Schengen Visa And How To Apply For It

The Schengen Area is a region comprising 26 countries in the European continent that subscribe to a common visa policy across their borders. This article will navigate you through the process of obtaining a Schengen Visa

Frequently Asked Questions

Policy related, service related, why do i need travel insurance, what is the best travel insurance policy, does the tata aig travel insurance policy some with a free-look period, do i get a grace period for my travel insurance policy, can i buy travel insurance after leaving the country, will pre-existing diseases be covered under my travel insurance policy, will i be refunded if i cancel my travel insurance coverage, how does a travel insurance policy work, can an individual purchase international travel insurance after they have booked their trip, how do i check the status of my travel insurance policy, what happens if my claim is rejected, how do i make a claim against my travel insurance, how would my policy assist me if i misplace my passport, how is a policyholder covered if they have an accident and incur injuries or loss, what documents are needed when filing a travel insurance claim, understanding travel insurance terminology.

- Accident Any unplanned mishap that happens due to no fault of the insured or others. It could lead to injury or a fatality.

- Act of Terrorism Any act of violence from an individual attempting to gain control of or overthrow a government that leads to major damage or loss of life.

- Common Carrier Any commercial individual or organisation that deals in the movement of people and goods from one place to another, such as a commercial airline.

- Condition Precedent A condition upon which the insurance provider agrees to provide cover.

- Congenital Anomaly Any condition that is present in the insured individual since birth and is considered to be abnormal in structure, form or position.

- Deductible A deductible is a small amount that the insured individual is required to pay every time they file a claim against their international student travel insurance policy.

- Disease/Illness Any pathological condition that impairs your body’s normal physiological functions. For cover, the disease or illness should show first signs or symptoms while the policy is in effect and should require medical treatment.

- Educational Institution A school, vocational institute, college, polytechnic, university or institute of higher learning that has the license to provide educational services by trained or qualified teachers and where the inured individual is a full-time student.

- Equipment Failure A sudden or unforeseen breakdown of the common carrier’s equipment, which results in a delay or interruption of the insured’s scheduled trip.

- Free Look Period A period of 15 days, from the day the insured receives the policy documents for a student travel insurance policy. During this time, the insured can look over the documents and choose to cancel the policy without incurring substantial cancellation charges.

- Grace Period A specific period of time, immediately following the premium due date, during which the insured can still pay the premium and continue to enjoy continuity benefits of getting cover.

- Hospitalisation Any instance in which the insured individual has to be admitted into a hospital for a minimum of 24 hours to receive treatment.

- Immediate Family Member An immediate family member refers to the insured’s legal spouse, siblings, siblings-in-law, legal children, parents, parents-in-law, legal guardian, and step-parents who reside in India.

- Inclement Weather Severe weather conditions, such as storms, that delay the scheduled arrivals or departures of common carriers.

- Inpatient/Inpatient Care Any treatment for which an individual needs to stay in a hospital for over 24 hours for a covered event.

- Insured Journey This refers to any trip that the insured individual takes within the policy term. It commences once the individual boards the aircraft for an onward journey and expires on their [arrival](https://www.tataaig.com/travel-insurance/visa-on-arrival-for-indians) back to their city or town of residence or when the policy is set to expire – whichever is earlier.

- Insured Period(s) This refers to the period of time, starting with the effective date and ending with the end date declared in the policy documents, during which the insured individual can get cover for their travel.

- Insured Person The individual, who is a permanent resident of India, and has purchased a travel insurance policy from us.

- Land/Sea Arrangements All pre-paid travel arrangements made for a scheduled trip or cruise for which insurance has been purchased and is arranged by a tour operator, travel agent, cruise line or other organisation.

- Medical Advise A consultation or advice received from a medical practitioner, including the issue of any prescriptions.

- Medical Expenses Expenses that the insured individual has incurred due to an illness or required medical treatment on the advice of a qualified medical practitioner.

- Medically Necessary Any treatments, tests or hospital stays that are required for the medical management of an illness on the advice of a qualified medical practitioner.

- Nervous Disorder A central nervous system disorder that requires the insured person to incur certain covered medical expenses.

- Notification of Claim The process by which the insured individual informs the insurance provider or their TPA that they require to make a claim against the policy.

- Pre-Existing Condition Any ailment, injury or related condition for which you have been diagnosed or had symptoms of or received treatment for in the 48 months prior to the date when the trip is scheduled to start.

- Professional Sports Any sport that the insured plays for which they receive remuneration that makes up 50% or more of their livelihood.

- Reasonable Additional Expense Expenses for services or supplies that are absolutely necessary due to an illness or injury.

- Reasonable and Customary Charges Standard charges for services or supplies that the insured is required to pay to get the required help or treatment.

- Room Rent The amount that a hospital or medical facility charges per day for an individual to occupy a bed.

- Single Trip Insurance A single given trip that is specified on the policy schedule with a beginning date and an expiration date.

