- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Trawick International Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Trawick International?

Trawick international’s travel insurance plan options, which trawick international travel insurance plan is best for me, can you buy trawick international travel insurance online, what isn't covered by trawick international travel insurance, is trawick international legit is it any good, is trawick international travel insurance worth it.

- Many different plan options.

- CFAR available as an add on.

- Specialty coverage for adventure sports (SafeTreker Basic).

- Reports of long resolution processes.

- Low customer service rating on SquareMouth.

When planning a trip, we often anticipate the excitement of seeing a new city, the taste of local gastronomy and the overall sense of adventure. Rarely do we imagine arriving at a destination without luggage, breaking a wrist from a fall down the stairs, or getting into a car accident on the road. But sometimes these things happen, and you want to be prepared for when they do.

Still, you probably don’t want half of your vacation budget to go toward travel insurance. Queue Trawick International with its comprehensive coverage and competitive rates. Let’s take a look at the plans offered and more in this Trawick International insurance review deep-dive.

Trawick International is a comprehensive travel insurance provider that offers trip delay and cancellation insurance, baggage delay coverage, medical coverage and medical evacuation, rental car damage protection , and even COVID-19 coverage among its various policies.

Trawick covers trips for worldwide destinations, including for foreign nationals coming to the U.S.

» Learn more: What to know before buying travel insurance

You can choose from several Trawick travel insurance plans.

Safe Travels First Class: This plan covers trip cancellation , interruption and delay, as well as fees associated with reinstating frequent traveler points. It includes up to $150,000 in emergency medical coverage and up to $1,000,000 for emergency medical evacuation. This plan also has the option to add " Cancel for Any Reason " protection (within 14 days of the initial trip deposit date), though it’s not available in New York or Washington state.

Safe Travels Single Trip: One of the more budget-friendly plans on the roster, Safe Travels Single Trip covers up to $75,000 in emergency medical costs and $350,000 in medical evacuation expenses .

Safe Travels Explorer: Another budget-friendly plan, Safe Travels Explorer gets you $50,000 toward emergency medical costs and $200,000 toward medical evacuation costs.

Safe Travels Explorer Plus: The medical coverage limits on the Safe Travels Explorer Plus plan are the same as on the Safe Travels Explorer plan, with the addition of a pre-existing condition waiver , as long as you purchase coverage within seven days of the initial trip deposit date.

Safe Travels Journey: With the Safe Travels Journey plan, you’re covered for up to $150,000 in emergency medical coverage and up to $500,000 in emergency medical evacuation. You also have frequent travels rewards protection (up to $250 for reinstating points if you cancel award travel) and a pre-existing conditions waiver, if you purchase a policy within 14 days of the initial trip deposit date.

Safe Travels Voyager: The Safe Travels Voyager plan is the only one that covers quarantine accommodation expenses as part of travel delay coverage in case you test positive for a covered illness and can’t fly home. It’s also the only plan that lets you increase trip delay coverage limits. You can add Cancel for Any Reason protection to this policy.

SafeTreker Basic . This plan is similar to other Trawick International options except for one major difference: It includes coverage for 450+ sports and activities for travelers up to age 65. High-altitude climbing requires additional vetting. If you're planning a particularly adventurous trip, consider this option.

Let’s compare the Trawick International plans and costs for a 10-day trip to France for a 35-year-old traveler from California with a prepaid, nonrefundable deposit of $1,000.

Once you pull up the details for each policy, take a close look at what is covered and the corresponding limits. When evaluating costs and coverage, consider what trip protections are important to you and what you can live without.

Also, take a look in your wallet and find out what kind of trip insurance is already offered by one of your credit cards . Most of the details are spelled out in each card’s guide to benefits, so use that knowledge to determine what else needs to be covered for your trip.

If none of your credit cards provide enough trip protections, consider purchasing a policy from Trawick.

» Learn more: The best travel credit cards right now

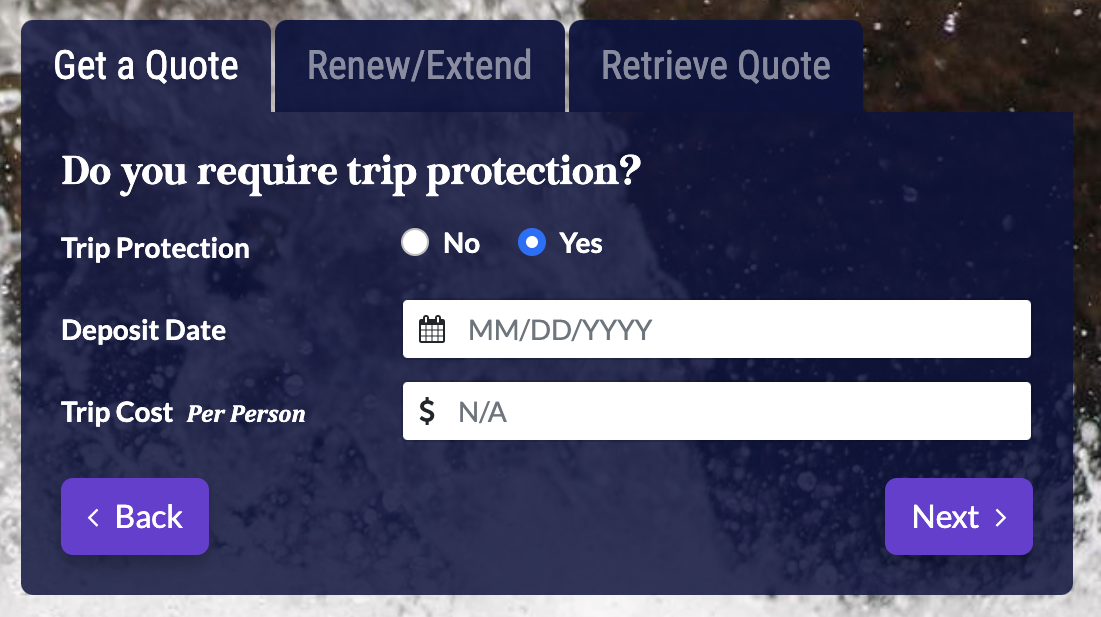

To get a quote, visit the Trawick International website and fill out your travel parameters, including destination, your home country and state, and departure and return dates. If it’s a multi-country trip, you can select “Multiple countries” from the dropdown menu.

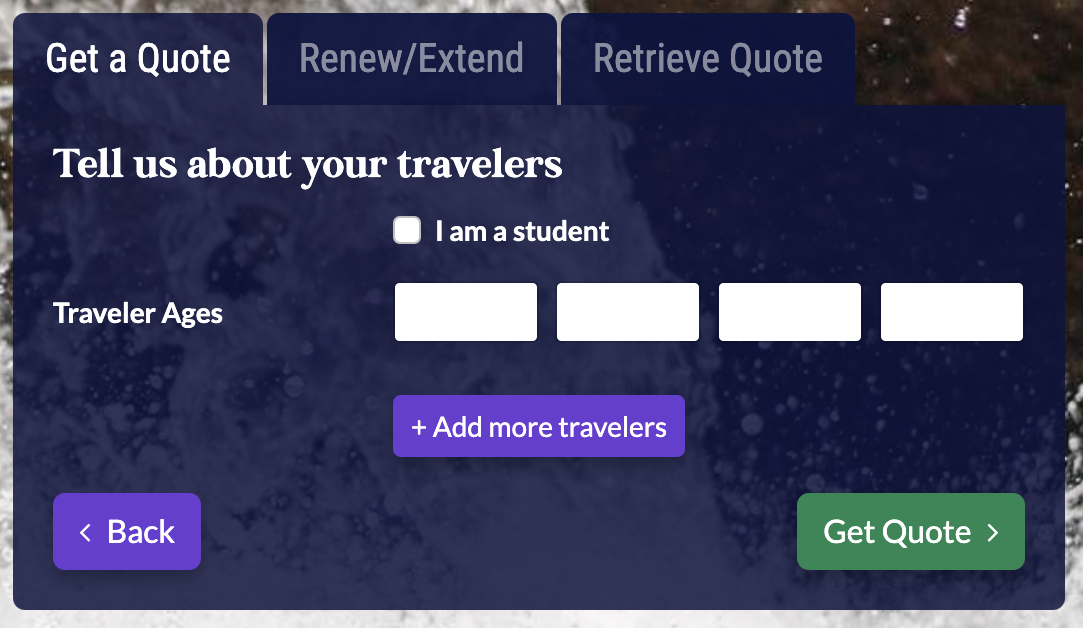

In the next set of fields, enter the traveler’s age, trip cost and the date you made the first deposit (for example, the date you booked flights).

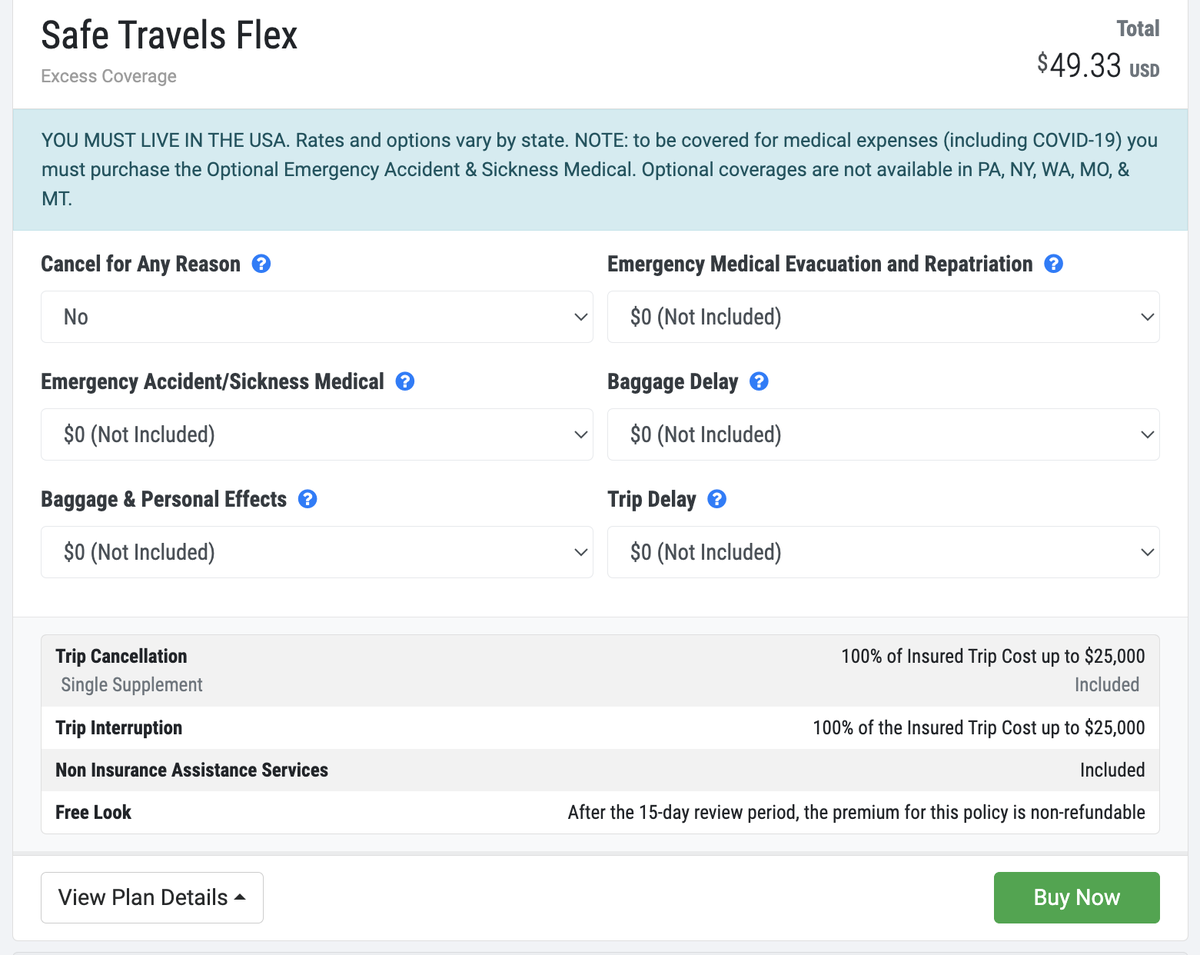

Tap the “Get quotes” button and compare the results. You can edit your quote by adding more travelers or updating the trip length and cost as many times as you want. Once you commit to a policy, select “Buy now” and submit your payment.

» Learn more: The best travel insurance companies

Trawick International has plans for different types of trips. Every plan has different coverage based on the state you reside and the policy you purchase.

Generally, some exclusions include accidental injury or sickness when traveling against the advise of a physician, care or treatment that is payable under any other insurance, and pre-existing conditions.

Trawick International has been in business for about 25 years and is a legitimate travel insurance provider. Trawick International reviews on Trustpilot and Squaremouth are generally good, with scores around 4.5/5 and 4.15/5, respectively.

According to Trawick, more than 650,000 travelers bought its coverage in 2021.

Trawick International covers trip cancellation, interruption and delay, fees associate with reinstating points, baggage delay, medical emergencies, pre-existing condition waiver, Cancel For Any Reason, pet medical costs and more. It also has a plan that can cover adventure activities, including high altitude climbing. Each plan has different benefits with the possibilities of add-ons.

Depending on your state, different Trawick travel insurance plans have the option to add Cancel For Any Reason within 14-21 days of the initial trip deposit date. Some plans include reimbursement for up to 50% of the pre-paid nonrefundable payments while others cover up to 75% of costs.

If you need to file a claim, you'll need to gather the necessary documents and complete the claim form. This can be submitted via email, mail or an online form. Once processed, you'll receive reimbursement via direct deposit or a check.

With unpredictable weather, frequent flight cancellations and or the possibility of an emergency, there’s no time like now to add a protection plan to your upcoming vacation. Travel insurance can save you more than just money — it also can save you time and spare you stress.

Trawick International offers a good balance of cost to coverage and is a legitimate company for your travel insurance needs.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Trawick International travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Kara McGinley

Updated 5:10 p.m. UTC Feb. 23, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Trawick International

Top-scoring plan

Covers covid, medical & evacuation limits per person, what you should know.

Trawick International’s Safe Travels First Class policy offers competitive rates, great “cancel for any reason” coverage upgrades and covers COVID-19 like it would any other illness.

Pros and cons

- Solid baggage loss coverage of $2,000 per person.

- Decent missed connection coverage of $1,000 per person for cruises and tours after a three-hour delay.

- “Cancel for any reason” coverage upgrade of 75% available.

- Employment layoff coverage requires five continuous years of employment.

- Hurricane and weather delay coverage kicks in after 48 hours, not 12 or even 24.

- Emergency medical coverage is secondary, not primary.

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Trawick travel insurance overview

Trawick International offers comprehensive travel insurance to protect you financially against severe weather, unexpected delays, medical emergencies and other unforeseen problems that may arise before or during your trip. Trawick has several plans so you can pick one that is right for you and your budget. In this Trawick International review, we take a deeper look into the plans offered, available optional add-on coverage and common exclusions.