- Scheduled Airline Any civilian aircraft that is operated by a civilian air carrier that holds a valid certificate, license or similar authorisation from the country’s aircraft registry. The airline must carry out all operations in accordance with the country’s rules and regulations.

- Serious Injury or Sickness Any injury that a qualified physician declares to be dangerous to the insured’s life.

- Sickness Any illness that first showed symptoms or was contracted after the policy has come into effect.

- Sound Natural Teeth Natural teeth that have not been altered in any way or simply restored to their normal function. The restored teeth should be disease- and decay-free and should not be more susceptible to injury or damage than unaltered natural teeth.

- Sponsor The individual responsible for paying the tuition fee for the insured individual while they are studying at an educational institution outside their home country.

- Strike Labour disagreements that end up interfering with the normal arrivals and departures of common carriers as per the definitions offered by the authorities of each respective country.

- Subrogation Any situation in which the insurance provider, on behalf of the insured individual, takes legal action against a third party that caused injury or loss to the insured.

- Sub-limits Sub-limit refers to the maximum amount that the insured individual will receive for any particular claim as per the amounts provided in the policy schedule. For certain claims, there is no sub-limit and the maximum sum insured can be paid.

- Sum Insured The maximum amount of coverage your international student travel insurance provider will have to pay in case of various injuries or loss.

- Travelling Companion Refers to two named individuals who are booked to travel along with the insured on the trip.

- Trip Any insured journey that the insured individual takes during the course of the policy term. The journey must start and end in India and should be to a destination outside of India.

- Tuition All legally required registration fees charged by an accredited educational institution for the required courses and any laboratory or extra-curricular course fee as well. This does not include the costs associated with purchasing text books, learning materials or boarding and lodging.

- Unproven/Experimental Treatment that does not have an established medical practice, including drug experimental therapy.

- Accidental Death and Dismemberment Any accident that causes the loss of life, sight, or limbs while travelling.

- Accommodation It refers to any establishment that charges a fee for temporary overnight housing and requires bookings.

- Pandemic An outbreak of an infectious disease or illness that spreads swiftly and extensively and is classified by the CDC (Centers for Disease Control and Prevention).

- Coverage Period The total length of time that a travel policy will cover you during a trip

- Premium It is the sum of money that an insured individual must pay to the insurance company in exchange for the insurance policy. The premium cost varies based on the insurance coverage you select. It is worth noting that choosing a greater deductible may decrease your monthly payments, but the quality of protection will be lesser, and you may be exposed to higher charges in the event of an accident.

- Reimbursement The amount of money that an insurance company will pay you for medical treatment or hospital fees that you have previously spent is referred to as reimbursement or compensation.

- Policyholder The policyholder, often known as the policy owner, is the individual who purchases the insurance policy and pays the premiums. The insured may or may not be the policy owner. For example, Kritika is free to purchase an insurance policy for her husband Swapnil; in such an instance, Kritika is the policyholder and her husband is the insured party, meaning he's the only one who would get benefits under the terms of the policy.

- Foreseeable Event It is one that was reasonably anticipated prior to the purchase of the plan. When it is feasible for persons heading to a region to be aware of an occurrence, it becomes predictable. For example, if the airline you're travelling with declares a strike, the event becomes predictable after they make the announcement.

- Physician It is defined as a person who is licenced as a medical doctor by the jurisdiction in which he or she resides and who practises the healing arts. They must be practising within the extent of their licensure for the service or treatment provided and cannot be you, a travelling companion, or a family member.

- Trip Cost It refers to the costs of your travel arrangements that you paid before leaving on your trip and would be lost if your trip was cancelled. This covers flights, cruises, lodgings, excursions, entertainment, and other fees that you may incur if you are unable to travel.

- Maximum Policy Coverage The maximum amount of compensation that will be paid for expenditures covered by a policy.

- Insured Journey This refers to any trip that the insured individual takes within the policy term. It commences once the individual boards the aircraft for an onward journey and expires on their arrival back to their city or town of residence or when the policy is set to expire – whichever is earlier.

- Single Trip Insurance These plans have a one-time premium charge and are only good for one trip. This is best suited for infrequent travellers and often provides no more than 6 months of coverage.

- Multi-Trip Travel Insurance For frequent flyers, multi-trip travel insurance policies are the best options. These plans have a yearly validity period and need a premium payment each year. Travellers are protected for any number of trips they take during this time period.

- Subrogation It occurs when an insurance company reimburses its insured for injuries or losses caused by a third party. If a third party caused harm, the insurer can still sue the third party to collect the lost money.

Top Travel Destinations

Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to TATA Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. 2008, TATA AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CIN: U85110MH2000PLC128425. IRDA of India Regn. No. 108. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] . Category of Certificate of Registration: General Insurance.

2008, Tata AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CINNumber : U85110MH2000PLC128425. Registered with IRDA of India Regn. No. 108. Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] .

404 Not found

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of April 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:52 a.m. UTC April 11, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?