Trawick compared to other travel insurance companies

Here’s how the best travel insurance companies compare to Trawick International.

Trawick travel insurance plans

Trawick offers several comprehensive travel insurance plans that include trip cancellation coverage , trip delay and interruption coverage, travel medical insurance , emergency evacuation coverage and lost baggage coverage. COVID-19 medical expenses are covered and treated the same as any other sickness.

Safe Travels Explorer

The Safe Travels Explorer plan is Trawick’s budget-friendly option. The plan includes all the basics of a comprehensive travel insurance plan including:

- Emergency medical: $50,000.

- Emergency medical evacuation: $200,000.

- Trip cancellation and trip interruption: 100% reimbursement of trips that cost $30,000 or less.

- Trip delay: $1,000 to cover things like lodging if you need to stay overnight due to a canceled flight.

- Optional rental car damage: $25,000 (not available in NY or TX).

This plan also includes lost and delayed baggage coverage and missed connections coverage.

Safe Travels Explorer Plus

The Safe Travels Explorer Plus plan includes the same coverages as the Safe Travel Explorer plan but automatically includes the rental car damage coverage. It also includes pre-existing medical condition coverage, as long as you buy the travel insurance within seven days of your initial trip deposit.

Safe Travels Journey

The Safe Travels Journey plan includes the below coverages:

- Emergency medical: $150,000.

- Emergency medical evacuation: $500,000.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $50,000.

- Trip delay : $2,000 ($200 per day after a six-hour delay).

- Trip interruption: 125% reimbursement of eligible trip costs up to $62,500.

- Optional “cancel for any reason” (CFAR) coverage: 50% of trip costs (only available within 14 days of first deposit).

- Optional accidental death and dismemberment (24-hour): $25,000.

- Optional rental car damage: $35,000 (not available in NY or TX).

Safe Travels Journey plans also includes coverage for missed connections, airline cancellation fees, lost and delayed baggage, and pre-existing medical coverage if purchased within 14 days of your trip deposit.

Safe Travels Single Trip

Another budget-friendly option is the Safe Travels Single Trip plan. This comprehensive coverage includes:

- Emergency medical: $75,000 (secondary coverage).

- Emergency medical evacuation: $350,000.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $14,000.

- Trip delay: $600 maximum ($200 per day after a 12-hour delay).

- Trip interruption: 150% reimbursement of eligible trip costs up to $21,000.

- Accidental death and dismemberment (24-hour): $10,000.

- Optional rental car damage: $35,000 (not available in NY or TX).

It also includes a pre-existing medical condition exclusion waiver if purchased within 10 days of the initial trip deposit date. This plan includes missed connections coverage, trip delay coverage and lost or delayed baggage coverage.

Safe Travels First Class

Safe Travels First Class offers excellent emergency medical evacuation coverage, as well as optional “cancel for any reason” (CFAR) coverage. The Safe Travels First Class plan scores 3 out of 5 stars in our analysis of the best travel insurance companies . Here’s a quick breakdown of the coverages in this plan:

- Emergency medical evacuation: $1 million.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $15,000.

- Trip delay: $1,000 (after a 12-hour delay).

- Trip interruption: 150% reimbursement of eligible trip costs up to $22,500.

- Optional “cancel for any reason” coverage: 75% reimbursement of eligible non-refundable trip costs (this upgrade is available if you buy it within 14 days of your initial trip deposit date; not available in NY or WA).

- Optional rental car damage: $50,000 (not available in NY or TX).

This plan also includes coverage for missed connections, delayed or lost baggage and property damage.

Tip: Safe Travels First Class plans include a pre-existing medical condition exclusion waiver if you purchase coverage within 14 days of your first trip deposit and insure the full value of your non-refundable trip expenses.

Safe Travels Voyager

This Trawick travel insurance plan has the highest available benefit limits to protect your trip:

- Emergency medical: $250,000.

- Emergency medical evacuation: $1 million.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $100,000.

- Trip delay: $3,000 ($250 per day after a six-hour delay).

- Trip interruption: 150% reimbursement of eligible trip costs up to $150,000.

- Accidental death and dismemberment (24-hour): $25,000.

- Rental car damage: $35,000 (not available in NY or TX).

- Optional “cancel for any reason” coverage: 75% reimbursement of eligible trip costs available within 21 days of your trip deposit.

- Optional trip “interruption for any reason” coverage: 50% reimbursement of eligible trip costs available within 21 days of your trip deposit.

This plan also includes coverage for missed connections, additional medical expenses and trip delay coverage, lost and delayed baggage, airline cancellation fees and fees to reinstate frequent traveler awards. And you can get coverage for pre-existing medical conditions if you buy this plan within 21 days of your first trip deposit and before your final payment.

Additional coverages offered by Trawick travel insurance

“cancel for any reason” (cfar) coverage.

“Cancel for any reason” (CFAR) coverage is available as an optional upgrade with the Trawick Safe Travels First Class and Safe Travels Voyager plans. CFAR coverage reimburses up to 75% of the prepaid, nonrefundable trip costs when you cancel your trip for any reason — not just those listed in the policy — as long as you do so at least two days before your scheduled departure date.

This optional upgrade must be purchased within 14 days (First Class) or 21 days (Voyager) of making your first trip deposit. CFAR is not available for New York or Washington state residents.

Rental car damage

Rental car damage coverage is included or offered as an add-on with most Trawick travel insurance plans. It provides reimbursement for the cost of repairs, rental charges or the actual cash value of the car if the car is damaged because of covered reasons. This coverage is not available for New York or Texas residents.

What Trawick travel insurance doesn't cover

Like all travel insurance companies, Trawick travel insurance doesn’t cover every incident that may arise during your travels. It is always a good idea to read the fine print before purchasing your policy. For Trawick travel insurance plans, examples of exclusions include:

- Any trip taken against the advice of a physician.

- Immunizations, routine physicals or cosmetic surgery.

- Illegal activities.

- Injuries due to participation in adventure or extreme activities such as bungee jumping, caving, mountain climbing, paragliding, rappelling and scuba diving.

- Injuries due to intoxication or drug use.

- Medical tourism.

- Mental, nervous or psychological disorder.

- Natural disasters that begin before you buy the policy.

- Normal pregnancy or childbirth.

Trawick’s “free-look” period gives you a specific length of time to review your policy and cancel for a full refund if it doesn’t suit your needs. Most states have a 10-day free look period beginning the date the policy was purchased (not available in NY or WA).

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024 . We shared information about the highest-scoring plan for companies with more than one travel insurance plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%. Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of six hours or less. Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Trawick International travel insurance FAQs

Nationwide Mutual Insurance Company underwrites Trawick’s travel insurance plans.

To file an insurance claim with Trawick, first you need to locate the name of your plan which can be found on your confirmation of coverage. Next, gather all the documentation needed to complete the claim. After that, complete the claim form on Trawick’s website, answer any pending questions and submit the claim online. Visit Trawick’s website for more information or to access Trawick’s various claim forms.

Yes, Trawick is a reliable travel insurance company. The company was founded in 1998. Trawick International’s Safe Travels First Class plan gets 3 stars in our rating of the best travel insurance .

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Kara McGinley is deputy editor of insurance at USA TODAY Blueprint and a licensed home insurance expert. Previously, she was a senior editor at Policygenius, where she specialized in homeowners and renters insurance. Her work and insights have been featured in MSN, Lifehacker, Kiplinger, PropertyCasualty360 and more.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of May 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of May 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Trawick International Travel Insurance Review — Is It Worth It?

Content Contributor

66 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Editor & Content Contributor

151 Published Articles 750 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Stella Shon

News Managing Editor

89 Published Articles 639 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Why Purchase Travel Insurance

Travel insurance and covid-19, why purchase travel insurance from trawick international, types of policies offered by trawick international, trawick international — reviews of plans and prices, how to get a quote, to credit card travel insurance, to other travel insurance companies, how to file a trawick international travel insurance claim, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

There are many travel insurance companies you could consider before your next vacation.

One such company is Trawick International , which got its start in 1998 by providing insurance for students at universities and study-abroad participants.

Now, 25 years later, the company sells a variety of travel insurance plans, including those for domestic and international travel and even covering volunteer workers. Its most popular plans for U.S.-based travelers are underwritten by Nationwide, a household name in insurance.

Let’s look at everything you need to know about Trawick International insurance , review some of its plan types and costs, and then compare it to your other options for travel insurance.

While it’s not fun to think about, travel insurance can protect your health and your bank account when something goes wrong during your trip. This can include relocation when medical help isn’t nearby and reimbursement for extra expenses when your suitcase is lost or stolen.

Travel insurance covers the parts of your trip that don’t go according to plan. This includes cancellations and interruptions due to unexpected events like severe weather, illness, medical emergencies, theft, and more .

Each time you travel, you’ll decide whether to purchase travel insurance. You can purchase from travel companies while buying flights or cruises as well as purchasing from specialized travel insurance companies and customizing your policy to suit your needs. This also allows you to shop around for the best price . Additionally, you should consider whether it makes sense to purchase insurance coverage for each trip or an annual policy.

When does it make sense to purchase travel insurance? Consider the following:

- Your trip includes non-refundable upfront expenses and losing these (if your trip is canceled at the last minute) would be costly.

- You have multiple travel providers (ex: airlines, hotels, cruises, a tour guide, etc.), creating additional opportunities for pain points .

While travel insurance is meant to cover unforeseen events, buying Cancel for Any Reason coverage also might allow you to cancel your trip for any reason.

The outbreak of the COVID-19 pandemic presented several new and unique problems for travelers. First, the medical concerns — should you contract COVID-19 while away from home, you may need to see a doctor or spend time in a hospital.

There are financial concerns, as well. The cost of tests, hospital visits, and seeing a doctor in a foreign country can add up quickly — as can the costs of quarantines or additional hotel nights. Moreover, some countries still require travelers to present proof of travel insurance that can cover these costs should they get sick or test positive for COVID-19 while in their destination country.

Trawick International has been providing travel insurance for 25 years and has an average of 4.4 stars across customer reviews on Trustpilot and 4.13 on Squaremouth . It also provides immediate plan documents and plan ID cards after purchasing a policy, helping you get proof of coverage immediately.

On top of positive customer reviews and the fact that it’s an established company with a worldwide footprint, Trawick International tends to provide higher maximum coverage amounts than competitors when comparing similar plan types. Moreover, COVID-19 coverage is included across plans , and coverage for pre-existing conditions can be added to most plans. This is good news for those needing this protection.

The variety of plan types is another bonus. While it may feel overwhelming to see so many options, this also indicates that plans are tailored to your specific needs, rather than a “one-size-fits-all” approach.

The biggest positive, however, may be Trawick’s partnership with Nationwide , which underwrites most of its trip cancellation-related policies for U.S.-based travelers. As a household name in insurance, this provides a sense of reliability.

Trawick International offers several types of insurance , depending on your home country, destination , and whether you’re looking for robust coverage or coverage that’s focused on medical costs .

For example, U.S. residents traveling internationally can buy a Safe Travels Outbound policy that’s focused on medical expenses but also includes coverage for delays, interruptions, or baggage problems. Policies start at $20 but have a 5-day minimum .

The most popular plan is the Safe Travels Voyager plan . It includes $1,000,000 of medical evacuation coverage, trip delay coverage, baggage delay benefits, rental car protections, and the ability to add “Cancel for Any Reason” (CFAR) coverage for an extra cost . However, there’s no option to add coverage for pre-existing medical conditions . The CFAR coverage can reimburse up to 75% of your non-refundable costs if you cancel at least 2 days before departure.

A Safe Travels First Class policy provides $1,000,000 in medical evacuation coverage, $150,000 in coverage for medical expenses, and missed connection coverage (for cruises and tours), but it requires a 12-hour delay before your baggage benefits kick in. You can add CFAR coverage to this policy also.

The Safe Travels Single Trip plan covers up to $75,000 of medical expenses and $350,000 for emergency medical evacuation (including COVID-19). Unfortunately, you can’t add CFAR to these policies.

With a Safe Travels Explorer plan, you get trip cancellation and trip interruption coverage at a low cost . You can add coverage for pre-existing conditions if you buy your plan within 7 days of your first deposit toward the trip.

If you’re concerned about coverage for pre-existing medical conditions, understanding the timeline for when you need to purchase your policy is critical. It’s typically based on the time from your first payment toward your trip.

A Safe Travels Rental Plus plan covers your non-refundable trip expenses if bad weather cancels or interrupts your trip. This policy applies to costs for tickets, hotels, vacation rentals, and more.

Students studying outside their home countries can buy a Collegiate Care Essential policy. It covers up to $150,000 of expenses per injury or illness with a maximum of $300,000 per policy. It covers COVID-19 expenses as well as injuries from some sports.

To compare prices, we got quotes for a 1-week trip to England for a family of 4 (ages 35, 34, 5, and 3). The travel dates were October 5-11, 2023, and the first trip deposit was made within 24 hours. We estimated the trip cost as $1,000 per person.

Plans don’t provide coverage in Belarus, Russia, or Ukraine . Additionally, the optional add-ons you see will vary based on your home state of residence .

If you’re looking for annual travel insurance, Trawick International has it. Here’s how the 3 options compare:

Note that for the above plans, coverage starts the day after purchase and is only available for U.S. citizens and residents.

If you’re looking for a plan that covers adventure sports, you can read about inclusions and exclusions with the SafeTreker plan .

Trawick also offers plans for non-U.S. residents traveling to countries outside the U.S., plans for those who need insurance that meets Schengen visa requirements, and more. We’ve focused on plans available to U.S. residents here, but there are additional options.

You can obtain a quote online easily by heading to Trawick International’s website . Interestingly, you can choose “multiple countries” as your destination .

After choosing your home and destination country (ies), provide your travel dates . Then, you’ll provide your deposit date and trip cost . You also have the option of choosing whether you want trip protection (for cancellations).

Policies will be cheaper if you choose “no” to trip protection, resulting in a policy that’s mostly focused on medical coverage. On the next page, you’ll provide the ages of anyone traveling on this policy and indicate whether or not you’re a student .

After this, you’ll receive a list of quotes showing prices and payout maximums in the various categories. You’ll also see options for add-ons and upgrades .

How Trawick International Compares

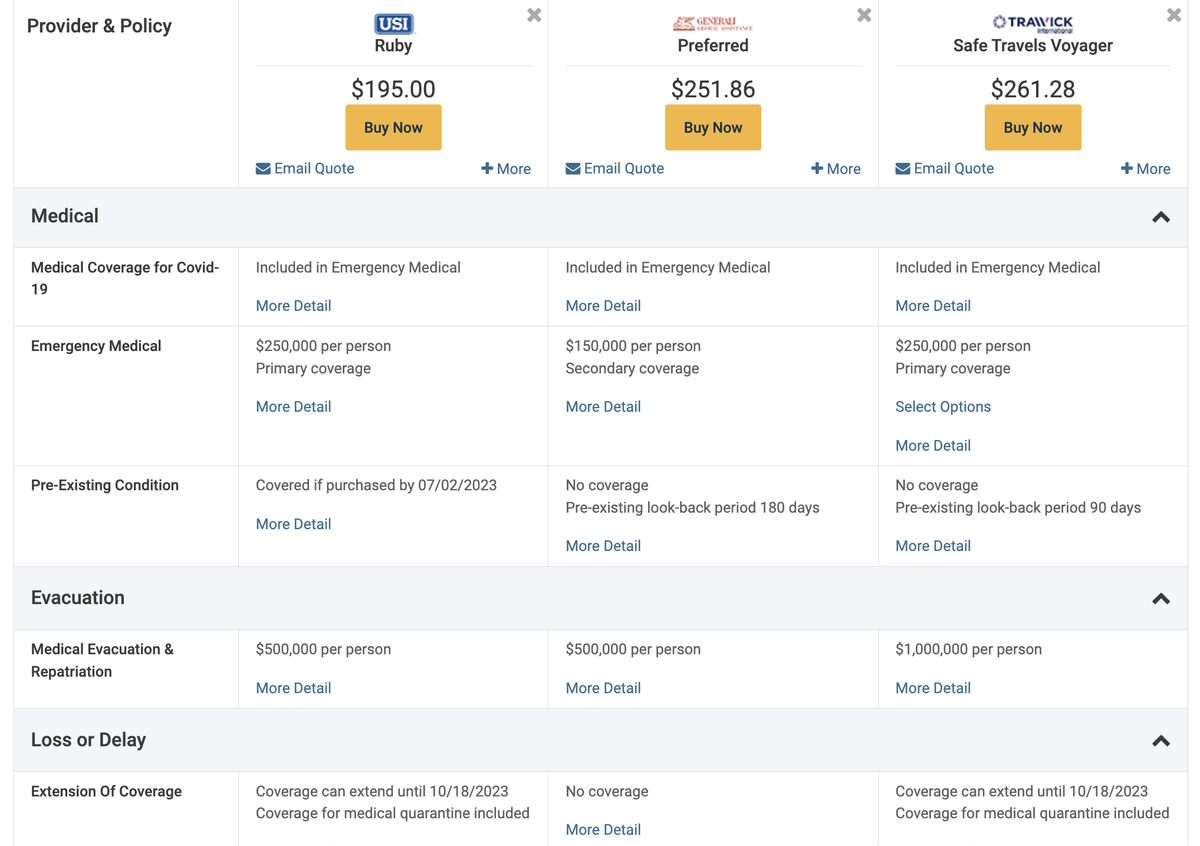

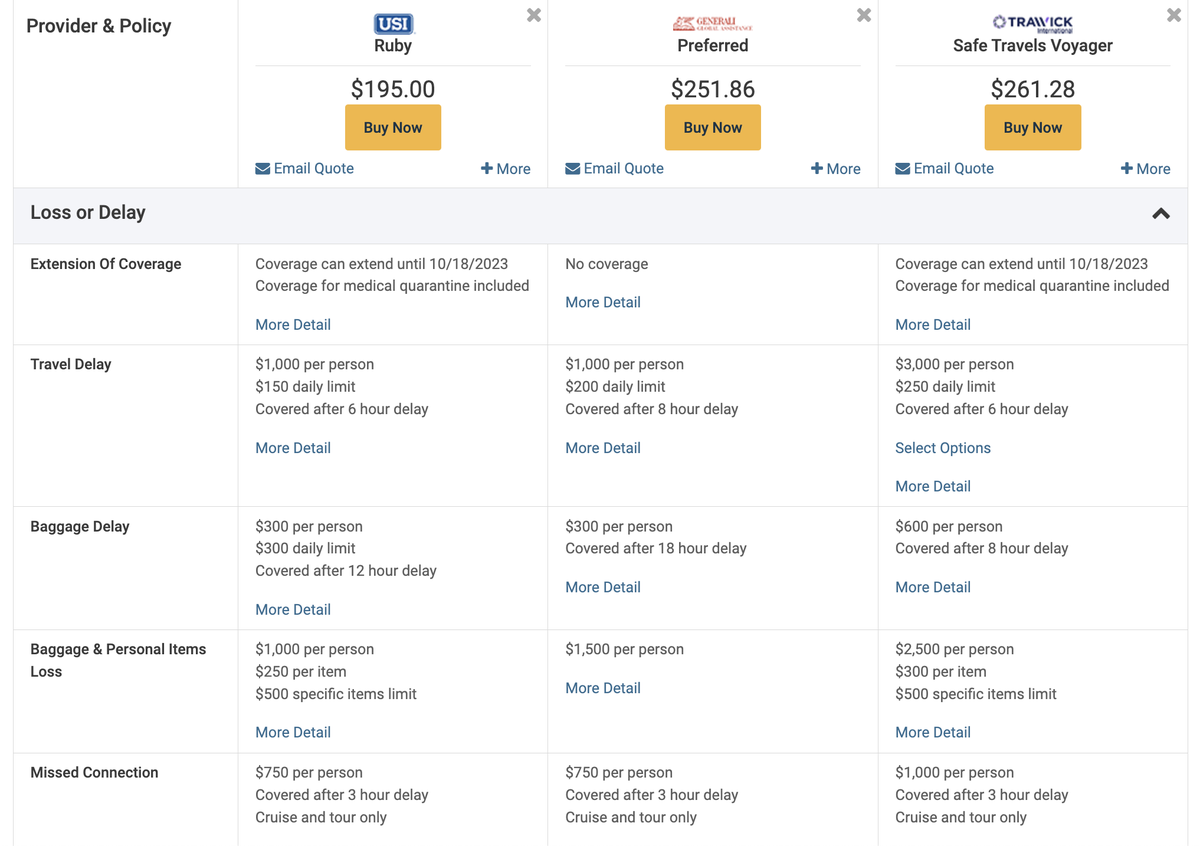

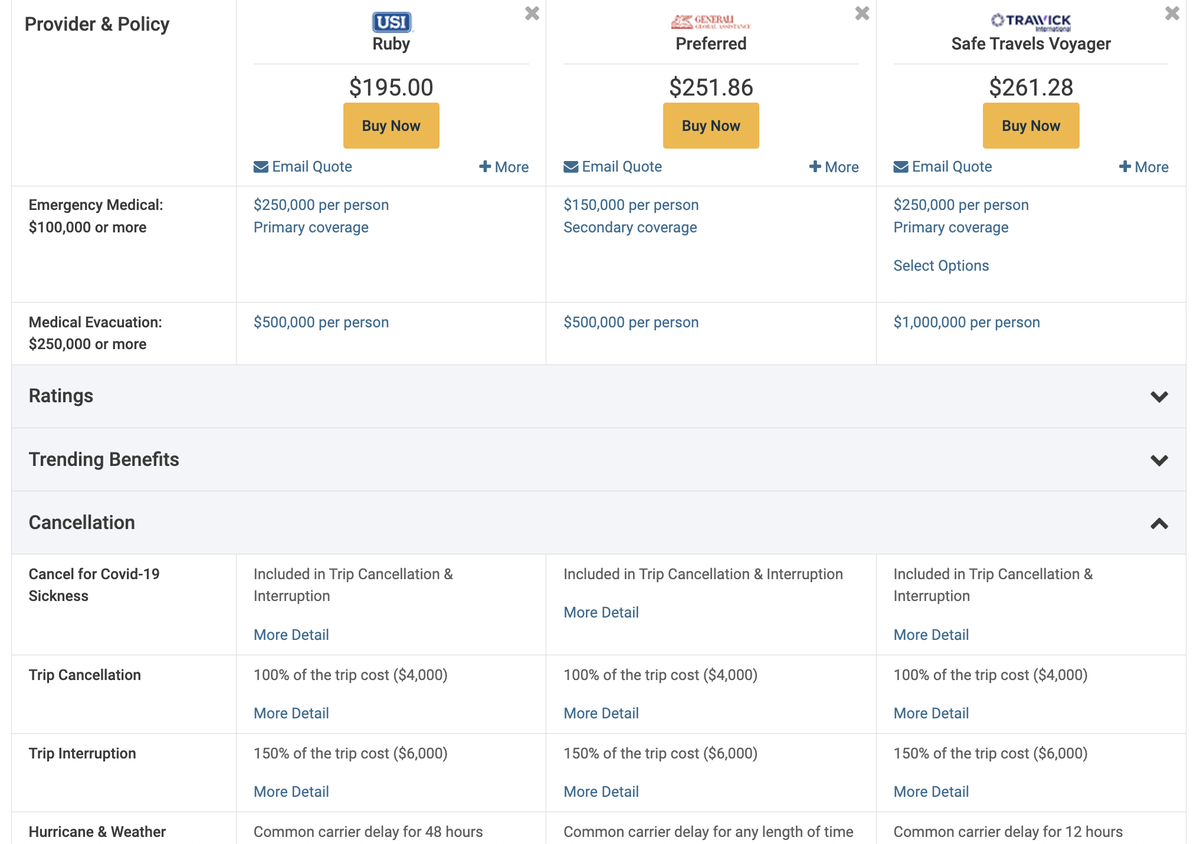

How does Trawick stack up to its competitors? We used Squaremouth to compare prices for that same 1-week family trip to England. Here’s how Trawick International compares to travel insurance plans and costs from USI Ruby and Generali Global Assistance Preferred when looking for similar types of coverage.

Trawick’s plan is the most expensive . All 3 plans cover COVID-19 but only USI and Trawick offer add-ons for pre-existing medical conditions ; Generali doesn’t offer this on the Preferred plan. While Generali only offers $150,000 of secondary emergency medical coverage, USI and Trawick offer $250,000 of primary coverage . Trawick offers $1,000,000 of medical evacuation and repatriation coverage, while the other 2 only offer $500,000.

Trawick has the shortest waiting period for baggage delays and travel delays, as well as the highest maximum payouts in these areas. It also provides the highest maximum coverage for missed connections and baggage loss.

All 3 plans have the same coverage amounts for trip cancellation and trip interruption. Generali’s coverage for hurricanes and weather kicks in immediately , while Trawick requires waiting 12 hours; USI requires 48 hours.

Trawick International charges a higher cost than competitors for plans with the same types of coverage if you compare mid-tier plans. However, its maximum payouts are higher in several categories, plus waiting periods for delay-related coverage are shorter in several aspects.

You can file a claim with Trawick International online, by email, or through the mail . You’ll start by finding the name of your plan (listed in the confirmation coverage, which you received after purchase) and gathering all documents related to your claim . These include receipts, documents related to the claim — such as a doctor’s note or letter from the airline confirming the reason for a delay — and a claim form specific to your plan type .

If you have a Safe Travels plan, you can submit your claim online at CBP Connect , by email to [email protected] , or by mail to this address:

Co-ordinated Benefit Plans, LLC On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies P.O. Box 26222 Tampa, FL 33623

Trawick International offers a wide range of travel insurance plans, has largely positive customer reviews, and its maximum coverage amounts tend to be higher than competitors when looking at similar plans. That said, its costs can be higher than competitors, so evaluate whether you need these extra benefits before paying for them.

All plans should cover COVID-19 and several cover pre-existing medical conditions. However, you need special plans for adventure sports. If you’re going to buy a plan, ensure you know what you need and get the right policy. Having a policy that doesn’t cover your needs is the same as not having a policy at all.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

According to trawick travel insurance, is scuba diving a hazardous sport.

Scuba diving is classified as an “extreme sport” in Trawick’s policies. This means it’s not covered under trip cancellation, trip interruption, emergency accident, accidental death, or other coverage on standard travel insurance plans. You must purchase a SafeTreker plan to cover scuba diving.

Is Trawick part of Nationwide insurance?

Trawick and Nationwide are partners but are not the same company. Nationwide underwrites (provides the backing) for Trawick’s trip cancellation policies, including its popular Safe Travels and SafeTreker insurance plans.

How do I claim Trawick International?

You can file a claim online (for most plans), by mail, or by email.

Is Trawick International legit?

Trawick International has been around for 25 years and has grown significantly in that time. It has high customer ratings on Trustpilot and Squaremouth. In addition, many of its policies are underwritten by Nationwide, which is a major name in insurance.

Does Trawick International cover COVID?

Coverage for COVID-19 is built into all plans and treated like other sicknesses/illnesses. This is good news, as you don’t need a special carve-out for pandemics. Any medical, cancellation, or other parts of your policy will apply if your trip is affected by becoming sick or testing positive.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Trawick International Travel Insurance Review

Trawick international plans.

- Trawick Travel Insurance Cost

Filing a Claim with Trawick Travel Insurance

Compare trawick travel insurance.

- Why You Should Trust Us

Trawick International Travel Insurance FAQs

Trawick travel insurance review 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning a trip, one of the most important things you can do is ensure you're protected if something goes wrong. That's where travel insurance comes in. Trawick International is among the best travel insurance companies with a variety of plans for different types of travelers, so you can find the coverage that's right for you.

Here we'll look at the variety of plans Trawick offers, coverage amounts, costs, and how to file a claim. We'll also compare Trawick's most popular policies and other leading travel insurance providers' coverage.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Useful for adventurous travelers headed to higher-risk destinations

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable plans with varying levels of coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. 10-day free look option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage loss replacement policy

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage kicks in after just six hours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some policies allow a CFAR add-on

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million medical evacuation coverage limit

- con icon Two crossed lines that form an 'X'. Baggage and trip delay coverages don’t kick in until after the 12-hour mark

- con icon Two crossed lines that form an 'X'. International student policies available for temporary stints abroad

- con icon Two crossed lines that form an 'X'. Complaints about claims not being paid or involving an intermediary to resolve claims

Trawick International travel insurance offers plans customized to diverse travelers' needs. We look at coverage options, claims processing, pricing, and other important factors for savvy travelers.

- Travel medical insurance

- Trip protection and cancellation

- International student insurance

- Visitor medical insurance (for traveling to the US)

Trawick International travel insurance is one of the most popular travel insurance companies on the market, earning spots on our guides on the best cheap travel insurance and the best CFAR travel insurance .

Trawick offers a wide array of policies, so you're sure to find one that will fit your travel plans. Even if you can't find a plan that is one-to-one with your trip, one of Trawick's stand-out options is its Safe Travel Flex plan, which allows you to build your own insurance plan from scratch. It includes travel cancellation and interruption insurance in addition to travel assistance. Everything else is optional, from medical coverage to baggage delay.

Trawick has received an average Trustpilot rating of 4.2 across nearly 500 reviews and 4.1 across over 3,100 SquareMouth reviews. Trawick reviews on its headquarters in Alabama are mixed, averaging 3.3 stars across nearly 350 reviews. Negative reviews cited a difficult claims process and unresponsive customer service.

Types of Plans Available

- Safe Travels Trip Protection: With 10 plans under this umbrella, Trawick Trip Protection is highly customizable. You can even build a plan from the ground up with Safe Travles Flex. It covers domestic and international trips for US residents.

- SafeTreker: Trawick's plan for adventure sports travel, SafeTreker covers sports equipment rental, search and rescue, and non-medical evacuation for over 450 sports.

- Safe Travels USA: Trawick offers four tiers of insurance for non-US citizens and non-US residents traveling in the USA, offering accident and sickness coverage, emergency medical evacuation, and unexpected recurrence of a pre-existing conditions (limitations apply).

- Safe Travels International: Trawick offers two plans for non-US citizens and non-US residents traveling outside the US, covering emergency medical procedures, emergency evacuation, and repatriation.

- Safe Travels Outbound: This plan offers primary but temporary travel insurance for US citizens and residents traveling outside the US. It includes medical and emergency evacuation coverage, including COVID-related illnesses.

- Safe Travels Annual: Trawick offers three multi-trip annual travel insurance plans that offers emergency medical, baggage delay, and trip delay coverage for trips up to 30 days long. Trip cancellation coverage spans between $2,500 to $10,000 per year.

- Safe Travels Vacation Rental Protection plan: This plan covers non-refundable expenses such as airfare, hotels, vacation rentals, and other pre-paid trip deposits. It's only available for US residents.

- Collegiate Care Essential plan: This plan is designed for students studying abroad for study and research purposes. It offers coverage for up to $300,000 in medical expenses, with a limit of $150,000 per injury or sickness. COVID-19 medical expenses are covered with the plan, as is coverage for sports activities.

Regardless of which policy you choose, it's vital to study each of them closely to see what is and isn't covered in the one you choose.

Key Features and Benefits

Trawick International travel insurance offers several plans for different types of travelers with different needs. The coverage levels and premiums will vary depending on the traveler's age, trip costs, and destination.

Below is a list of six travel insurance plans Trawick offers with its Trip Protection plan:

Additional Coverage Options

Trawick International travel insurance offers additional coverage options on specific plans. Some come with no extra charge. Others cost extra. And only some policies allow for these additional coverage options.

Additional coverage options include:

Rental car damage coverage: It's possible to add this coverage to certain plans from Trawick, like its Safe Travels First plan. This coverage will reimburse damage to a rental car up to an allowed amount.

Pre-existing condition coverage: Pre-existing condition waivers are available if you purchase travel insurance within seven to 21 days of booking your flight, depending on the policy.

CFAR coverage: "Cancel for any reason" coverage can only be added to Trawick's Armor, Journey, Voyager, First Class, Flex, and Rental Plus plans. This add-on allows travelers to cancel their trip, for any reason, up to two days before departure and get 75% of trip costs reimbursed. CFAR coverage is only available for US residents and US citizens.

How Much Does Trawick International Cost?

Getting a quote from Trawick is a straightforward process. You can visit its website or use an insurance comparison site like Squaremouth.

You must provide traveler and trip details like your date of birth, state of residence, destination, and trip costs. With this information, you should be able to get quotes for the different plans available almost instantly.

Below are a few real-world examples of coverage options and costs from Trawick as of April 2024.

For example, let's look at what it would cost to insure a 35-year-old resident of Ohio spending $8,000 on a two-week trip to France. Below are the costs for each of the six different coverage options.

The cost of coverage ranges from the bottom-tier Safe Travels Explorer plan at $257.04 to the top-tier Safe Travels First Class policy for $453.33. That equates to about 3% to 6% of the total trip cost, which is on the lower end when compared to the average cost of travel insurance .

Now let's look at the cost of coverage for a 55-year-old from Colorado traveling to Argentina and spending $6,000 on a three-week trip.

The premiums for this traveler are higher, but that's to be expected given their age. The lowest cost Safe Travels First Class plan costs $243.23 and the top-tier Safe Travels Voyager costs $574.14. That represents a cost of between 4% and 9.5% of the total trip cost, higher than the previous example but still within industry averages.

Lastly, we'll look at the premium costs for a 45-year-old resident of Texas traveling to Fiji for two weeks and spending $7,000 on the trip.

The lowest cost plan in this scenario is the Safe Travels Explorer plan, which runs $284.28. And the most expensive is the Safe Travels First Class, at $405.54. You're paying between 4% and 5.8% of the total trip cost at these prices. Again, that's right on track with the averages in the travel insurance industry.

Trawick International travel insurance has several different claims departments and forms, so how you file a claim will vary depending on the coverage you purchase.

You can find claims forms and contact information on Trawick's claims forms page . That's where you'll find information regarding where to mail or email your claim form and contact information for the appropriate claims group.

Reviews on SquareMouth and Google say claims process can take up to several months and require constant hassling. To avoid additional issues with the claims process, be sure to keep thorough documentation of any unexpected costs incurred during travel. Additionally, you should be as specific as possible when filing a claim.

See how Trawick stacks up against the competition.

Trawick International vs. Allianz Travel Insurance

Allianz and Trawick International travel insurance are similar in offering several different coverage options.

Allianz offers 10 travel insurance plans, including one-off and multi-trip policies. So you'll have options whether you're looking to cover a specific trip or plan to take multiple trips a year. Of course, the different plans offer varying levels of coverage, and the premiums depend on the traveler and trip specifics.

Allianz's most popular single-trip travel insurance option, the OneTrip Prime plan, offers up to $100,000 in trip cancellation coverage, up to $150,000 in trip interruption coverage, $50,000 in emergency medical coverage, up to $1,000 in coverage for baggage loss, theft, or damage, and up to $800 in travel-delay coverage.

Trawick's most comparable plan is its Safe Travels Explorer Plus plan, which offers up to $100,000 in trip cancellation and interruption coverage, $50,000 in emergency medical coverage, up to $750 for personal effects, and trip delay coverage of $500.

The best way to decide which company to go with is to compare quotes using your specific trip details and personal information, as those are the details that will affect the cost the most.

Read our Allianz travel insurance review here.

Trawick International vs. Nationwide Travel Insurance

Nationwide is a household name when it comes to insurance providers and one of the most well-known and recognized insurance firms in the US. By providing just two single-trip options, the Essential and Prime plan, Nationwide travel insurance has made it simple to find coverage. Nationwide also offers yearly trip insurance for those that travel a lot throughout the year, as well as Cruise specific plans and annual trip insurance.

To compare the two companies, we'll put Nationwide's Essential plan beside Trawick International travel insurance's middle-of-the-road Safe Travels Single Trip plan.

Nationwide's Essential Plan provides up to $10,000 in trip cancellation coverage, up to $250,000 in emergency medical evacuation, up to $150 per day ($600 maximum) reimbursement for travel delays of six or more hours, and coverage for delayed or lost baggage.

In comparison, Trawick's Safe Travels Single Trip plan offers 100% of the insured trip (up to two times the trip cost) in trip cancellation coverage, $350,000 in emergency medical evacuation, and up to $200 per day ($600 maximum) for travel delays of 12 or more hours, and lost and delayed baggage coverage.

So, this particular plan from Trawick offers slightly higher coverage limits for most of the coverages compared.

The high-tier Prime Plan from Nationwide offers even more coverage, including up to $30,000 in trip cancellation, up to $1 million in coverage for emergency medical evacuation, up to 200% of the trip cost (maximum of $60,000) in trip interruption coverage, and $250 per day for trip delays of six or more hours.

To compare, Trawick's highest-tier Safe Travels Voyager plan comes with trip cancellation coverage of up to $100,000, up to $1 million in emergency medical evacuation, up to 150% of the insured trip cost for trip interruption, up to $2,000 maximum reimbursement for travel delays, and coverage for delayed or lost baggage.

Comparing these two policies, you see how it's somewhat of an apples-to-oranges comparison, as some coverage limits are higher or lower. And don't forget that the coverage premiums will vary depending on the traveler and trip specifics.

Read our Nationwide travel insurance review here.

Trawick International vs. Credit Card Travel Insurance Benefits

Be sure to compare the coverage of travel insurance plans with the coverage offered by your rewards credit cards before purchasing a travel insurance policy. Some basic coverage, like rental car insurance, could already be available through one of your existing cards.

If you're on a road trip and all your expenses are refundable, or if your health insurance covers you while abroad and you don't think you'll have many medical bills, the coverage from your credit card may be sufficient.

It's also worth noting that in most cases, credit card travel protection is only supplementary to a travel insurance policy. This implies you'll have to file your claim with the other relevant insurance (such as the airline) before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed Trawick International

We compared Trawick International's travel insurance offerings to those of the best travel insurance companies to help you find the policy that fits your needs. When reviewing a policy, we considered coverage options and limits, what's included in your plan, add-ons available, and costs. The best policy for you is one that offers adequate coverage without breaking the bank.

Choosing the best policy for you and any co-travelers is about selecting a policy with the right type of coverage and adequate coverage limits. Ideally, you should ensure that it works well in your budget and allows you to submit a claim quickly. You can read more about how we rate travel insurance products here.

Trawick International travel insurance is a very popular and reputable travel insurance provider. The company has been in business since 1998 and is known for offering solid coverage options at affordable prices.

Trawick's policies included access to 24/7 travel assistance. Travelers can reach a customer service representative by phone, email, and live chat. Representatives can answer questions about the travel insurance and trip cancellation plans available, help purchase the right plan for an upcoming trip or cruise, and assist with changes to already purchased plans. The toll-free number is 888-301-9289. You can reach the company by email at [email protected] . Live chat is available on its website.

CFAR (cancel for any reason) is one of the many coverages buyers can expect in Trawick International plans. Always check individual plans to ensure you get all the coverages you want.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Travel Insurance

- Trawick International Review

Trawick International Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Trawick International rated?

Overall rating: 3.8 / 5 (very good), trawick international plans & coverage, coverage - 3.8 / 5, emergency medical coverage details, baggage coverage details, trawick international financial strength, financial strength - 3.8 / 5, trawick international price & reputation, price & reputation - 4 / 5, trawick international customer assistance services, extra benefits - 3.9 / 5, travel assistance services.

- Return Travel Arrangements

- Up to the Minute Travel Advisories

Emergency Medical Assistance Services

- Arrange Medical Payment Where Available

- Emergency Prescription Replacement

Our Comments Policy | How to Write an Effective Comment

11 Customer Comments & Reviews

- ← Previous

- Next →

- Coverage for trip cancellations, delays, medical emergencies, and more

- Group travel products available

- International Student Insurance available

- Top-rated cruise insurance plans, and adventure travel insurance

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

A leading provider of USA & International Travel Insurance, Visitor Insurance for visitors traveling to the USA, Trip Cancellation Insurance, International Student Insurance and more.

Visit website

Why choose Trawick International

Founded in 1998, Trawick International® offers many different types of insurance products to travelers all around the world. They continue to research ground-breaking plans to satisfy the needs of travelers everywhere. Trawick International is a worldwide insurance provider with expertise in international travel medical insurance and international student health insurance. They provide medical coverage, emergency evacuation, repatriation, emergency reunion, security/political evacuation, and much more for anyone traveling outside of their home country. Trawick International offers an extensive worldwide network of quality physicians, hospitals and pharmacies both in the U.S. and around the world.” Trawick International was awarded top honors by Forbes Advisor in their Best Travel Insurance Companies list for consumers. Out of 15 travel insurance companies ranked by the financial news outlet, Trawick International came in first, based on Forbes rigorous, data-driven methodology. Trawick International is accredited by the Better Business Bureau (BBB) with an A+ rating for our responsible, trustworthy, and client centric business operations.

Comprehensive Plans

Safe travels explorer.

Budget-friendly travel protection plan designed for leisure or business travel for domestic and international trips. This plan includes Worldwide 24/7 Emergency Assistance Services, Trip Cancellation and Interruption, $50,000 Emergency Medical Expense as well as baggage and many other essential benefits while you travel. COVID-19 MEDICAL EXPENSES are covered and treated the same as any other sickness.

Trip cancellation for US citizens and US Residents travelling to other countries or domestically

Underwritten by Crum and Forster, SPC

Safe Travels Explorer Plus

The Explorer Plus plan features everything in the Explorer plan along with coverage for Pre-Existing Medical Conditions on plans purchased within 7 days of making your initial trip deposit. For leisure or business travel for domestic and international trips. This plan includes Worldwide 24/7 Emergency Assistance Services, Trip Cancellation and Interruption, $50,000 coverage for Emergency Medical Expense as well as baggage and many other essential benefits while you travel. COVID-19 MEDICAL EXPENSES are covered and treated the same as any other sickness.

Safe Travels Journey

The Journey plan includes all the benefits as the Explorer Plus with extended coverage and coverage for airline ticket exchange fees. This product includes coverage for Pre-Existing Medical conditions when purchased prior to or within 14 days of making your deposit and $150,000 of Emergency Medical Coverage along with $500,000 of Emergency Evacuation coverage. COVID-19 MEDICAL EXPENSES are covered and treated the same as any other sickness.

Safe Travels Voyager for US Citizens

Covers trip cancellation from $0 up to $100,000 and includes $250,000 Primary Medical with coverage for Pre-Existing Medical conditions on plans purchased prior to or with final trip payment. The optional Cancel for Any Reason (CFAR) provides reimbursement for the percentage of the prepaid, non-refundable, forfeited payments you paid for your trip, if you cancel your trip for any reason not otherwise covered. Must be purchased with initial policy and within 21 days of the initial trip deposit date, and the full, nonrefundable trip cost is insured.

Underwritten by: Nationwide

Travel Medical Plans

Safe travels outbound.

Travel Medical and Evacuation Plan - for US Citizens and US Residents traveling outside the USA

Primary Medical Plan for US Citizens and US Residents traveling outside the USA for up to 180 days. It includes medical, emergency medical evacuation, repatriation, and security evacuation and is for those traveling outside the United States. Rates are based on age and plan choices. Minimum 5 days of coverage purchase - up to 180 days. COVID-19 EXPENSES are covered and treated as any other sickness. This is stated on the VISA letter you receive upon purchase.

Safe Travels Outbound Cost Saver

Safe Travels Outbound Cost Saver is an excess temporary travel medical plan for US Citizens and US Residents while traveling outside the USA for up to 180 days. It includes medical, emergency medical evacuation, repatriation, and security evacuation and is for those traveling outside the United States. Rates are based on age and plan choices. Minimum 5 days of coverage purchase - up to 180 days. COVID-19 EXPENSES are covered and treated as any other sickness. This is stated on the VISA letter you receive upon purchase.

Safe Travels USA

For NON US Citizens traveling to the USA or traveling to USA with a side trip or stop in another country (Must have some time in USA)

For Non US Citizens and Non US Residents traveling to the USA or to USA and Worldwide for up to 364 days

Safe Travels USA Cost Saver

Safe Travels USA Cost Saver plan provides coverage to non-US citizens who reside outside the USA and are traveling outside their Home Country to visit the United States or to the United States & Worldwide for up to 364 days This plan is not available to green card holders in the USA or US Citizens. This plan is not available to anyone age 90 or above. This plan does not cover any treatment for or complications arising from COVID-19, SARS-CoV-2 Illness.

Safe Travels USA Comprehensive

For Non US Citizens and Non US Residents traveling to the USA or to USA and Worldwide for up to 364 days. Covers Acute Onset of Pre-Existing conditions up to the policy maximum on some ages. Covers one Well Visit per policy. Rates are based on age, policy maximum and Out of Network Deductible choice. COVID-19 EXPENSES are covered and treated as any other sickness.

Safe Travels International